Get the free HEALTH SAVINGS ACCOUNT INVESTMENT ACCOUNT TRANSACTION FORM

Show details

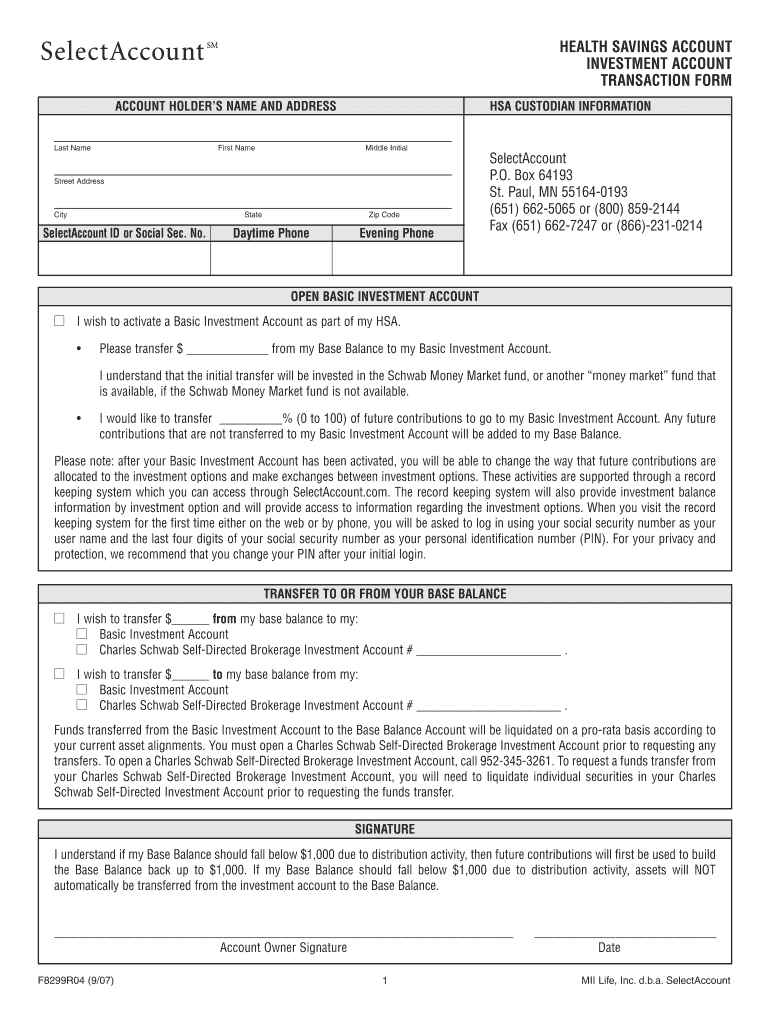

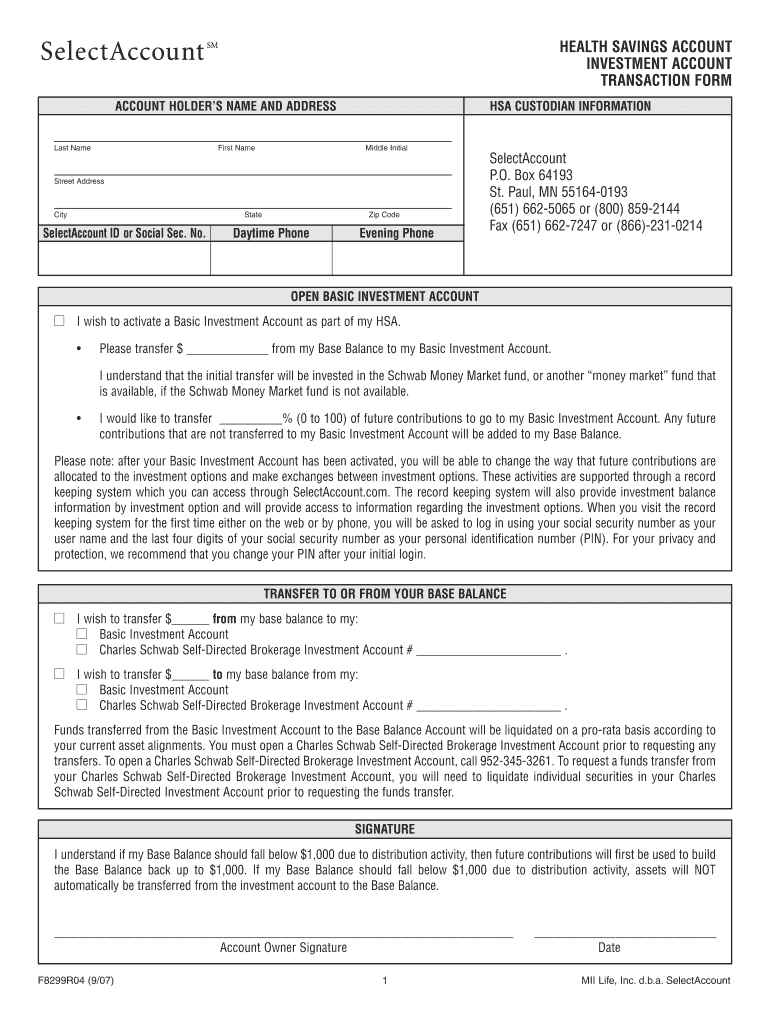

HEALTH SAVINGS ACCOUNT INVESTMENT ACCOUNT TRANSACTION FORM ACCOUNT HOLDERS NAME AND ADDRESS HSA CUSTODIAN INFORMATION Last Name First Name Middle Initial Street Address City State SelectAccount ID

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign health savings account investment

Edit your health savings account investment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your health savings account investment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing health savings account investment online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit health savings account investment. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out health savings account investment

How to fill out health savings account investment:

01

Gather the necessary documents: To fill out a health savings account investment, you will need your personal identification information, such as your social security number and address, as well as your HSA account details, including the account number and routing number.

02

Choose an HSA provider: Research and select a reputable HSA provider that offers investment options. Consider factors such as fees, investment choices, customer service, and user-friendly online platforms.

03

Review the investment options: Once you have selected a provider, familiarize yourself with the investment options available. These options can vary from simple interest-bearing accounts to a range of mutual funds or exchange-traded funds (ETFs).

04

Assess your risk tolerance: Determine your risk tolerance level when it comes to investing. Consider factors such as your age, financial goals, and tolerance for market volatility. This will help guide your investment decisions.

05

Determine your investment allocation: Decide how much of your HSA funds you want to allocate towards investments. Keep in mind that there are usually minimum investment requirements and fees associated with investment options.

06

Complete the necessary forms: Fill out the required forms provided by your HSA provider to initiate the investment process. This may include agreeing to the terms and conditions, specifying your investment allocation, and providing any additional information requested.

07

Fund your investment: Transfer funds from your HSA account into the selected investment option. Follow the instructions provided by your HSA provider to ensure a smooth and secure transfer.

08

Monitor and manage your investment: Regularly review your investment performance and make any necessary adjustments to your allocation based on your financial goals and market conditions. Stay informed about any changes or updates from your HSA provider or investment manager.

Who needs health savings account investment:

01

Individuals with high-deductible health plans: Health savings accounts (HSAs) are specifically designed for individuals who are enrolled in high-deductible health insurance plans. These plans typically have lower premiums but require individuals to pay higher out-of-pocket costs before insurance coverage kicks in.

