Get the free Stock Option Backdating: Emerging Issues

Show details

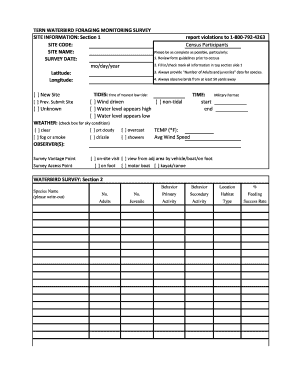

This document provides details about a course on stock option backdating, including its implications for Director and Officer liability and insurance, registration details, fee structure, and how

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign stock option backdating emerging

Edit your stock option backdating emerging form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your stock option backdating emerging form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing stock option backdating emerging online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit stock option backdating emerging. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out stock option backdating emerging

How to fill out Stock Option Backdating: Emerging Issues

01

Research the legal implications of stock option backdating to ensure compliance with regulations.

02

Gather necessary documentation on the stock options in question, including grant dates and exercise prices.

03

Review the company's stock option plans for guidelines on backdating procedures.

04

Consult with legal and financial experts to assess the risks and benefits of backdating options.

05

Prepare a detailed report outlining the rationale for the backdating, including market conditions and company performance.

06

File any required disclosures with regulatory bodies as mandated by law.

07

Communicate transparently with shareholders regarding the decision to backdate options.

Who needs Stock Option Backdating: Emerging Issues?

01

Companies that offer stock options to their employees and need to navigate complex regulations.

02

Legal consultants and advisors working with firms on stock option strategies.

03

Investors assessing the governance practices of companies they are considering investing in.

04

Regulatory agencies monitoring compliance with stock option laws.

Fill

form

: Try Risk Free

People Also Ask about

Why is backdating stock options wrong?

Such backdating may be construed as illegally avoiding income recognition because falsely under-reporting the market price of such stocks makes them appear to have no value in excess of the strike price at the time the option is granted.

What is the controversy with stock options?

Hall and Murphy argue that, in many cases, stock options are an inefficient means of attracting, retaining, and motivating a company's executives and employees since the company cost of stock options is often higher than the value that risk-averse and undiversified workers place on their options.

Why is backdating bad?

Hall and Murphy argue that, in many cases, stock options are an inefficient means of attracting, retaining, and motivating a company's executives and employees since the company cost of stock options is often higher than the value that risk-averse and undiversified workers place on their options.

What is the practice of backdating?

Backdating is the practice of marking a document, whether a check, contract, or another legally binding document, with a date that is prior to what it should be. Backdating is usually disallowed and can even be illegal or fraudulent based on the situation.

Why is backdating stock options illegal?

Public companies face additional scrutiny under Section 162(m), which caps the tax deductibility of compensation exceeding $1 million paid to top executives unless it qualifies as “performance-based.” Backdating that alters the exercise price of stock options may disqualify them from being considered performance-based

Is it illegal to backdate stock options?

While not inherently illegal, backdating without proper disclosure and adherence to applicable laws can lead to a range of consequences, including regulatory scrutiny, penalties, and litigation.

What is the controversy with stock options?

In finance, options backdating is the practice of altering the date a stock option was granted, to a usually earlier date (i.e backdating), but sometimes later date (i.e. forward dating), at which the underlying stock price was lower.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Stock Option Backdating: Emerging Issues?

Stock option backdating refers to the practice of setting the grant date of stock options to an earlier date when the stock price was lower, allowing the options to have intrinsic value. This practice raises legal and ethical issues, particularly regarding transparency and proper accounting.

Who is required to file Stock Option Backdating: Emerging Issues?

Companies and individuals involved in the issuance and management of stock options, especially public companies that must comply with SEC regulations, are required to file disclosures related to stock option backdating.

How to fill out Stock Option Backdating: Emerging Issues?

Filling out the documentation requires a thorough understanding of the transaction details, including the exact grant dates, exercise prices, and compliance with SEC reporting requirements. It's advisable to consult legal and financial experts during this process.

What is the purpose of Stock Option Backdating: Emerging Issues?

The purpose of reporting on stock option backdating is to enhance transparency, ensure compliance with accounting standards, and protect shareholders' interests by adequately disclosing practices that could affect the company’s financial statements.

What information must be reported on Stock Option Backdating: Emerging Issues?

Information that must be reported includes the dates on which stock options were granted, the exercise price, the fair market value at the time of grant, and any discrepancies that may indicate backdating practices.

Fill out your stock option backdating emerging online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Stock Option Backdating Emerging is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.