Get the free COMMERCIAL FINANCE APPLICATION EQUIPMENT amp MOTOR FINANCE

Show details

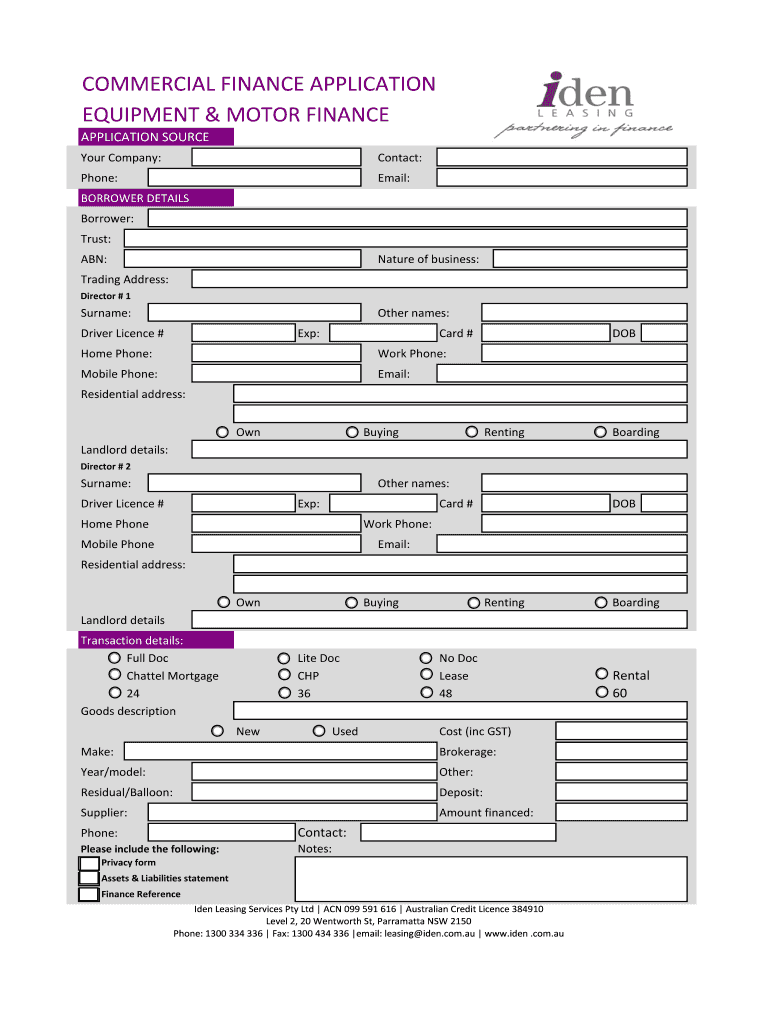

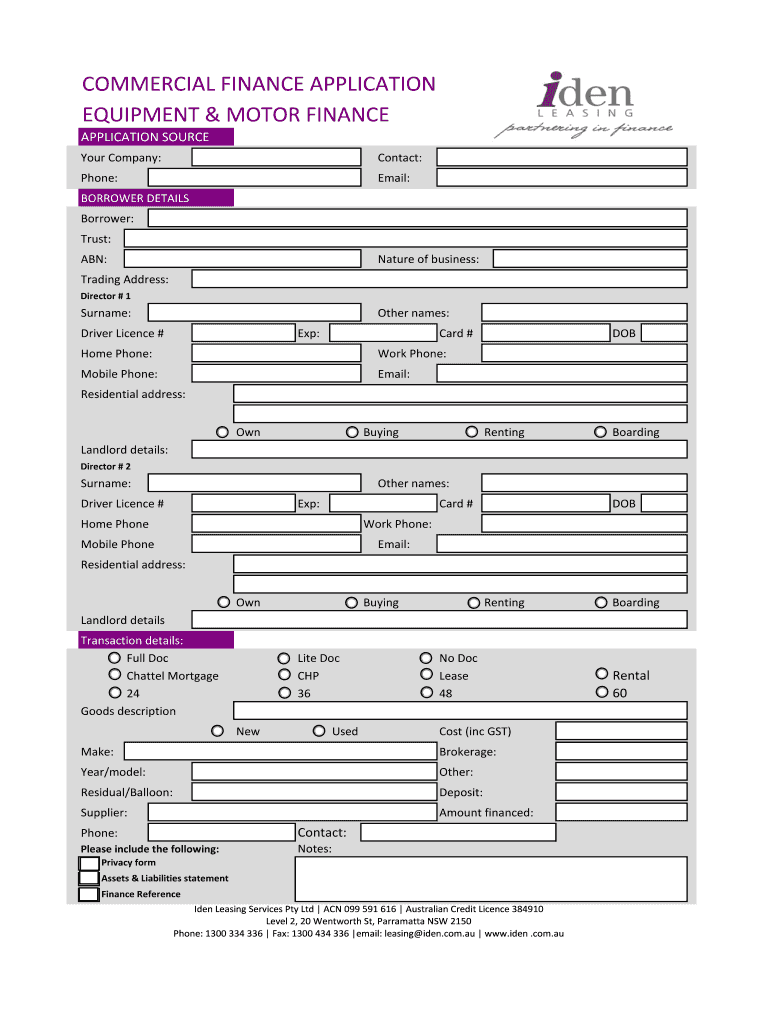

COMMERCIAL FINANCE APPLICATION EQUIPMENT & MOTOR FINANCE APPLICATION SOURCE Your Company: Contact: Phone: Email: BORROWER DETAILS Borrower: Trust: ABN: Nature of business: Trading Address: Director

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commercial finance application equipment

Edit your commercial finance application equipment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercial finance application equipment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing commercial finance application equipment online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit commercial finance application equipment. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commercial finance application equipment

How to fill out commercial finance application equipment:

01

Gather all necessary documents: Before starting the application, make sure you have all the required documentation ready. This may include business financial statements, tax returns, bank statements, and equipment invoices.

02

Provide accurate business information: The application will likely ask for details about your business, such as its legal name, address, industry, and years in operation. Ensure that you provide accurate and up-to-date information.

03

Specify the equipment details: Clearly identify the equipment you are seeking finance for. Include information such as the make, model, serial number, and any additional features or specifications that may be relevant.

04

Describe the financing requirements: Indicate the type of financing you are seeking, whether it's a lease, loan, or any other financial arrangement. Provide details on the desired loan amount or lease terms, including the repayment period and interest rate, if applicable.

05

Provide financial information: Be prepared to share financial statements, such as balance sheets, income statements, and cash flow statements. These documents give lenders insight into your business's financial health and ability to repay the financing.

06

Explain the purpose and benefits: Clearly articulate why you need the equipment and how it will benefit your business. Describe how it will increase productivity, improve efficiency, or generate additional revenue.

07

Include personal information: Depending on the lender's requirements, you may need to provide personal financial information, especially if you are a small business owner or a sole proprietor. This may include personal tax returns, bank statements, or credit history.

Who needs commercial finance application equipment?

01

Small businesses looking to acquire or upgrade equipment: Commercial finance application equipment is essential for small businesses that require equipment to operate or grow their operations. From manufacturing machinery to IT infrastructure, businesses across various industries often rely on equipment to remain competitive.

02

