Get the free Tax Law 101 2012

Show details

This document serves as a registration form for the Tax Law 101 course, detailing participation options, pricing, and materials. It also provides instructions for obtaining MCLE credit and payment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax law 101 2012

Edit your tax law 101 2012 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax law 101 2012 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax law 101 2012 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax law 101 2012. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax law 101 2012

How to fill out Tax Law 101 2012

01

Gather all necessary financial documents, including income statements, deduction receipts, and previous tax returns.

02

Review the current Tax Law 101 2012 guidelines to understand the requirements and changes from the previous year.

03

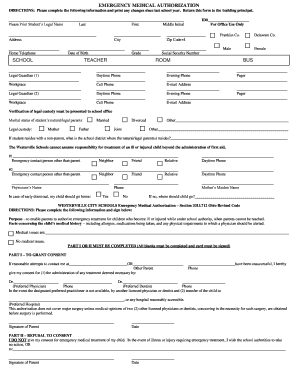

Fill out the personal information section, including your name, address, and Social Security number.

04

Report all sources of income, including wages, dividends, and interest, in the income section of the form.

05

Calculate eligible deductions and credits, ensuring to keep supporting documentation for each item claimed.

06

Review the applicable tax rates and apply them to your taxable income to calculate your tax liability.

07

Complete the tax payment section, indicating if you owe taxes or if you are due for a refund.

08

Double-check all entries for accuracy and sign the form before submitting it.

Who needs Tax Law 101 2012?

01

Individuals who earn income and are required to file taxes.

02

Businesses wanting to understand their tax obligations under the 2012 laws.

03

Tax professionals and accountants needing the framework for client filings.

04

Students or learners of tax law seeking foundational knowledge.

Fill

form

: Try Risk Free

People Also Ask about

How to file 2012 taxes?

In order to file a 2012 IRS Tax Return, download, complete, print, and sign the 2012 IRS Tax Forms below and mail them to the address listed on the IRS and State Forms. Select your state(s) and download, complete, print, and sign your 2012 State Tax Return income forms.

Does the Taxpayer Relief Act bring over 800 changes to tax law?

The Taxpayer Relief Act of 1997 made more than 800 changes to the existing tax code. Today, the IRS is a service agency that checks tax returns, collects tax payments, and issues refunds to taxpayers. Electronic filing, available nationwide in 1990, makes filing taxes faster, easier, and more accurate than ever before.

Where can I pick up IRS publications?

These forms and publications are available on the Internet, on CD-ROM, through fax on demand, over the telephone, through the mail, at local IRS offices, at some banks, post offices, and libraries, and even at some grocery stores, copy centers and office supply stores.

What was federal income tax in 2012?

Federal Income Tax Rates: Filing Status and Income Tax Rates 2012* Tax Rate Married Filing Jointly or Qualified Widow(er) Married Filing Separately 10% $0 - 17,400 $0 - 8,700 15% $17,400 - 70,700 $8,700 - 35,350 25% $70,700 - 142,700 $35,350 - 71,3504 more rows

What is the publication 17 of the IRS?

Publication 17 covers the general rules for filing a federal income tax return. It supplements the information contained in your tax form instruction booklet.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax Law 101 2012?

Tax Law 101 2012 is a set of regulations and guidelines established to govern tax reporting and compliance for individuals and businesses. It outlines the various tax obligations and procedures to be followed in filing taxes.

Who is required to file Tax Law 101 2012?

Individuals and businesses that earn income above a certain threshold are required to file according to Tax Law 101 2012. This includes employees, self-employed individuals, and corporations, among others.

How to fill out Tax Law 101 2012?

To fill out Tax Law 101 2012, individuals must gather their income information, deductions, and credits, then complete the required forms provided by the tax authorities, ensuring all relevant sections are filled accurately before submission.

What is the purpose of Tax Law 101 2012?

The purpose of Tax Law 101 2012 is to establish clear guidelines for tax compliance, ensure fair taxation, promote tax literacy among taxpayers, and facilitate efficient tax collection by government authorities.

What information must be reported on Tax Law 101 2012?

Tax Law 101 2012 requires the reporting of various information, including total income earned, allowable deductions, tax credits claimed, and any other relevant financial details pertinent to the taxpayer's financial situation.

Fill out your tax law 101 2012 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Law 101 2012 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.