Get the free GST IMPLEMENTING

Show details

GST IMPLEMENTING IT IN YOUR BUSINESS Ir. Aziz Smallest Impact To Your Business Contents 1.0Summary......................................................................................................................

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gst implementing

Edit your gst implementing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gst implementing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

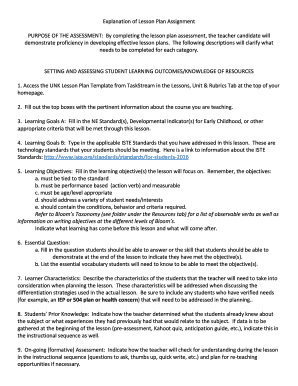

Editing gst implementing online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit gst implementing. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

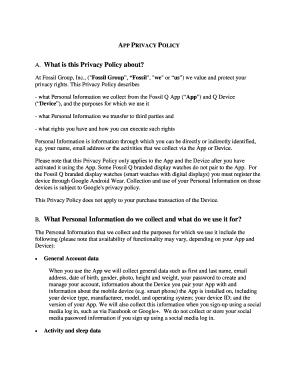

How to fill out gst implementing

How to Fill Out GST Implementing:

01

Gather all necessary financial information: Before starting the process of filling out the GST implementing, make sure to collect all relevant financial records, such as sales invoices, purchase invoices, and expense receipts. This will ensure that you have all the information needed to accurately calculate and report your GST.

02

Understand the GST rules and regulations: Familiarize yourself with the GST rules and regulations of your country or region. These regulations may vary, so it is crucial to have a comprehensive understanding of the specific requirements and guidelines for GST implementation.

03

Determine your GST registration status: Determine whether you need to register for GST or if you are already registered. This will depend on factors such as your annual turnover, business type, and location. If you are not already registered for GST and meet the criteria, you will need to complete the necessary registration forms before proceeding with the implementation.

04

Calculate the GST amount: Once you have all the relevant financial information, calculate the GST amount to be included in your sales, purchases, and expenses. The GST amount is typically a percentage of the transaction value and may vary depending on the type of goods or services involved. Use the appropriate GST rate for each transaction.

05

Complete the GST return or statement: After calculating the GST amount, you need to complete the GST return or statement form according to the guidelines provided by the tax authority. Make sure to accurately enter all the necessary information, including your business details, taxable supplies, input tax credits, and any other required details.

06

File the GST return: Once the form is completed, file the GST return with the appropriate tax authority within the specified deadline. This may involve submitting it online or physically mailing it to the designated tax office. Ensure that you adhere to the deadlines to avoid penalties or fines.

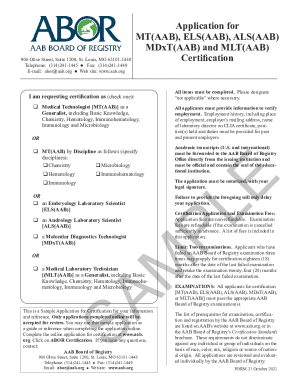

Who Needs GST Implementing:

01

Businesses selling goods or services: Any business engaged in selling goods or providing services may need to implement GST, depending on the turnover and other criteria determined by the tax authority.

02

Small and medium-sized enterprises (SMEs): GST implementation is often mandatory for SMEs, as they may have annual turnover that exceeds the threshold set by the tax authority.

03

Startups and entrepreneurs: Startups and entrepreneurs entering the business world should evaluate whether they meet the criteria for GST registration. Even if not mandated, voluntary registration may be beneficial for certain business activities.

04

Importers and exporters: Importers and exporters may also need to implement GST, as international transactions and cross-border trade are subject to specific GST rules and regulations.

It is important to consult with a tax professional or refer to the applicable laws and guidelines to determine whether GST implementation is required for your specific circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my gst implementing directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your gst implementing as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I execute gst implementing online?

Filling out and eSigning gst implementing is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my gst implementing in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your gst implementing right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is gst implementing?

GST (Goods and Services Tax) implementing involves the implementation of a tax system that replaces a multitude of indirect taxes in India.

Who is required to file gst implementing?

Businesses registered under GST are required to file GST returns.

How to fill out gst implementing?

GST implementing can be filled out online on the GST portal by providing details of sales, purchases, and tax payments.

What is the purpose of gst implementing?

The purpose of GST implementing is to streamline the indirect tax system, reduce tax evasion, and create a common market within India.

What information must be reported on gst implementing?

Information such as sales, purchases, input tax credit, and tax paid must be reported on GST implementing.

Fill out your gst implementing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gst Implementing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.