Get the free Projected Cash Receipts - UAW-GM - uawgmjas

Show details

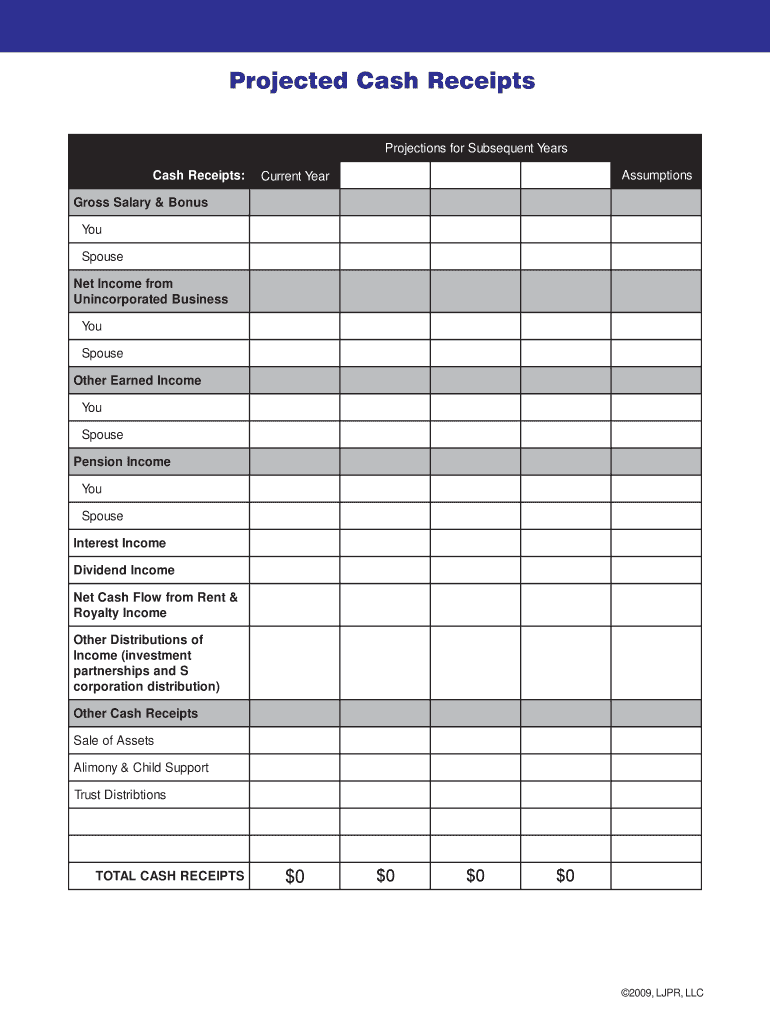

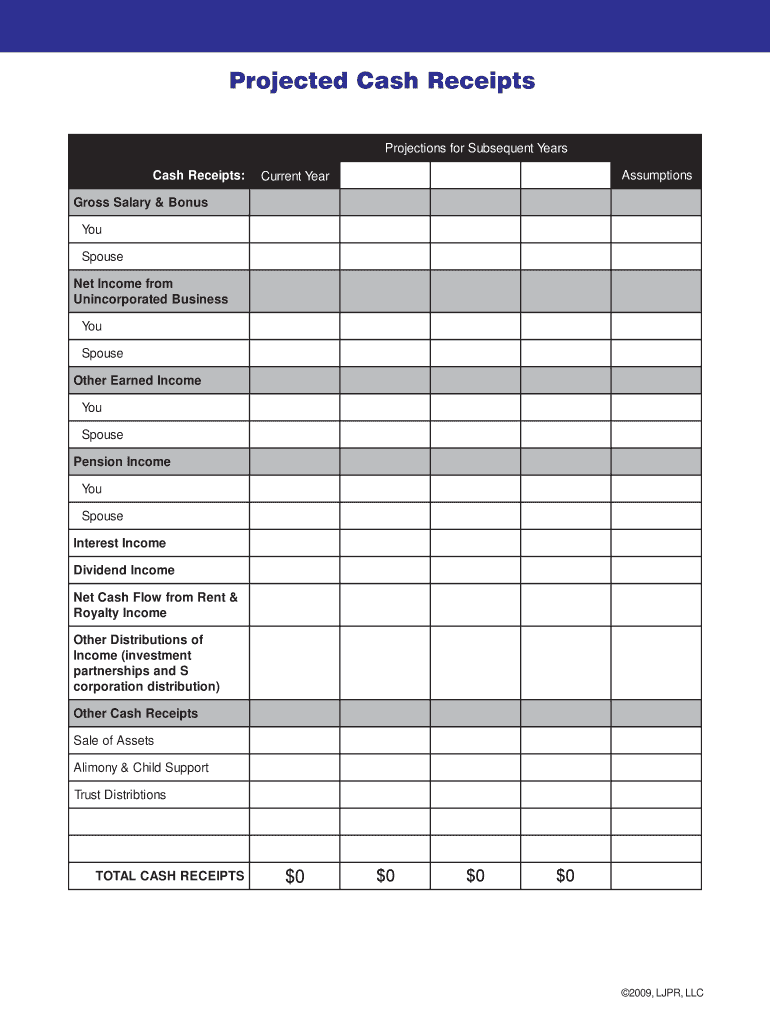

2009, JPR, LLC Projected Cash Receipts: Cunt Year Projections for Subsequent Years Assumptions Gross Salary & Bonus You Spouse Net Income from

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign projected cash receipts

Edit your projected cash receipts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your projected cash receipts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit projected cash receipts online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit projected cash receipts. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out projected cash receipts

How to fill out projected cash receipts:

01

Begin by gathering information on your anticipated sources of cash inflows, such as sales revenue, loan proceeds, investments, or grants.

02

Estimate the timing and amount of each cash inflow. Consider factors like sales cycles, payment terms, seasonal fluctuations, and industry trends to project when and how much money you expect to receive.

03

Categorize your projected cash receipts based on their nature, such as cash sales, accounts receivable collections, or cash infusions from external sources.

04

Determine the duration of your projection period. Typically, businesses project cash receipts on a monthly, quarterly, or annual basis, depending on their specific needs and industry practices.

05

Utilize historical data, market research, customer trends, and other relevant information to make realistic and accurate estimations. Avoid overestimating or underestimating your cash inflows to maintain a reliable projection.

06

Take into account any anticipated changes or events that may impact your cash inflows. For example, if you plan to launch a new product or expand into new markets, consider how these factors may affect your projected cash receipts.

07

Regularly review and revise your projected cash receipts as new information becomes available or circumstances change. This will help you make informed decisions and adjust your financial plans accordingly.

Who needs projected cash receipts:

01

Small businesses: Projected cash receipts are crucial for small businesses to effectively manage their cash flow, anticipate future shortfalls or surpluses, and make informed financial decisions.

02

Startups: Startups, particularly those seeking funding or investment, may need projected cash receipts to provide investors or lenders with a clear picture of their anticipated cash inflows and financial viability.

