Get the free Offers in Compromise and the New Bankruptcy Law

Show details

This document analyzes the effectiveness of Offers in Compromise (OIC), Installment Agreements (IA), and bankruptcy options under the new bankruptcy law for resolving unpaid taxes. It compares these

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign offers in compromise and

Edit your offers in compromise and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your offers in compromise and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing offers in compromise and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit offers in compromise and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out offers in compromise and

How to fill out Offers in Compromise and the New Bankruptcy Law

01

Gather all necessary financial documents, including income, expenses, assets, and debts.

02

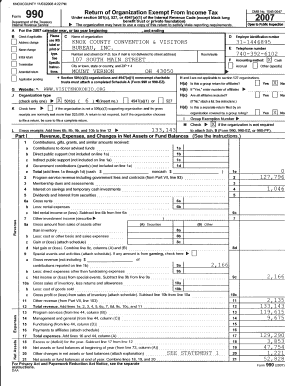

Complete IRS Form 656, which outlines your offer for the compromise.

03

Fill out Form 433-A (OIC) or Form 433-B (OIC) to provide detailed financial information.

04

Determine the amount you can afford to offer based on your financial situation.

05

Submit the completed forms along with the required payment (application fee and initial payment).

06

Wait for a response from the IRS regarding your offer.

Who needs Offers in Compromise and the New Bankruptcy Law?

01

Individuals or businesses struggling to pay their tax debts.

02

Taxpayers facing financial hardship and unable to negotiate a payment plan.

03

Those who qualify under the New Bankruptcy Law seeking relief from overwhelming debts.

04

Individuals considering bankruptcy as an option to manage debts.

Fill

form

: Try Risk Free

People Also Ask about

Is a compromise better than bankruptcy?

Debt Resolution: An offer in compromise allows you to negotiate a settlement with the SBA to resolve the debt. If accepted, the SBA agrees to accept a reduced amount as full satisfaction of the debt. This can provide a quicker resolution compared to bankruptcy, which may involve a more extensive legal process.

What is the offer in compromise for the New York State Department of Taxation and Finance?

The Offer in Compromise program allows qualifying, financially distressed taxpayers the opportunity to put overwhelming tax liabilities behind them by paying a reasonable portion of their tax debt. We can consider offers in compromise from: individuals and businesses that are insolvent or discharged in bankruptcy, and.

Is an offer in compromise better than bankruptcy?

This can provide a quicker resolution compared to bankruptcy, which may involve a more extensive legal process. Potential Debt Reduction: With an offer in compromise, you have the opportunity to negotiate a reduced settlement amount that is affordable for you.

Which is worse, debt settlement or bankruptcy?

How Will This Affect Your Credit Score? Bankruptcy will have a longer-term impact on your credit report. If you file Chapter 7 — it will be on your report for 10 years; if you file Chapter 13 — it will be 7 years. Debt settlement has a shorter-term impact on your credit.

What is the offer of compromise in New York?

New York City's Offer-in-Compromise program allows qualifying financially distressed taxpayers to settle their non-property tax debt for less than the full amount owed.

What is the downside of offer in compromise?

And those who do should still consider the potential disadvantages of this option. Your accepted offer in compromise is public record, and you must undergo intense public scrutiny. Your privacy is limited with this option. You must be compliant with tax requirements for five years after your accepted offer.

What does OIC mean?

OIC means Oh, I see. OIC is an internet slang initialism that conveys that the writer understands what is going on in the context of an online conversation.

What is the success rate of an offer in compromise?

The success rate for an Offer in Compromise (OIC) is around 30-40%. This rate depends on the completeness and accuracy of the application, as well as the taxpayer's financial situation. Hiring a tax attorney, like J. David Tax Law, can improve the chances of approval by ensuring all requirements are met.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Offers in Compromise and the New Bankruptcy Law?

Offers in Compromise is a tax relief program that allows taxpayers to settle their tax debts for less than the full amount owed. The New Bankruptcy Law refers to the legal framework governing bankruptcy filings and their implications on debts, including tax liabilities.

Who is required to file Offers in Compromise and the New Bankruptcy Law?

Taxpayers who owe more in taxes than they can afford to pay and are facing financial hardship may file an Offer in Compromise. Individuals who are unable to meet their financial obligations may consider filing for bankruptcy under the New Bankruptcy Law.

How to fill out Offers in Compromise and the New Bankruptcy Law?

To fill out Offers in Compromise, taxpayers must complete Form 656 and submit information regarding their financial situation, including income, expenses, assets, and liabilities. For bankruptcy, individuals must complete the required bankruptcy forms and provide a comprehensive disclosure of their financial affairs.

What is the purpose of Offers in Compromise and the New Bankruptcy Law?

The purpose of Offers in Compromise is to provide a way for taxpayers to resolve tax debts at a more manageable amount. The New Bankruptcy Law aims to help individuals and businesses reorganize or liquidate their debts while providing a fresh start financially.

What information must be reported on Offers in Compromise and the New Bankruptcy Law?

In Offers in Compromise, taxpayers must report their total income, expenses, assets, and liabilities. For the New Bankruptcy Law, individuals must report their income, debt, assets, liabilities, and any transfers of property or assets made prior to filing.

Fill out your offers in compromise and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Offers In Compromise And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.