Get the free Marathon Petroleum Life Insurance Plan

Show details

This document serves as the Plan document and summary plan description for the Marathon Petroleum Life Insurance Plan, detailing eligibility, coverage amounts, costs, and benefits related to life

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign marathon petroleum life insurance

Edit your marathon petroleum life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your marathon petroleum life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing marathon petroleum life insurance online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit marathon petroleum life insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out marathon petroleum life insurance

How to fill out Marathon Petroleum Life Insurance Plan

01

Obtain the Marathon Petroleum Life Insurance Plan application form from the HR department or company website.

02

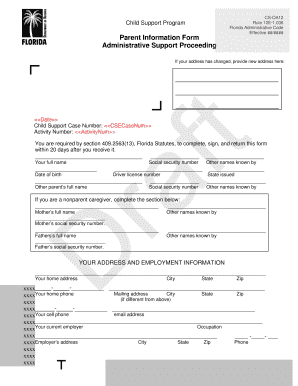

Fill in your personal information, including your full name, address, and contact details.

03

Provide your employment details, such as your job title, department, and employee ID number.

04

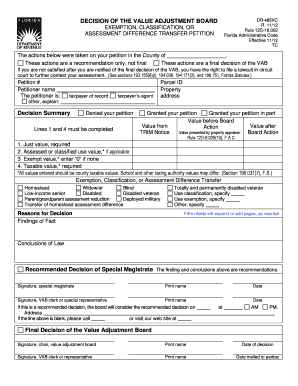

Choose the type and amount of life insurance coverage you wish to enroll in.

05

List any beneficiaries you want to designate for your life insurance policy, including their relationship to you.

06

Review your options for additional coverage or riders that may be available.

07

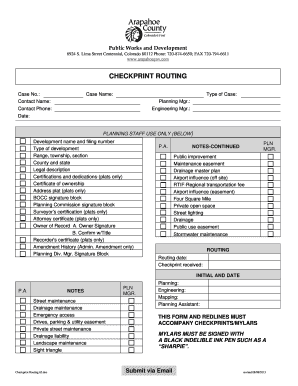

Sign and date the application form.

08

Submit the completed form to the HR department by the specified deadline.

Who needs Marathon Petroleum Life Insurance Plan?

01

Employees of Marathon Petroleum who want financial security for their beneficiaries in the event of their death.

02

Individuals seeking to provide for their family or dependents in case of unforeseen circumstances.

03

Employees looking for additional benefits as a part of their overall compensation package.

Fill

form

: Try Risk Free

People Also Ask about

What is the Marathon Oil retirement plan?

The plan operates as a cash balance pension, fully funded by the company. Each year, Marathon Petroleum allocates Pay Credits to your account, calculated as a percentage of your eligible pay: 7% if the sum of your age and Cash Balance service is under 50. 9% if the sum is between 50 and 69.

What is the difference between Marathon Oil and Marathon Petroleum Company?

In 2005, Ashland sold its share of Marathon Ashland to Marathon and the company became Marathon Petroleum. The company became a 100% owned subsidiary of Marathon Oil, after Ashland sold off its downstream assets and exited the retail business. In 2006, Marathon began using STP-branded additives in its fuel.

What is life insurance in simple terms?

Life insurance is a contract between an insurance company and policyholder. In exchange for a premium, the life insurance company agrees to pay a sum of money to one or more named beneficiaries upon the death of the policyholder.

What is term life insurance in simple words?

A term life insurance policy is the simplest form of life insurance: You pay a premium for a period of time — typically between 10 and 30 years — and if you pass away during that time, a death benefit is paid to your beneficiary or beneficiaries.

Does Marathon Petroleum have good benefits?

Marathon Petroleum benefits Employees rate the benefits and perks provided by Marathon Petroleum with 4.3 out of 5 stars. This is based on 310 Reviews anonymously submitted on Glassdoor by Marathon Petroleum employees in United States.

What best describes term life insurance?

Term life insurance provides a death benefit for a specified period of time that pays the policyholder's beneficiaries. Once the term expires, the policyholder can either renew it for another term, possibly convert it to permanent coverage, or allow the term life insurance policy to lapse.

What is the term life insurance in English?

A term life insurance policy is the simplest form of life insurance: You pay a premium for a period of time — typically between 10 and 30 years — and if you pass away during that time, a death benefit is paid to your beneficiary or beneficiaries.

What is the point of a term life insurance?

Term life insurance provides coverage in case you pass away during the policy term. A term life policy stays in effect for a specific length of time (e.g., 10, 20, 30, or even 40 years). Some families prefer to have coverage during their working years to help replace their income in a worst-case scenario.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Marathon Petroleum Life Insurance Plan?

The Marathon Petroleum Life Insurance Plan is a corporate benefit program that provides life insurance coverage for eligible employees, helping to ensure financial security for their beneficiaries in the event of the employee's death.

Who is required to file Marathon Petroleum Life Insurance Plan?

Employees who are eligible for coverage under the plan are required to file their enrollment forms and any necessary documentation as part of the application process.

How to fill out Marathon Petroleum Life Insurance Plan?

To fill out the Marathon Petroleum Life Insurance Plan, employees should obtain the required enrollment forms, complete all necessary sections including personal information and beneficiary details, then submit the forms to the HR department or designated enrollment coordinator.

What is the purpose of Marathon Petroleum Life Insurance Plan?

The purpose of the Marathon Petroleum Life Insurance Plan is to provide financial protection to employees' families and beneficiaries in the event of untimely death, thereby offering peace of mind and financial security.

What information must be reported on Marathon Petroleum Life Insurance Plan?

Information that must be reported on the Marathon Petroleum Life Insurance Plan includes employee personal details (name, address, Social Security number), coverage amount desired, choice of beneficiaries, and any health-related information that may be requested.

Fill out your marathon petroleum life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Marathon Petroleum Life Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.