Get the free WASHINGTON’S RECEIVERSHIP ACT

Show details

This document provides a comprehensive overview of the Washington State receivership laws, including the rights and responsibilities of receivers, appointment procedures, creditor rights, and other

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign washingtons receivership act

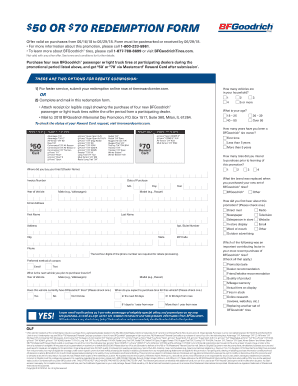

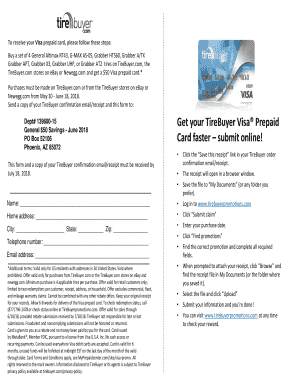

Edit your washingtons receivership act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your washingtons receivership act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit washingtons receivership act online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit washingtons receivership act. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out washingtons receivership act

How to fill out WASHINGTON’S RECEIVERSHIP ACT

01

Obtain a copy of the Washington's Receivership Act from the Washington state legislature website or legal resources.

02

Read through the entire Act to understand its provisions and requirements.

03

Identify the type of receivership you need, whether it is for a business, a property, or another legal matter.

04

Gather required documentation, including financial records, property deeds, or business documents.

05

Prepare a petition for receivership, detailing your reasons for requesting a receiver.

06

File the petition with the appropriate court in Washington along with the necessary filing fees.

07

Serve notice to all interested parties as required by the Act.

08

Attend the court hearing where a judge will review your petition.

09

Comply with the court's orders once the receivership is granted, including cooperating with the appointed receiver.

Who needs WASHINGTON’S RECEIVERSHIP ACT?

01

Business owners facing insolvency or financial difficulties.

02

Individuals or entities seeking to manage or protect assets during legal disputes.

03

Creditors aiming to recover debts through a court-appointed receiver.

04

Landlords dealing with tenants who are unable to pay rent and require receivership for property management.

Fill

form

: Try Risk Free

People Also Ask about

What are the pros and cons of receivership?

The advantages and disadvantages of receivership. A creditor finds receivership beneficial, but a director facing it sees drawbacks. Directors lose control swiftly, a disadvantage. Yet, for creditors, it's advantageous – quick liquidation of company assets and prompt distribution of proceeds.

What does it mean when your company goes into receivership?

A receivership is a legal process in which a neutral third party — the receiver — is appointed by a court to take custody, control, and management of property, assets, or a business.

What is the Washington receivership Act?

Under the Washington Receivership Act, a receiver must be either a general receiver or a custodial receiver. A general receiver has the authority to wind up the affairs of a business. A general receiver takes possession and control of property of an entity with the authority to liquidate that property.

What is the federal receivership law?

A federal receivership is a legal process in which a neutral third-party, called a receiver, is appointed by a federal court to take control of a business or individual's assets. A federal receivership can be an effective way to preserve, protect, or sell assets or property at issue.

What is a receivership in simple terms?

In law, receivership is a situation in which an institution or enterprise is held by a receiver – a person "placed in the custodial responsibility for the property of others, including tangible and intangible assets and rights" – especially in cases where a company cannot meet its financial obligations and is said to

What happens to employees in receivership?

If the company's business is sold by the receiver as a going concern, the company's employees may keep their jobs. In this case, it is usual for the new owner to take over the company's liability for outstanding employee entitlements, although this is not always the case.

What is a receiver English law?

A person appointed by a court to protect property pending a resolution of the underlying dispute. A receiver generally takes control over and manages: Real property, including the right to collect income and profits from the property. The financial affairs of a business or person.

Why is it called receivership?

Receivership, on the other hand, is a state-court-based legal remedy where a neutral third party, known as a receiver, is appointed by the court to manage a financially distressed company.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is WASHINGTON’S RECEIVERSHIP ACT?

WASHINGTON’S RECEIVERSHIP ACT is a legal framework that governs the appointment and powers of a receiver in cases of financial distress for businesses, allowing for the management and protection of assets during proceedings.

Who is required to file WASHINGTON’S RECEIVERSHIP ACT?

Entities or individuals facing financial difficulties or insolvency may be required to file under WASHINGTON’S RECEIVERSHIP ACT, typically including corporations, partnerships, or other business organizations.

How to fill out WASHINGTON’S RECEIVERSHIP ACT?

Filling out WASHINGTON’S RECEIVERSHIP ACT generally involves completing specific forms detailing the financial state of the business, the reasons for receivership, and information about creditors and assets.

What is the purpose of WASHINGTON’S RECEIVERSHIP ACT?

The purpose of WASHINGTON’S RECEIVERSHIP ACT is to provide a structured process for managing and distributing a distressed company's assets, ensuring fair treatment of creditors and maximizing recovery from the business.

What information must be reported on WASHINGTON’S RECEIVERSHIP ACT?

Required information on WASHINGTON’S RECEIVERSHIP ACT typically includes financial statements, a list of assets and liabilities, information about creditors, and any relevant operational details of the business.

Fill out your washingtons receivership act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Washingtons Receivership Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.