Start-ups or businesses with limited capital: For new businesses or those with limited capital, purchasing equipment outright may not be feasible. Commercial finance provides an opportunity to acquire necessary equipment while preserving cash flow and spreading out payments over time.

03

Businesses experiencing rapid growth or seasonal demand: Growing businesses often require additional equipment to meet increased production or service demands. Seasonal businesses may need to lease equipment to manage fluctuations in demand during peak and off-peak periods.

04

Companies looking to preserve credit lines: Opting for commercial finance allows businesses to keep credit lines available for other purposes, such as working capital, emergencies, or unexpected expenses. By financing equipment separately, companies can avoid tying up their credit capacity.

05

Businesses seeking tax benefits: In some jurisdictions, equipment financing offers tax advantages. Lease payments, for example, may be tax-deductible expenses, reducing the overall tax liability for businesses.

Remember to always consult with financial professionals and lenders to fully understand the requirements and options specific to your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify commercial finance application equipment without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like commercial finance application equipment, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make edits in commercial finance application equipment without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing commercial finance application equipment and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit commercial finance application equipment on an Android device?

The pdfFiller app for Android allows you to edit PDF files like commercial finance application equipment. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is commercial finance application equipment?

Commercial finance application equipment refers to a process where businesses can apply for financing to acquire equipment for their business operations.

Who is required to file commercial finance application equipment?

Businesses looking to acquire equipment through financing are required to file commercial finance application equipment.

How to fill out commercial finance application equipment?

Commercial finance application equipment can be filled out by providing information about the business, the equipment being acquired, and the financing terms.

What is the purpose of commercial finance application equipment?

The purpose of commercial finance application equipment is to allow businesses to acquire necessary equipment through financing to support their operations.

What information must be reported on commercial finance application equipment?

Information such as business details, equipment details, financing terms, and relevant financial information must be reported on commercial finance application equipment.

Fill out your commercial finance application equipment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commercial Finance Application Equipment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.