02

Individuals seeking tax advantages: HSAs offer tax advantages that can be beneficial for individuals looking to save for current and future medical expenses. Contributions made to an HSA are tax-deductible, and qualified withdrawals for eligible medical expenses are tax-free.

03

Those wanting to save for healthcare expenses: HSAs allow individuals to set aside pre-tax dollars specifically for medical expenses. By investing the funds in an HSA, individuals have the opportunity to grow their savings over time and potentially offset future healthcare costs.

04

Individuals desiring flexibility: Unlike flexible spending accounts (FSAs), HSAs do not have a use-it-or-lose-it policy. This means that any funds contributed to an HSA can roll over from year to year and remain available for future healthcare needs, even if you change jobs or health insurance plans.

05

People looking to save for retirement: HSAs can also serve as a retirement savings tool. After the age of 65, individuals can use HSA funds for non-medical expenses without penalty, although taxes will still apply. This makes HSAs a potential additional source of retirement income.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my health savings account investment directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your health savings account investment and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I edit health savings account investment from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including health savings account investment. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit health savings account investment in Chrome?

Install the pdfFiller Google Chrome Extension to edit health savings account investment and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

What is health savings account investment?

A health savings account investment is a tax-advantaged medical savings account for individuals who are enrolled in a high-deductible health plan.

Who is required to file health savings account investment?

Individuals who have a health savings account are required to file their investment information.

How to fill out health savings account investment?

To fill out a health savings account investment, individuals must report contributions, distributions, and account earnings on IRS form 8889.

What is the purpose of health savings account investment?

The purpose of a health savings account investment is to help individuals save for medical expenses not covered by their high-deductible health plan.

What information must be reported on health savings account investment?

Information such as contributions, distributions, and account earnings must be reported on a health savings account investment.

Fill out your health savings account investment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Health Savings Account Investment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.