Get the free HSA Eligibility and Owner Information Name Address 1238 Broad St

Show details

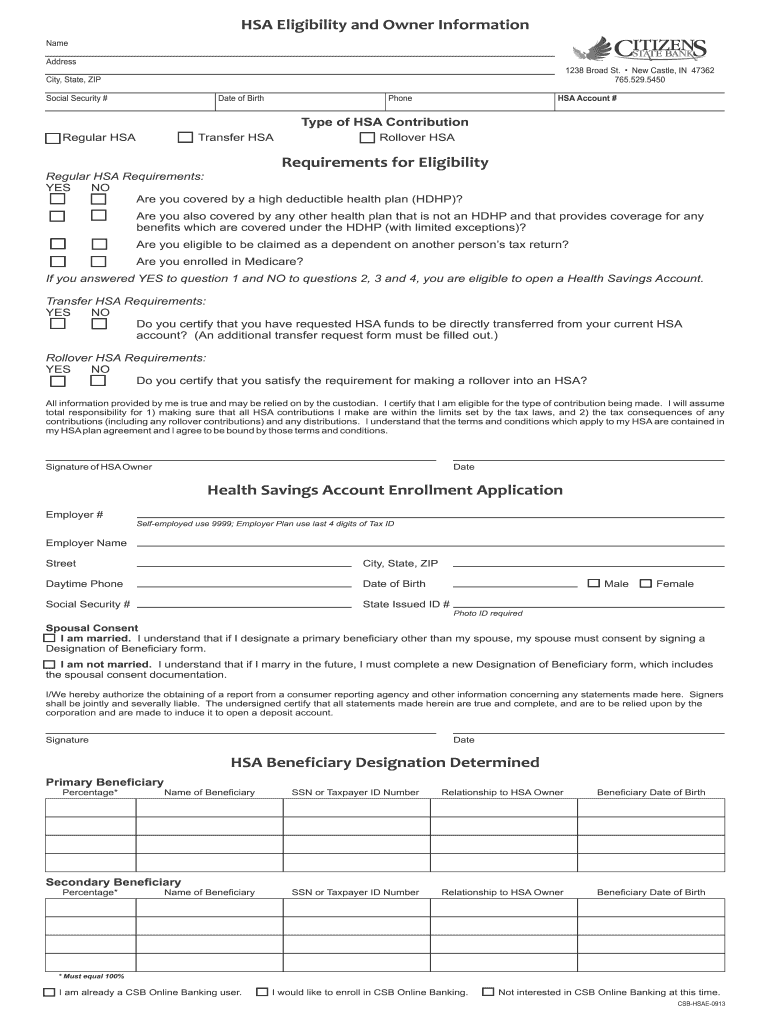

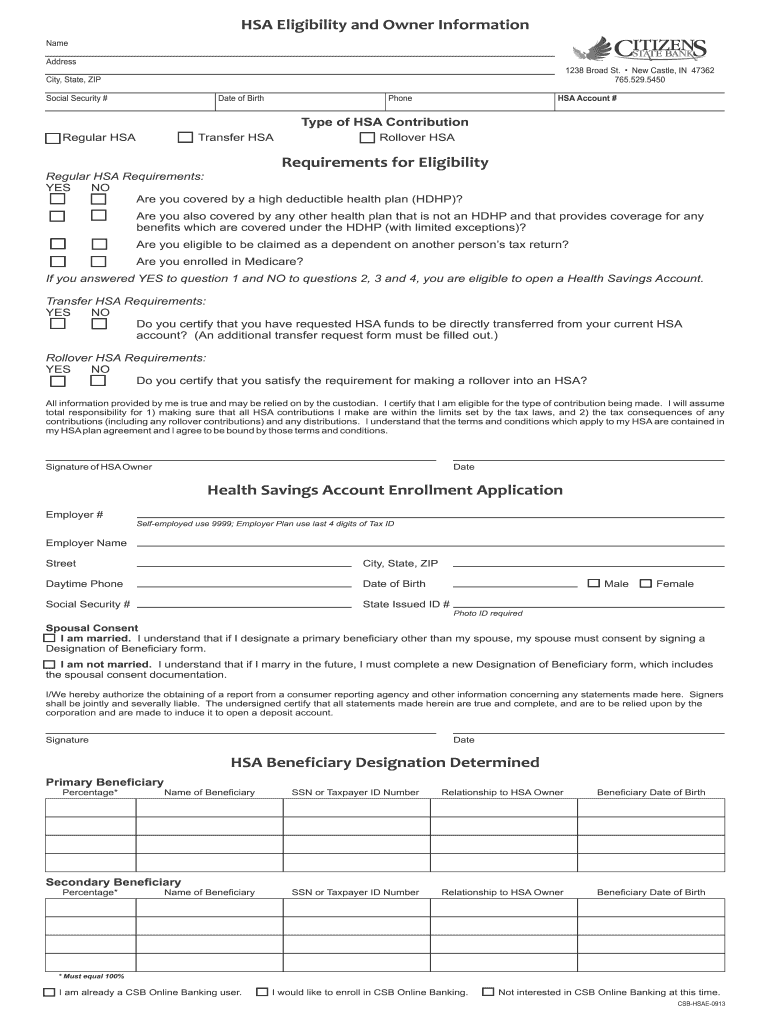

HSA Eligibility and Owner Information Name Address 1238 Broad St. New Castle, IN 47362 765.529.5450 l City, State, ZIP Social Security # Date of Birth Phone HSA Account # Type of HSA Contribution

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hsa eligibility and owner

Edit your hsa eligibility and owner form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hsa eligibility and owner form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hsa eligibility and owner online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit hsa eligibility and owner. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hsa eligibility and owner

How to fill out HSA eligibility and owner?

01

Determine your eligibility: The first step in filling out HSA eligibility is to determine if you are eligible for a Health Savings Account (HSA). Generally, to qualify for an HSA, you must be enrolled in a high-deductible health plan (HDHP), not have any other health coverage, not be enrolled in Medicare, and not be claimed as a dependent on someone else's tax return.

02

Obtain the necessary paperwork: Once you have determined your eligibility, gather the required paperwork to establish and prove your eligibility. This may include documents such as proof of enrollment in a HDHP, proof of not having any other health coverage, and any other supporting documents that may be required by your HSA provider or the Internal Revenue Service (IRS).

03

Complete the application: Fill out the application form provided by your HSA provider. The form will typically require information such as your personal details, contact information, employment information, and any other relevant details.

04

Designate an owner: When filling out the HSA application, you will need to designate an owner for the account. The owner is typically the individual who will have control and management of the HSA funds. The owner can be yourself, your spouse, or someone else, depending on your specific circumstances and the rules established by your HSA provider.

Who needs HSA eligibility and owner?

01

Individuals covered by a high-deductible health plan (HDHP): HSA eligibility is crucial for individuals who have chosen to enroll in a high-deductible health plan. These plans often have lower monthly premiums but higher deductibles, and having an HSA can help individuals save for medical expenses while enjoying certain tax advantages.

02

