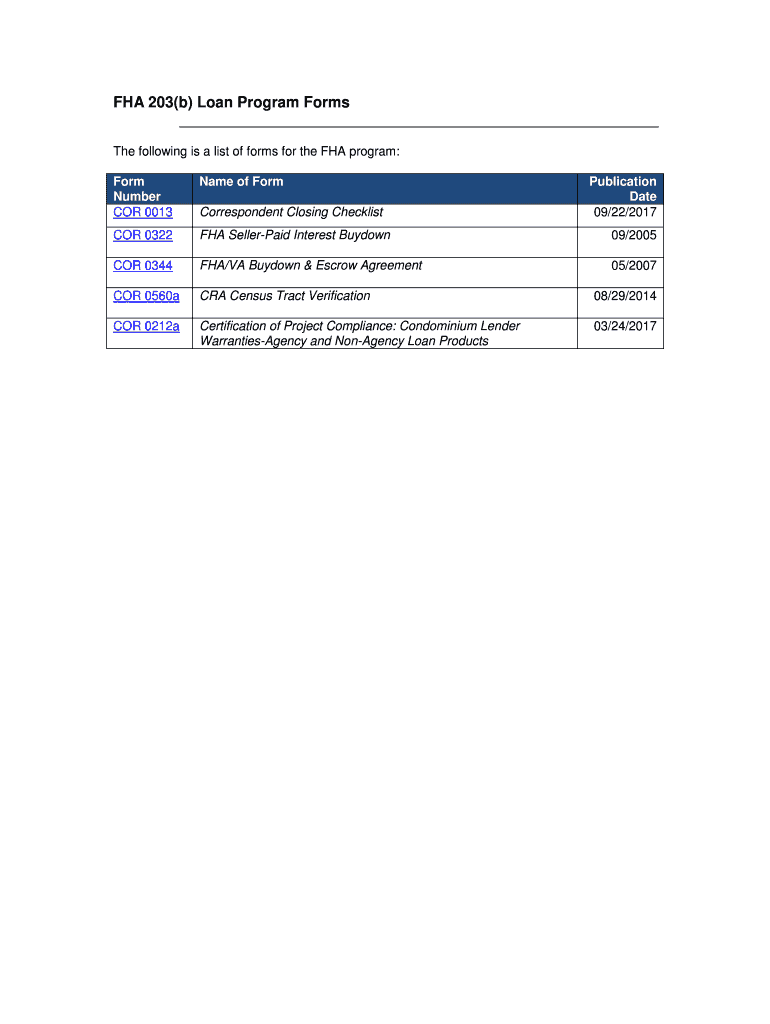

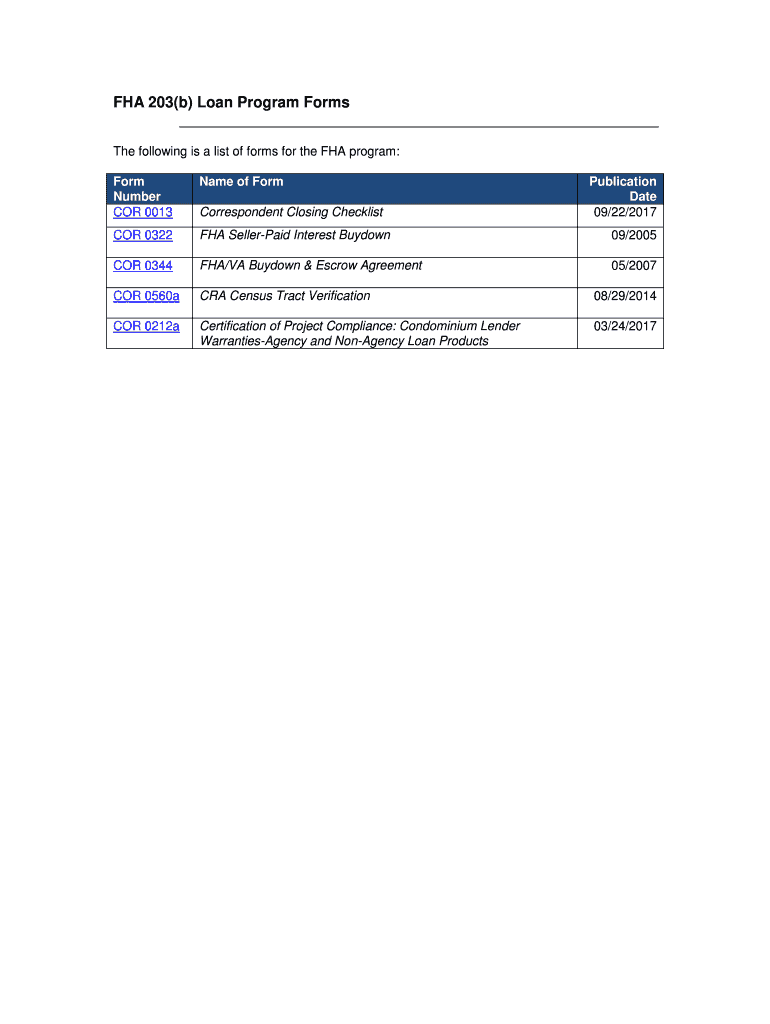

Get the free FHA 203(b) Loan Program Forms

Show details

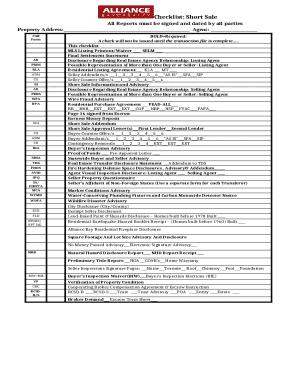

A list of forms related to the FHA loan program, detailing various agreements and compliance certifications.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fha 203b loan program

Edit your fha 203b loan program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fha 203b loan program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fha 203b loan program online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fha 203b loan program. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fha 203b loan program

How to fill out FHA 203(b) Loan Program Forms

01

Obtain the FHA 203(b) Loan Program forms from your lender or the official FHA website.

02

Carefully read all instructions provided with the forms to understand the requirements.

03

Fill in your personal information, including your name, address, Social Security number, and contact details accurately.

04

Provide information about your employment history, including employer name, job title, and length of employment.

05

Disclose your financial information, such as income, assets, debts, and liabilities, ensuring to include all relevant documents.

06

Detail the property information, including the address, type of property, and purchase price.

07

Review the completed forms for accuracy and completeness before submission.

08

Sign and date the forms where required.

Who needs FHA 203(b) Loan Program Forms?

01

Homebuyers looking to purchase a home with a low down payment.

02

Individuals with lower credit scores seeking financing options.

03

Borrowers who are purchasing a primary residence and want to take advantage of FHA insurance.

04

Real estate professionals assisting clients in securing FHA financing.

Fill

form

: Try Risk Free

People Also Ask about

What makes the 203 B loan a likely option for borrowers who don't qualify for a mortgage due to low credit scores?

FHA 203(b) loans tend to be among the easiest to qualify for in the mortgage world. They allow for low credit scores (down to 500 for some borrowers), higher debt-to-income ratios (sometimes more than 50%), and low down payments (3.5% is the minimum).

Are FHA 203k loans a good idea?

Here are some of the reasons an FHA 203(k) loan may be appealing to you: A low 3.5% down payment is required for individuals with a credit score of 580 or higher. You make one payment every month (a combination of the mortgage and the improvements). The interest on your loan is tax-deductible, like other mortgages.

How does an FHA 203k loan work?

