Get the free Roth IRA Distribution Request

Show details

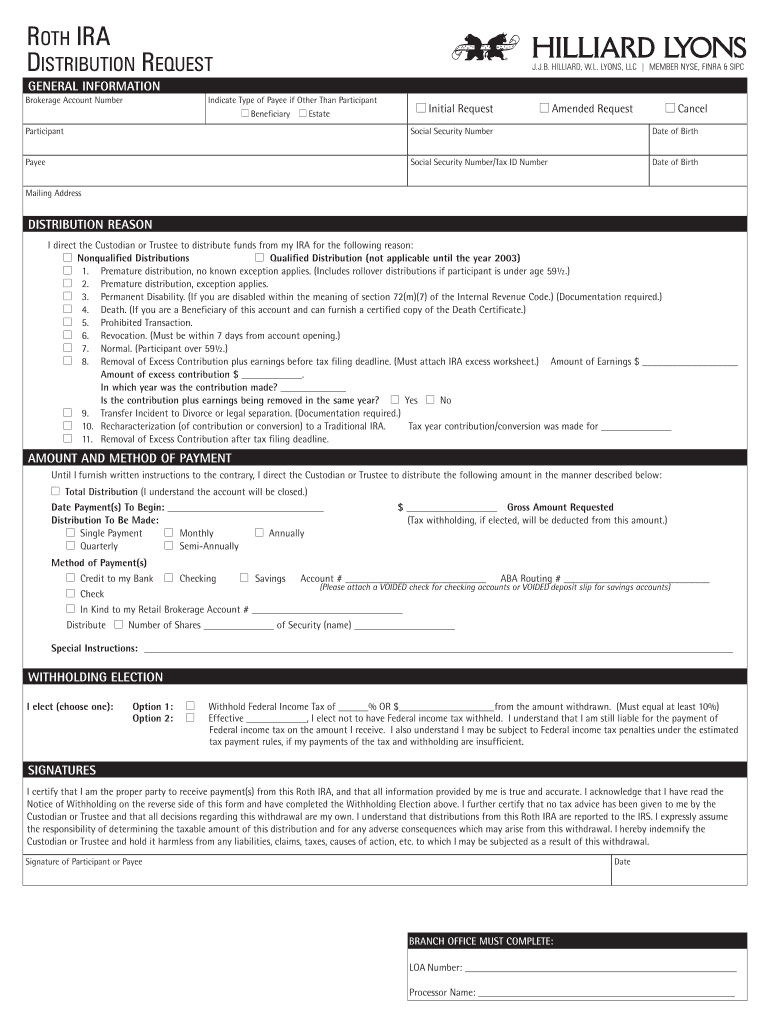

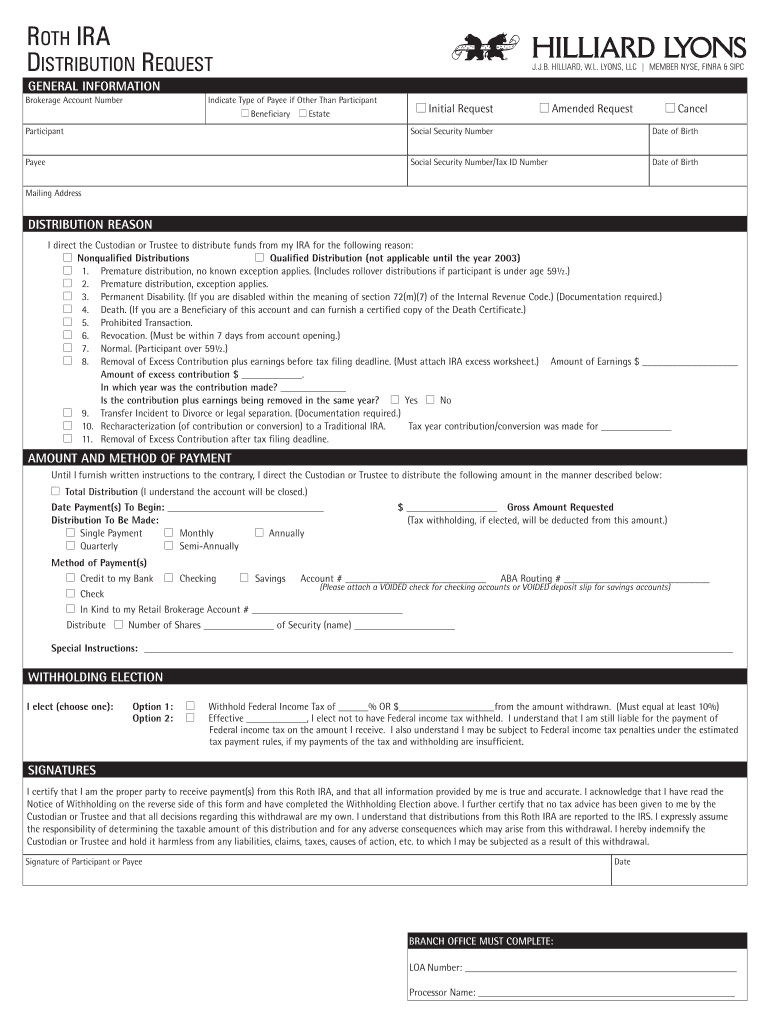

This document is a request form for distributions from a Roth IRA account. It gathers information about the participant, payee, and the specifics of the distribution request, including reasons for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign roth ira distribution request