Individuals without other health coverage: To be eligible for an HSA, an individual should not have any other health coverage, such as a separate health insurance plan or coverage through their employer. It is important to review the requirements and guidelines to ensure eligibility.

03

Individuals seeking tax advantages: An HSA can offer various tax advantages, making it an attractive option for individuals who want to save money on healthcare expenses. Contributions made to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free. Therefore, individuals looking to save on taxes may find value in having an HSA.

04

Individuals wanting to save for future medical expenses: One of the primary purposes of an HSA is to save money for future medical expenses. By contributing to an HSA, individuals can build up a fund that can be used for qualified medical expenses, even in retirement. Having an HSA can provide a sense of financial security and peace of mind when it comes to healthcare costs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit hsa eligibility and owner in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing hsa eligibility and owner and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for the hsa eligibility and owner in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your hsa eligibility and owner in minutes.

How do I complete hsa eligibility and owner on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your hsa eligibility and owner. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is hsa eligibility and owner?

HSA eligibility refers to the requirements that must be met in order to qualify for a Health Savings Account (HSA), while HSA owner is the individual who holds and manages the HSA.

Who is required to file hsa eligibility and owner?

Individuals who have a Health Savings Account (HSA) are required to file information about their eligibility and ownership.

How to fill out hsa eligibility and owner?

To fill out HSA eligibility and owner information, individuals need to provide details about their eligibility status, ownership information, and any contributions made to the HSA.

What is the purpose of hsa eligibility and owner?

The purpose of HSA eligibility and owner information is to ensure that individuals are meeting the requirements for maintaining a Health Savings Account and to track ownership of the account.

What information must be reported on hsa eligibility and owner?

Information such as eligibility status, ownership details, and any contributions to the Health Savings Account must be reported.

Fill out your hsa eligibility and owner online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hsa Eligibility And Owner is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.