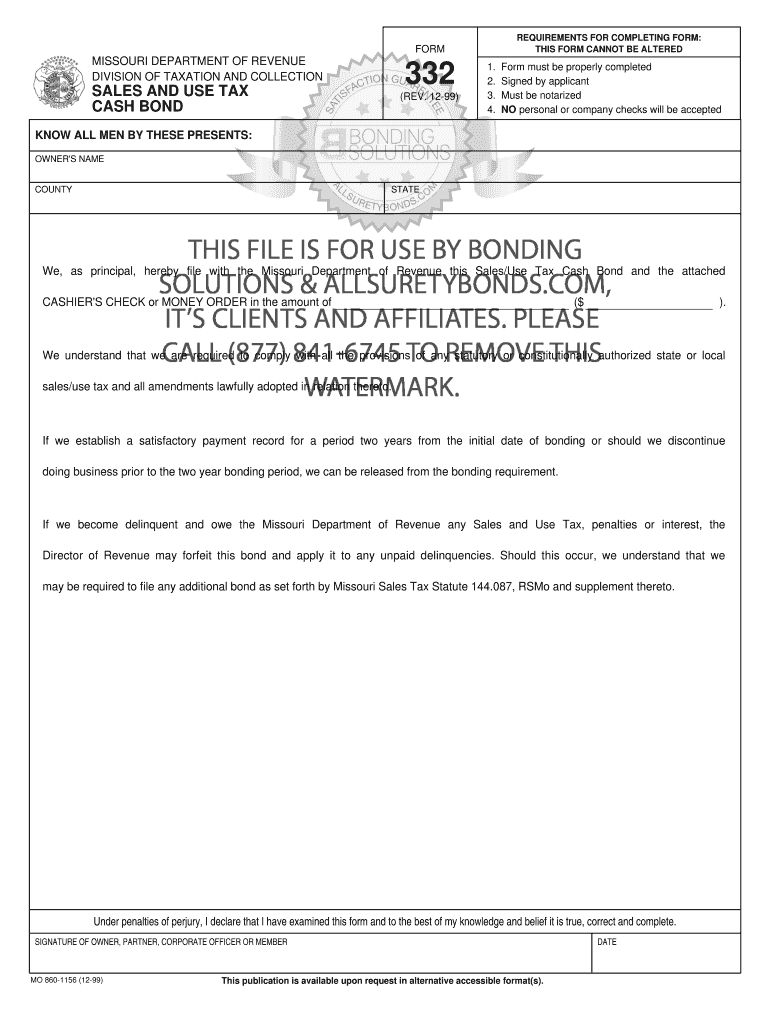

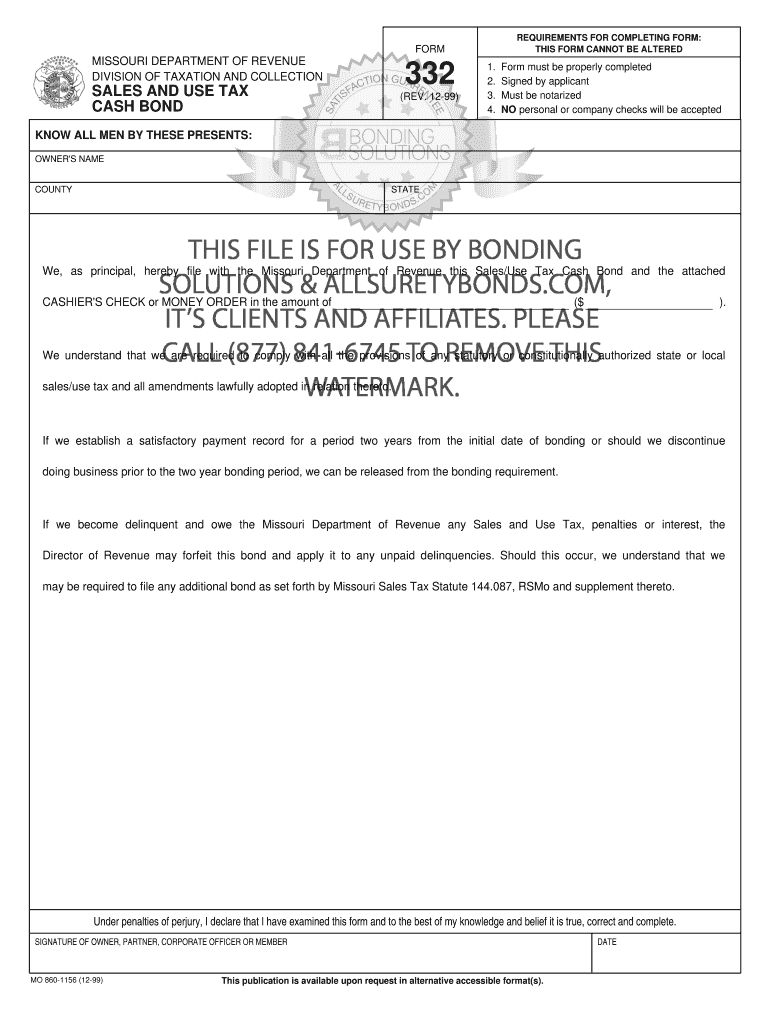

Get the free SALES AND USE TAX CASH BOND

Show details

This form is used to file a cash bond with the Missouri Department of Revenue for sales and use tax compliance.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sales and use tax

