Get the free SURETY BOND TO OPERATE MONEY BROKER BUSINESS

Show details

This document serves as a surety bond required for operating a money broker business in North Dakota, ensuring compliance with state regulations and protecting the state from claims against the business.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign surety bond to operate

Edit your surety bond to operate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your surety bond to operate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit surety bond to operate online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit surety bond to operate. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

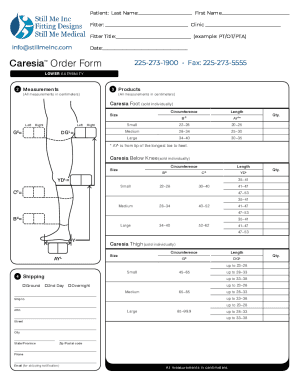

How to fill out surety bond to operate

How to fill out SURETY BOND TO OPERATE MONEY BROKER BUSINESS

01

Gather necessary documents required for the surety bond application, including financial statements and business licenses.

02

Choose a reputable surety bond company or agent that specializes in money broker business bonds.

03

Complete the bond application form provided by the surety company.

04

Provide information about your business, including ownership structure, business address, and previous financial history.

05

Submit any additional documentation requested by the surety company, such as personal credit reports or business plans.

06

Pay the required premium for the surety bond, which is typically a percentage of the total bond amount.

07

Upon approval, receive the executed surety bond and ensure it is filed with the appropriate regulatory agency.

Who needs SURETY BOND TO OPERATE MONEY BROKER BUSINESS?

01

Any business or individual looking to operate as a money broker must obtain a surety bond to comply with state or federal regulations.

02

Money brokers who facilitate transactions in foreign exchange or money transfers typically require this bond as a part of the licensing process.

03

Entities involved in providing financial services or acting as intermediaries in monetary transactions also need this bond to ensure consumer protection.

Fill

form

: Try Risk Free

People Also Ask about

How much does a $100 000 surety bond cost?

$100,000 surety bonds typically cost 0.5–10% of the bond amount, or $500–$10,000. Highly qualified applicants with strong credit might pay just $500 to $1000, while an individual with poor credit will receive a higher rate.

How much does it cost to get a $100,000 surety bond?

$100,000 surety bonds typically cost 0.5–10% of the bond amount, or $500–$10,000. Highly qualified applicants with strong credit might pay just $500 to $1000, while an individual with poor credit will receive a higher rate.

What is a surety bond for broker dealers?

Investment Advisor & Broker-Dealer Bonds The surety bond protects customers against financial losses in the event that the advisor misuses or misapplies funds, violates fiduciary duties or license regulations.

How much do surety bonds usually cost?

The cost of a surety bond is calculated as a small percentage of the total bond coverage amount — typically 0.5–10%. This means a $10,000 bond policy may cost between $50 and $1,000. For applicants with strong credit, most bond rates are 0.5–4% of the bond amount.

How much do you pay for a $100,000 bond?

Typically, you'll pay a premium of 10% of the total bail amount – which means $10,000 for a $100,000 bail bond. This fee compensates the bail bondsman for taking on the significant financial risk of guaranteeing the full amount to the court.

What is a surety bond in business?

What Are Surety Bonds? A surety bond is a promise to be liable for the debt, default, or failure of another. It is a three-party contract by which one party (the surety) guarantees the performance or obligations of a second party (the principal) to a third party (the obligee).

How much is a 1,000,000 surety bond?

$1,000,000 Surety Bond Cost by Credit Score Surety Bond AmountOver 675 (0.5-3%)600-675 (3-5%) $1,000,000 $5,000–$30,000 $30,000–$50,000 *This table provides general estimates. Bond pricing fluctuates due to various factors.

How do I get a surety bond for my business?

Most bonding companies issue surety bonds through an agent or broker so finding an experienced broker that specializes in surety bonds is key. A professional surety bond broker will guide your company through this process and assist you in establishing a relationship with a bonding company that will meet your needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SURETY BOND TO OPERATE MONEY BROKER BUSINESS?

A surety bond to operate a money broker business is a legally binding agreement between a money broker, a surety company, and the state, ensuring that the broker will adhere to applicable laws and regulations in their operations.

Who is required to file SURETY BOND TO OPERATE MONEY BROKER BUSINESS?

Individuals or businesses who are seeking to operate a money broker business typically are required to file a surety bond, as mandated by state laws or regulations.

How to fill out SURETY BOND TO OPERATE MONEY BROKER BUSINESS?

To fill out a surety bond to operate a money broker business, one must complete the bond form with accurate business details, including the business name, address, and license information, and have it signed by the surety company.

What is the purpose of SURETY BOND TO OPERATE MONEY BROKER BUSINESS?

The purpose of a surety bond to operate a money broker business is to protect clients and the public by ensuring that the broker complies with financial regulations and fulfills contractual obligations.

What information must be reported on SURETY BOND TO OPERATE MONEY BROKER BUSINESS?

The information that must be reported on the surety bond includes the bond amount, the names of the parties involved (the principal, obligee, and surety), the duration of the bond, and any specific terms stipulated by the state or regulatory authority.

Fill out your surety bond to operate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Surety Bond To Operate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.