Get the free Non-Qualified Deferred Compensation Plans More Important

Show details

Guardian Advantages Unqualified Deferred Compensation Plans: More Important than Ever under the Obama Administrations Fiscal Year 2011 Budget Proposal Many business owners, executives and professionals

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-qualified deferred compensation plans

Edit your non-qualified deferred compensation plans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-qualified deferred compensation plans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non-qualified deferred compensation plans online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit non-qualified deferred compensation plans. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-qualified deferred compensation plans

How to Fill out Non-Qualified Deferred Compensation Plans:

01

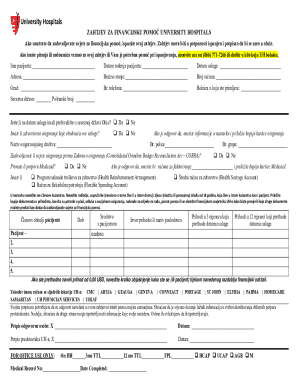

Understand the purpose: Non-qualified deferred compensation plans allow employees to set aside a portion of their income for retirement, typically above the contribution limits of qualified plans like 401(k)s or IRAs. These plans provide tax advantages and flexibility in terms of contribution limits and distribution options.

02

Consult with a financial advisor: Before filling out a non-qualified deferred compensation plan, it is advisable to seek guidance from a financial advisor who specializes in retirement planning. They can help you understand the specific details, implications, and potential benefits of these plans.

03

Review plan eligibility: Non-qualified deferred compensation plans are typically offered to a select group of highly compensated employees, executives, or key individuals within an organization. Confirm if you meet the eligibility requirements to participate in such a plan.

04

Determine your contribution amount: Decide how much of your income you would like to defer into the plan. The contribution limit for non-qualified plans is typically higher than that of qualified plans. However, the precise limits may vary depending on the specific plan and employer.

05

Choose contribution methods: Non-qualified deferred compensation plans may offer different contribution options such as salary reduction, bonus deferral, or excess savings deferral. Understand the available methods and select the one that aligns with your financial goals and preferences.

06

Understand vesting schedules: Vesting refers to the period of time an employee must work for an employer before becoming entitled to the deferred compensation benefits. Review the vesting schedule of the plan to determine when you will have access to your deferred funds.

07

Evaluate investment options: Many non-qualified deferred compensation plans offer investment choices for the funds you defer. Carefully assess the investment options available to optimize your potential returns and align them with your risk tolerance and investment objectives.

08

Seek legal counsel, if necessary: Non-qualified deferred compensation plans involve complex legal and tax implications. It is recommended to consult with an attorney who specializes in employee benefits and compensation to ensure compliance with applicable laws and regulations.

Who needs non-qualified deferred compensation plans?

01

Highly compensated employees: Non-qualified deferred compensation plans are particularly beneficial for highly paid individuals who have already reached the maximum contribution limits of qualified retirement plans, such as 401(k) or IRA accounts.

02

Executives and key personnel: Employers often use non-qualified deferred compensation plans as an incentive to attract, retain, and reward top executives, key employees, or highly valued talent within their organizations.

03

Individuals seeking additional retirement savings: Non-qualified deferred compensation plans provide an opportunity to save more for retirement beyond the limits of qualified plans. If you want to supplement your retirement savings, a non-qualified plan can be a valuable tool.

04

Those looking for tax advantages: Non-qualified deferred compensation plans offer potential tax advantages by allowing employees to defer taxes on their income until the funds are distributed. This can be advantageous for individuals in higher tax brackets.

Remember, it is essential to consult with a professional advisor and carefully assess your specific financial situation before deciding to fill out a non-qualified deferred compensation plan.

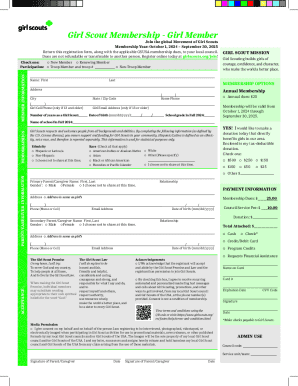

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit non-qualified deferred compensation plans straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing non-qualified deferred compensation plans.

How can I fill out non-qualified deferred compensation plans on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your non-qualified deferred compensation plans. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out non-qualified deferred compensation plans on an Android device?

Use the pdfFiller app for Android to finish your non-qualified deferred compensation plans. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

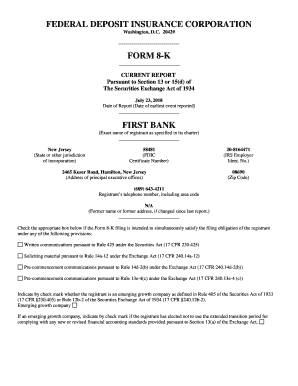

What is non-qualified deferred compensation plans?

Non-qualified deferred compensation plans are agreements between an employer and an employee to defer the receipt of earned income to a later date, often for tax purposes.

Who is required to file non-qualified deferred compensation plans?

Employers who offer non-qualified deferred compensation plans to their employees are required to file the necessary documentation with the IRS.

How to fill out non-qualified deferred compensation plans?

Non-qualified deferred compensation plans can be filled out by using IRS Form 1099-MISC or other appropriate tax forms provided by the IRS.

What is the purpose of non-qualified deferred compensation plans?

The purpose of non-qualified deferred compensation plans is to allow employees to defer receipt of income until a later date when they may be in a lower tax bracket.

What information must be reported on non-qualified deferred compensation plans?

Non-qualified deferred compensation plans must report the amount of deferred income, the timing of payments, and any other relevant details.

Fill out your non-qualified deferred compensation plans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Qualified Deferred Compensation Plans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.