Edit your sales and use tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sales and use tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sales and use tax online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sales and use tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sales and use tax

How to fill out SALES AND USE TAX CASH BOND

01

Obtain the SALES AND USE TAX CASH BOND form from your local tax authority or their website.

02

Carefully read through the instructions provided on the form to understand the requirements.

03

Fill in your business name, address, and tax identification number in the designated fields.

04

Specify the amount of the cash bond required; this amount is usually determined by your state’s guidelines.

05

Provide details of your business operations, including the type of goods sold and the estimated sales tax liability.

06

Sign the form to certify that the information provided is accurate and complete.

07

Include any required documentation as specified by the tax authority.

08

Submit the completed form, along with the cash bond payment, to the appropriate tax office.

Who needs SALES AND USE TAX CASH BOND?

01

Businesses that are required to collect and remit sales tax.

02

New businesses that may not have an established credit history with the tax authority.

03

Businesses with a history of sales tax compliance issues.

04

Companies operating in states that mandate a cash bond for sales tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is a sales bond?

A sales tax surety bond is a form of financial security that ensures a business will remit all applicable sales taxes due to local and state governments by the specified deadlines. The bond is also referred to as: Continuous bond of seller. Sales and use tax bond.

What is the sales tax bond in Texas?

Sales Tax Bond Requirements in Texas Applicants for a tax permit may be required to provide a bond or security that equals either $100,000 or four times their average monthly tax liability. For itinerant vendors, while a bond may also be necessary, the minimum bond amount cannot be less than $500.

What does it mean when you sell bonds?

What Happens When I Sell My Bonds? When you sell bonds on the secondary market, you keep the interest payments you received before the sale. The new owner gets the interest payments from that point until the bond reaches its maturity date. The price you get for your bonds will reflect the loss of the past payments.

What would selling bonds do?

In general, when interest rates go down, bond prices go up. If this happens, you can make money by selling your bond before it matures. You'll get more than you paid for it, and you'll keep the interest you've made up until the time you sell it. Learn more about how interest rates affect bond prices .

Is a Texas sales and use tax permit the same as a resale certificate?

While resale certificates require the purchaser's Texas taxpayer number, the customer's sales tax permit number or a copy of the customer's permit is not a substitute for a resale certificate and does not relieve a seller's responsibility for collecting sales tax.

Who needs a sales tax permit in Texas?

You must obtain a Texas sales and use tax permit if you are an individual, partnership, corporation or other legal entity engaged in business in Texas and you: Sell tangible personal property in Texas; Lease or rent tangible personal property in Texas; Sell taxable services in Texas; or.

Is selling bonds debt?

Debt financing involves companies selling fixed-income products such as bonds, bills, or notes to creditors, including investors.

What is the difference between buying and selling bonds?

If you're holding the bond to maturity, the fluctuations won't matter — your interest payments and face value won't change. But if you buy and sell bonds, you'll need to keep in mind that the price you'll pay or receive is no longer the face value of the bond.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SALES AND USE TAX CASH BOND?

A Sales and Use Tax Cash Bond is a financial guarantee that a business provides to a state government to ensure compliance with sales and use tax laws, protecting the state from potential losses due to uncollected taxes.

Who is required to file SALES AND USE TAX CASH BOND?

Businesses that are required to collect and remit sales and use taxes may be mandated to file a Sales and Use Tax Cash Bond, particularly if they have a history of noncompliance or are considered high-risk.

How to fill out SALES AND USE TAX CASH BOND?

To fill out a Sales and Use Tax Cash Bond, a business must provide accurate business information, complete the bond form as specified by the state department, and determine the appropriate bond amount based on expected tax liabilities.

What is the purpose of SALES AND USE TAX CASH BOND?

The purpose of a Sales and Use Tax Cash Bond is to ensure that the state will receive the tax revenues that are due, especially in cases where a business may fail to comply with tax regulations.

What information must be reported on SALES AND USE TAX CASH BOND?

The Sales and Use Tax Cash Bond must include the business's legal name, address, type of business, tax identification number, and the amount of the bond, as well as any other specific information required by the state government.

Fill out your sales and use tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sales And Use Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.