03

Nonprofits: Nonprofit organizations rely on projected cash receipts to forecast and manage their revenues, plan fundraising initiatives, and track the effectiveness of their programs and activities.

04

Financial institutions: Banks and other financial institutions may require projected cash receipts as part of the loan application process to assess a borrower's ability to repay the loan based on their anticipated cash inflows.

05

Investors and shareholders: Investors and shareholders may request projected cash receipts to assess the financial health and growth potential of a company before making investment decisions or evaluating their existing holdings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify projected cash receipts without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your projected cash receipts into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an eSignature for the projected cash receipts in Gmail?

Create your eSignature using pdfFiller and then eSign your projected cash receipts immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I edit projected cash receipts on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing projected cash receipts right away.

What is projected cash receipts?

Projected cash receipts refer to the estimated amount of money a business expects to receive from customers or clients within a specific time period.

Who is required to file projected cash receipts?

Businesses of all sizes are required to file projected cash receipts in accordance with tax laws and regulations.

How to fill out projected cash receipts?

Projected cash receipts can be filled out by documenting expected payments from customers, taking into account factors like sales forecasts, payment terms, and anticipated collection dates.

What is the purpose of projected cash receipts?

The purpose of projected cash receipts is to help businesses plan and manage their cash flow effectively, by anticipating incoming revenue and ensuring they have enough funds to cover expenses.

What information must be reported on projected cash receipts?

Projected cash receipts should include details such as customer names, invoice numbers, payment amounts, due dates, and any outstanding balances.

Fill out your projected cash receipts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Projected Cash Receipts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.