Get the free HOME-BASED BUSINESS File 120000 APPLICATION

Show details

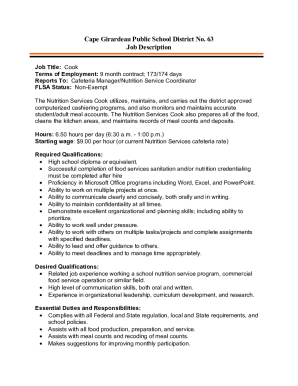

HOMELAND BUSINESS APPLICATION File: 12.00.00 Name of Applicant (please print) Business or Company Name Contact Phone No. Mailing Address (including postal code) Location of Homeland Business if different

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home-based business file 120000

Edit your home-based business file 120000 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home-based business file 120000 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing home-based business file 120000 online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit home-based business file 120000. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home-based business file 120000

How to fill out home-based business file 120000:

01

Identify the purpose of the home-based business file 120000. Is it for taxes, legal compliance, or record keeping? Understanding the purpose will help you determine what information needs to be included.

02

Gather all relevant financial documents and records related to your home-based business. This may include income statements, expense receipts, bank statements, and sales records. Ensure that you have accurate and up-to-date information.

03

Begin filling out the file by providing your business information. This may include your business name, address, contact details, and any official registration numbers or identifiers.

04

Include a detailed breakdown of your business income. List all sources of revenue, including sales, services rendered, or any other income earned through your home-based business. Be sure to specify the time period for which the income is being reported.

05

List all business expenses. This should include any costs incurred in running your home-based business, such as rent or mortgage payments, utility bills, supplies, marketing expenses, and any other relevant expenditures. Categorize your expenses to make it easy for future reference and analysis.

06

Calculate your net profit or loss. Subtract the total expenses from the total income to determine your business's financial performance. This information is essential for tax purposes and evaluating the profitability of your home-based business.

07

Include any additional information or documentation required by the specific purpose of the home-based business file 120000. This may vary depending on your local tax regulations or any other governing authority that requires the file.

Who needs home-based business file 120000:

01

Small business owners operating from home: If you have a home-based business, maintaining a proper record of your business activities is crucial. The home-based business file 120000 can help you keep track of your income, expenses, and other relevant financial information required for tax filing or legal compliance.

02

Self-employed individuals: If you are self-employed and working from home, it is essential to maintain a proper record of your business activities. The home-based business file 120000 can serve as an organized documentation system to track your financial transactions, making it easier to manage your taxes and financial responsibilities.

03

Freelancers and consultants: Many freelancers and consultants work from home. Having a well-maintained home-based business file 120000 can help them keep track of their income, expenses, and other financial details, making it easier to invoice clients, file taxes, and evaluate the profitability of their freelance or consulting work.

04

Independent contractors and sole proprietors: Independent contractors and sole proprietors who operate their businesses from home can benefit from maintaining a home-based business file 120000. This file can help them track their business finances, ensure compliance with legal requirements, and provide accurate records for tax purposes.

In summary, individuals operating a home-based business or self-employed professionals can use the home-based business file 120000 to organize their financial records, track income and expenses, and fulfill tax and legal obligations. It provides a systematic way to maintain records and is beneficial for overall business management.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit home-based business file 120000 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like home-based business file 120000, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make edits in home-based business file 120000 without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your home-based business file 120000, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit home-based business file 120000 on an Android device?

You can make any changes to PDF files, like home-based business file 120000, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is home-based business file 120000?

Home-based business file 120000 is a form used to report income from a business operated out of a person's home.

Who is required to file home-based business file 120000?

Individuals who operate a business from their home and meet certain criteria set by the tax authorities are required to file home-based business file 120000.

How to fill out home-based business file 120000?

Home-based business file 120000 can be filled out by providing information about the income generated from the home-based business, expenses incurred, and other relevant details as requested on the form.

What is the purpose of home-based business file 120000?

The purpose of home-based business file 120000 is to accurately report the income generated from a home-based business and ensure compliance with tax regulations.

What information must be reported on home-based business file 120000?

On home-based business file 120000, individuals must report details such as income earned, expenses incurred, deductions claimed, and other relevant financial information related to the home-based business.

Fill out your home-based business file 120000 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home-Based Business File 120000 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.