Get the free common transaction form

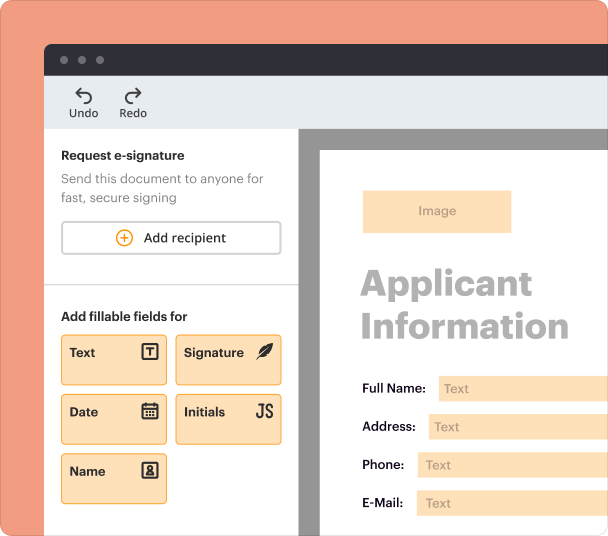

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

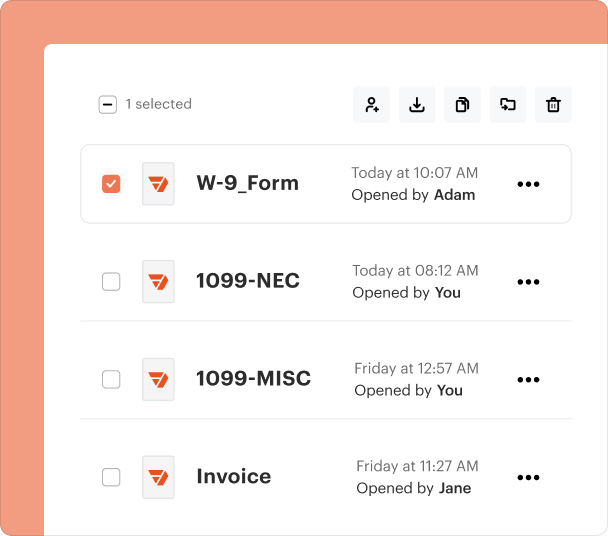

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

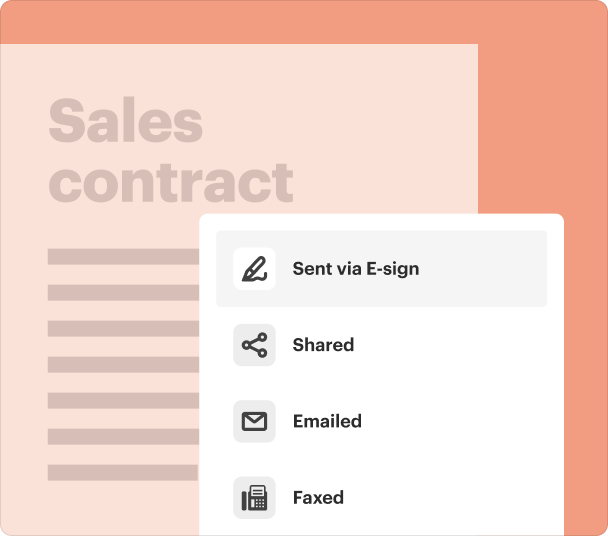

End-to-end document management

Accessible from anywhere

Secure and compliant

How to fill out a common transaction form effectively

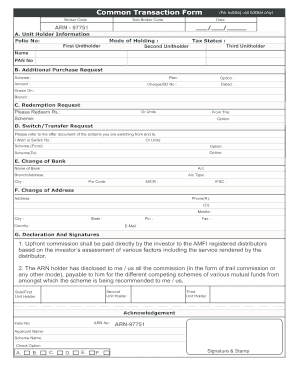

What is a common transaction form?

A common transaction form is a standardized document used in various financial transactions, primarily within investment sectors. Its main purpose is to facilitate the accurate processing of transactions such as purchases, redemptions, and changes in account details. By understanding this form, users can ensure that their financial engagements are conducted smoothly and efficiently.

-

The common transaction form is a document that standardizes transaction requests in the financial industry.

-

This form is vital as it mitigates errors, enhances compliance, and accelerates transaction processes.

-

Typically, the form includes sections for broker information, investor details, transaction type, and required signatures.

What are the key components of the common transaction form?

Each field on a common transaction form is essential for ensuring accuracy. The broker information, folio and scheme details, and investor data all play crucial roles in the successful execution of a transaction. Users must understand the significance of each entry to avoid complications.

-

This includes Broker Code and Broker Name, which identify the financial intermediary facilitating the transaction.

