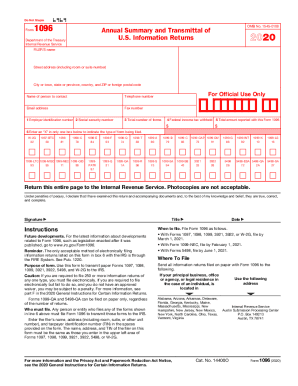

NJ UZ-5-SB-A 2008 free printable template

Show details

UZ-5-SB-A 12-08 STATE OF NEW JERSEY DIVISION OF TAXATION Application for Exemption from Sales Tax on Purchases of Goods and Materials for Exclusive Use or Consumption within an Urban Enterprise Zone

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign uz 5

Edit your uz 5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uz 5 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

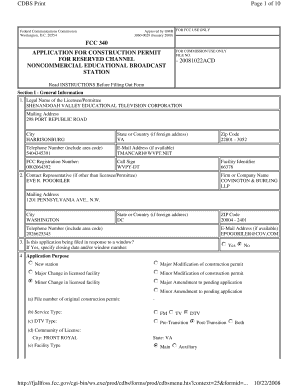

How to edit uz 5 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit uz 5. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ UZ-5-SB-A Form Versions

Version

Form Popularity

Fillable & printabley

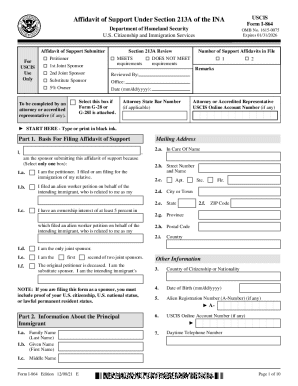

How to fill out uz 5

How to fill out NJ UZ-5-SB-A

01

Obtain the NJ UZ-5-SB-A form from the New Jersey Division of Taxation website or your local tax office.

02

Fill out your personal information in the designated sections, including your name, address, and Social Security number.

03

Provide details about your business entity, including the name and type of business.

04

Indicate the reason for the application in the appropriate section.

05

Include any required financial information or documentation as specified on the form.

06

Review the completed form for accuracy and completeness to avoid processing delays.

07

Sign and date the form before submission.

08

Submit the form either online or via mail to the specified address on the form.

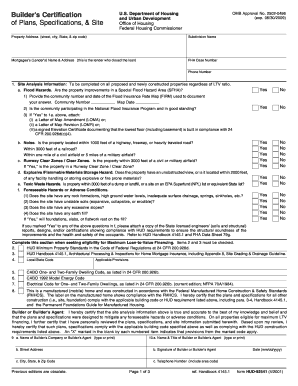

Who needs NJ UZ-5-SB-A?

01

Business owners seeking to apply for a specific tax benefit in New Jersey.

02

Individuals looking to request a change in their business tax status.

03

Entities that need to report exempt or reduced sales tax use.

Fill

form

: Try Risk Free

People Also Ask about

What does it mean to be tax exempt?

What Is a Tax Exemption? A tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the IRS, preventing them from having to pay income tax.

What is an ST 3 tax exempt form for in nj?

Resale Certificate for Non-New Jersey Sellers (Form ST-3NR) Form ST-3NR can be used by qualified out-of-state sellers to make tax-exempt purchases in New Jersey of goods or services purchased for resale.

What items are exempt from nj sales tax?

The current Sales Tax rate is 6.625% and the specially designated Urban Enterprise Zones rate is one half the Sales Tax rate. Certain items are exempt from sales tax, such as food, clothing, drugs, and manufacturing/processing machinery and equipment. A resale exemption also exists.

How do I get a St 5 form in nj?

To obtain the form or go to .state.nj.us/treasury/taxation forms, print and download, sales tax forms go to REG 1E – Application for Exempt.

What is Form UZ 5 NJ?

UZ-5 (Urban Enterprise Zone Exempt Purchase Certificate) – Qualified businesses may use a UZ-5 exemption certificate to make exempt purchases of most tangible personal property and services. The purchases must be used exclusively at the qualified business's UEZ location.

What is New Jersey Form UZ 4?

A UZ-4 certificate allows contractors to make tax free purchases of materials, supplies, and services for the exclusive use of improving, altering or repairing the real property of a qualified UEZ business located in the zone.

What is the tax rate for UEZ in NJ?

Customers benefit by paying half the normal Sales Tax rate on many purchases at a UEZ Business (current UEZ Sales Tax rate is 3.3125%).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send uz 5 to be eSigned by others?

Once you are ready to share your uz 5, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit uz 5 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your uz 5 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out uz 5 using my mobile device?

Use the pdfFiller mobile app to complete and sign uz 5 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is NJ UZ-5-SB-A?

NJ UZ-5-SB-A is a form used in New Jersey for reporting specific tax-related information, including business income and expenses.

Who is required to file NJ UZ-5-SB-A?

Businesses in New Jersey that meet certain criteria, such as having a specific level of income or expenses, are required to file NJ UZ-5-SB-A.

How to fill out NJ UZ-5-SB-A?

To fill out NJ UZ-5-SB-A, businesses must provide accurate financial information in designated sections, including income, expenses, and other relevant data.

What is the purpose of NJ UZ-5-SB-A?

The purpose of NJ UZ-5-SB-A is to collect tax information from businesses for state revenue purposes and to ensure compliance with New Jersey tax laws.

What information must be reported on NJ UZ-5-SB-A?

The information that must be reported on NJ UZ-5-SB-A includes total income, allowable deductions, business expenses, and any credits that may apply.

Fill out your uz 5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Uz 5 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.