Get the free Ordinance to Opt Out of State Imposed Sales Tax Holiday

Show details

This document outlines the ordinance passed by a city's governing body to opt out of the state's sales tax holiday due to concerns over lost local revenues and the need for municipalities to uphold

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ordinance to opt out

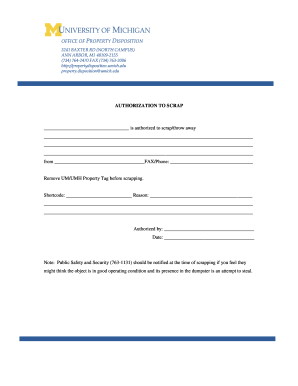

Edit your ordinance to opt out form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ordinance to opt out form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ordinance to opt out online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ordinance to opt out. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ordinance to opt out

How to fill out Ordinance to Opt Out of State Imposed Sales Tax Holiday

01

Obtain the Ordinance form from your local government's website or office.

02

Fill in the required information, including your name, address, and any relevant identification numbers.

03

Indicate your intention to opt out of the state imposed sales tax holiday by checking the appropriate box.

04

Review the specific dates and details of the sales tax holiday that you are opting out of.

05

Sign and date the Ordinance form to certify that the information provided is accurate.

06

Submit the completed Ordinance form to the appropriate local authority by the specified deadline.

Who needs Ordinance to Opt Out of State Imposed Sales Tax Holiday?

01

Local governments or municipalities that wish to opt out of the state sales tax holiday.

02

Businesses that prefer to maintain their sales tax collections during the holiday.

03

Residents who reside in areas where sales tax holidays are imposed and want to understand their options.

Fill

form

: Try Risk Free

People Also Ask about

Does Amazon participate in the Ohio tax-free weekend?

Ohio's tax-free "weekend" lasts until Aug. 14 and includes online purchases via Amazon and Walmart.

What items are exempt from sales tax in Ohio?

Common exemptions from Ohio sales and use tax: Groceries and food sold for off premises consumption. Prescription medicines. Housing related utilities, such as gas, electric, water and steam.

What is excluded from tax-free weekends in Ohio?

Anything more than $500 will still have the state sales tax attached to it at checkout. Other items that may be less than $500 that are not exempt include: Alcohol. Tobacco and vape products.

What are the rules for tax free weekend in Ohio?

The event covers nearly all tangible personal property priced under $500, including food, plants, and sporting gear. There is no limit on the amount of the total purchase. The qualification is determined item by item.

What is included in a tax free weekend in Missouri?

0:44 2:49 Clothing. Each individual item has to cost $100. Or less to get the tax break For school supplies.MoreClothing. Each individual item has to cost $100. Or less to get the tax break For school supplies.

What is excluded from Massachusetts tax free weekend?

Benefit: No sales tax on most items ≤ $2,500. Exclusions: Alcohol, meals, cars, boats, energy, and more. Online Purchases: Any qualifying purchase made online can qualify if made during the sales tax window. Other states have similar tax-free holidays - see the full list below.

Does Ohio tax-free weekend apply to restaurants?

Ohio's expanded sales tax holiday Aug. 1 - 14, 2025 includes restaurants.

What qualifies for a tax free weekend in New Mexico?

FAMILIES CAN GET SOME HELP BUYING SCHOOL SUPPLIES WITH NEW MEXICO'S ANNUAL TAX FREE WEEKEND. TOMORROW THROUGH SUNDAY, YOU CAN BUY CERTAIN THINGS TAX FREE. THIS INCLUDES CLOTHING AND SHOES PRICED LESS THAN $100 PER ITEM, COMPUTERS OR TABLETS UP TO $1,000, AND SCHOOL SUPPLIES UNDER $30 PER ITEM.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Ordinance to Opt Out of State Imposed Sales Tax Holiday?

An Ordinance to Opt Out of State Imposed Sales Tax Holiday is a local government measure that allows municipalities to choose not to participate in a state-mandated sales tax holiday, thus maintaining local sales tax revenue during the designated period.

Who is required to file Ordinance to Opt Out of State Imposed Sales Tax Holiday?

Local governments, such as cities or counties that wish to opt out of the state sales tax holiday, are required to file the Ordinance to formally declare their intention.

How to fill out Ordinance to Opt Out of State Imposed Sales Tax Holiday?

To fill out the Ordinance, local officials generally need to provide details about the jurisdiction, specify the reasons for opting out, and follow the required format and procedures outlined by state law.

What is the purpose of Ordinance to Opt Out of State Imposed Sales Tax Holiday?

The purpose of the Ordinance is to help local governments retain sales tax revenue and control their budgeting and financial planning, particularly during peak shopping times associated with sales tax holidays.

What information must be reported on Ordinance to Opt Out of State Imposed Sales Tax Holiday?

The Ordinance must report the local jurisdiction’s decision, the effective dates of the opt-out, any rationale for the decision, and may require public hearing details or council meeting records where the decision was made.

Fill out your ordinance to opt out online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ordinance To Opt Out is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.