-

It’s important to provide accurate folio numbers and scheme names to ensure the transaction is recorded in the correct accounts.

-

Correctly filling out these sections is crucial as they directly impact how transactions are processed.

How can you fill out the common transaction form?

Filling out the common transaction form can be straightforward when approached systematically. Start by carefully completing each section, following the guidelines. Ensuring accuracy in each entry is vital, as mistakes can lead to delays or transaction failures.

-

Adhere to a step-by-step process for filling out each part of the form to ensure all information is accurately captured.

-

Use resources or consult with a financial advisor to clarify any doubts concerning the required information.

-

Double-check your entries to avoid frequent errors like incorrect bank details or missing signatures.

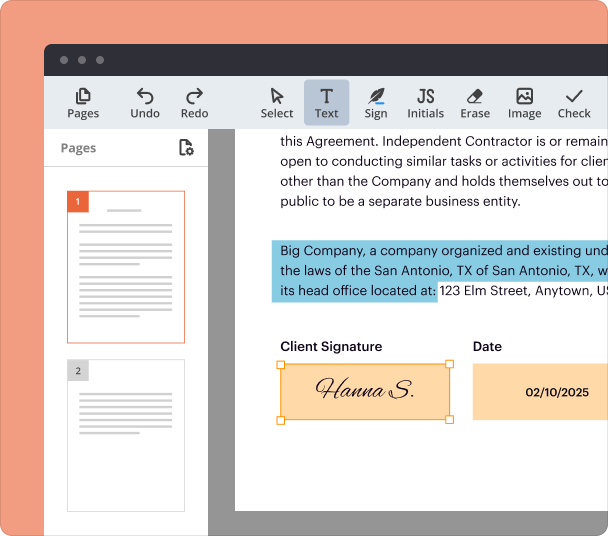

How to manage your common transaction form with pdfFiller?

pdfFiller provides a user-friendly platform for managing your common transaction form. Users can upload, edit, and collaborate on their documents easily, ensuring that all team members can access the latest versions.

-

Upload your form to pdfFiller, and access it from anywhere with internet connectivity.

-

Utilize various editing features available on pdfFiller to modify your form with ease.

-

Ensure team-based management of your forms through collaboration features that allow multiple users to view and edit.

What additional transactions can you process?

The common transaction form also serves various other functions, such as processing additional purchases, fund redemptions, and switching between different schemes. Understanding these processes can optimize your investment management.

-

Learn the necessary steps and documentation required for purchasing additional units in a given scheme.

-

Understand the requirements and steps needed to redeem or re-purchase units.

-

Transitioning assets between schemes is also possible; knowing when and how to do this can enhance investment flexibility.

How to update personal information on the common transaction form?

Keeping your personal information up to date on your common transaction form is crucial for compliance and communication. Any changes in address or contact details should be accurately reflected to avoid complications.

-

Effectively complete this section to ensure all future correspondence goes to the correct address.

-

Regularly updating contact details ensures that you remain informed about your financial engagements.

-

Utilize pdfFiller for submitting changes, ensuring your updates are promptly recorded.

What bank information is required for transactions?

Accurate bank information is essential for executing transactions securely. Understanding the details required in the 'New Bank' section, such as account type and bank city, can prevent errors that may delay transactions.

-

Carefully fill in details like account type and bank city to ensure your banking preferences are correctly established.

-

Accurate banking details protect your investments and personal information from fraud or errors.

-

Use pdfFiller’s secure input features to ensure your bank information is safely stored and managed.

How do you finalize your common transaction form?

Finalizing your common transaction form is essential for ensuring that your transactions are authorized and processed without delays. Pay attention to the signature and authorization requirements as these elements validate your requests.

-

Ensure all required signatures are collected to validate the transaction request.

-

Use the eSigning capabilities on pdfFiller for quick and easy approvals without needing physical signatures.

-

Follow best practices for submitting your completed form to ensure timely processing.

Frequently Asked Questions about cams common transaction form

What is a common transaction form?

A common transaction form is a standardized document used in financial transactions, primarily in investments, to ensure accurate processing of transactions like purchases and redemptions.

How do I fill out the common transaction form?

Fill out the common transaction form by systematically following each section, ensuring accuracy in your entries to avoid delays or errors.

Can I manage my form using pdfFiller?

Yes, pdfFiller enables you to upload, edit, and collaborate on your common transaction forms using user-friendly tools.

What additional transactions can be processed with this form?

You can process several additional transactions such as additional purchases, redemptions, and switching between investment schemes.

What information is required for the New Bank section?

You need to provide details like account type, bank city, and other pertinent banking information to establish transaction security.

pdfFiller scores top ratings on review platforms