Limited 203(k) Mortgage Permits homebuyers and homeowners to finance up to $35,000 into their mortgage to repair, improve, or upgrade their home. Homebuyers and homeowners can quickly and easily tap into cash to pay for property repairs or improvements, such as those identified by a home inspector or an FHA appraiser.

What is the minimum credit score for an FHA 203B program?

FHA 203(b) loans tend to be among the easiest to qualify for in the mortgage world. They allow for low credit scores (down to 500 for some borrowers), higher debt-to-income ratios (sometimes more than 50%), and low down payments (3.5% is the minimum).

What is a 203 B FHA loan?

The FHA 203(b) program provides mortgage insurance against loan default, and the guarantee is backed by the full faith and credit of the federal government.

What is the difference between FHA 203B and FHA 203K?

However, 203(b) loans are meant to help you buy a turnkey house that is more or less move-in ready. The home must meet the FHA's minimum property standards and not have any major structural issues or damage. A 203(k) loan, on the other hand, can be used to finance a fixer-upper that needs work.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FHA 203(b) Loan Program Forms?

The FHA 203(b) Loan Program Forms are the documents required for obtaining a mortgage insured by the Federal Housing Administration (FHA) under the 203(b) program, which is designed to help low to moderate-income homebuyers purchase a home.

Who is required to file FHA 203(b) Loan Program Forms?

Homebuyers who apply for an FHA-backed loan under the 203(b) program are required to file these forms, which are typically completed by lenders on behalf of the borrowers.

How to fill out FHA 203(b) Loan Program Forms?

To fill out the FHA 203(b) Loan Program Forms, applicants must provide personal identification information, financial details, property information, and sign necessary disclosures and certifications as outlined by their lender.

What is the purpose of FHA 203(b) Loan Program Forms?

The purpose of the FHA 203(b) Loan Program Forms is to gather essential information about the borrower and the property to ensure compliance with FHA regulations and to initiate the mortgage approval process.

What information must be reported on FHA 203(b) Loan Program Forms?

The information that must be reported includes the borrower's personal and financial details, employment history, credit history, property details, and any other pertinent financial documents required by the lender or the FHA.

Fill out your fha 203b loan program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fha 203b Loan Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.