Edit your roth ira distribution request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your roth ira distribution request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing roth ira distribution request online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit roth ira distribution request. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out roth ira distribution request

How to fill out Roth IRA Distribution Request

01

Obtain the Roth IRA Distribution Request form from your financial institution or their website.

02

Fill in your personal information, including your name, address, and social security number.

03

Specify the type of distribution you are requesting (full or partial withdrawal).

04

Indicate the amount you wish to withdraw and the reason for the distribution, if required.

05

Provide any necessary documentation, such as proof of eligibility for specific withdrawal types.

06

Select your preferred method of receiving the funds (check, electronic transfer, etc.).

07

Sign and date the form to certify that the information provided is accurate.

08

Submit the completed form according to your financial institution's instructions, either by mail or electronically.

Who needs Roth IRA Distribution Request?

01

Individuals who wish to access funds from their Roth IRA account.

02

Account holders who have reached the eligible age for tax-free withdrawals.

03

Those who need to withdraw funds for qualified expenses such as first-time home purchase or education costs.

04

Beneficiaries of a Roth IRA who need to claim distributions after the account holder's death.

Fill

form

: Try Risk Free

People Also Ask about

Do Roth IRA distributions need to be reported?

Yes, the Form 1099-R must be entered into TurboTax. The distribution must appear on Form 1040 line 4a but will be excluded from line 4b because it is not taxable. Still have questions?

What are the distribution rules for Roth IRAs for beneficiaries?

Fortunately, based on the ordering rules, Roth IRA contributions come out first. Until you exceed the amount of contributions with your withdrawals, converted dollars and earnings will stay put. Conversions. Conversions come out next.

What is an IRA distribution request form?

Use this form to request a lump-sum distribution or to establish a systematic withdrawal plan from a traditional IRA, Roth IRA, Coverdell ESA, or SEP IRA.

Can you take a distribution from your Roth IRA?

Withdrawals, also called distributions, are either qualified or non-qualified. This designation drives whether taxes, penalties, or both apply. The Roth IRA five-year rule says that earnings in Roth IRAs can only be withdrawn tax-free when this or any other Roth IRA you own has been open for at least five years.

What is the order of distributions for a Roth IRA?

The order of the distribution of assets is (1) IRA participant contributions, (2) taxable conversions, (3) non-taxable conversions, and (4) earnings. Roth ordering rules only apply when a withdrawal from an account is a non-qualified distribution.

What two requirements must be met in order for distributions from a Roth IRA to be completely tax free?

The Bottom Line If you opened your Roth IRA at least five years ago and you're at least 59½ years old, your Roth IRA withdrawals are generally tax-free and penalty-free. Otherwise, you might be able to avoid penalties and taxes on Roth IRA earnings if you meet an exception, such as purchasing a home or being disabled.

Are Roth withdrawals first in first out?

There are rules of thumb to guide you, the most notable being to subtract your age from 100 (or, to sway more toward risk, 110). The resulting number is the percentage of your portfolio that should be allocated toward stocks: Under this rule, if you're 30, you'd direct 70% to 80% that way.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Roth IRA Distribution Request?

A Roth IRA Distribution Request is a formal document that an account holder submits to request a withdrawal of funds from their Roth Individual Retirement Account (IRA). It outlines the amount to be withdrawn and the reason for the distribution.

Who is required to file Roth IRA Distribution Request?

Any account holder who wishes to withdraw funds from their Roth IRA must file a Roth IRA Distribution Request. This includes individuals seeking to take qualified and non-qualified distributions.

How to fill out Roth IRA Distribution Request?

To fill out a Roth IRA Distribution Request, the account holder should provide their personal information, account number, the amount they wish to withdraw, select the type of distribution, and sign the form, affirming their request.

What is the purpose of Roth IRA Distribution Request?

The purpose of the Roth IRA Distribution Request is to formally document and process a withdrawal request from an account holder, ensuring that the transaction complies with IRS regulations and the account’s terms.

What information must be reported on Roth IRA Distribution Request?

The information that must be reported on a Roth IRA Distribution Request includes the account holder’s name, account number, requested distribution amount, reason for the distribution, and the method of payment.

Fill out your roth ira distribution request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Roth Ira Distribution Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.