Get the free BUSINESS PERSONAL PROPERTY TAX RETURN - Augusta Georgia

Show details

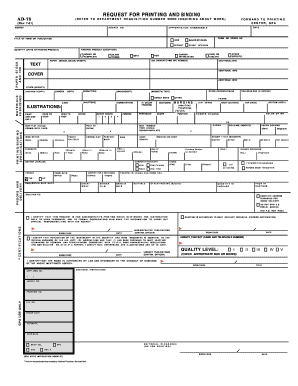

BUSINESS PERSONAL PROPERTY TAX RETURN RICHMOND COUNTY BOARD OF ASSESSORS 535 Bel Air STREET, ROOM 120 AUGUSTA GA 30901 THIS RETURN IS CONSIDERED PUBLIC INFORMATION AND WILL BE OPEN FOR PUBLIC INSPECTION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business personal property tax

Edit your business personal property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business personal property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business personal property tax online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit business personal property tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business personal property tax

How to fill out business personal property tax:

01

Gather all necessary documentation: Start by collecting all relevant information and documentation required to complete the business personal property tax form. This may include a detailed inventory of your business assets, purchase receipts, and any applicable depreciation schedules.

02

Determine the assessment period: Determine the specific assessment period for which you need to report your business personal property. This typically corresponds to a specific fiscal year or calendar year.

03

Calculate the total value of your business personal property: Use the information and documentation gathered in step 1 to calculate the total value of your business personal property. This may involve estimating the current market value or using the original purchase price adjusted for depreciation.

04

Complete the tax form accurately: Fill out the business personal property tax form accurately and ensure that all required fields are completed. Include the relevant details such as property descriptions, dates of acquisition, cost or current value, and any other requested information.

05

Verify and review the completed form: Take the time to review the filled-out form for any mistakes or missing information. Double-check the accuracy of the calculations and make sure all necessary attachments or supporting documents are included.

06

Submit the completed form: Once you are confident that the form is accurately filled out, submit it to the appropriate tax authority by the designated deadline. This may involve mailing the form or electronically submitting it through an online portal.

Who needs business personal property tax:

01

Business owners: Any individual or entity that owns and operates a business or commercial property may be required to pay business personal property tax. Whether you are a sole proprietor, partnership, corporation, or limited liability company, you are responsible for complying with the tax requirements.

02

Owners of tangible business assets: Business personal property tax applies to tangible assets used in the operation of a business. This can include machinery, equipment, furniture, fixtures, computers, vehicles, inventory, and other assets that are not considered real estate.

03

Businesses in certain jurisdictions: The requirement to pay business personal property tax may vary depending on your location. Some jurisdictions impose this tax at the state level, while others may have county or municipal-specific requirements. It is important to consult the local tax authority or a tax professional to determine if you are subject to this tax.

Note: The specific regulations and processes for filling out business personal property tax forms can vary depending on the jurisdiction. It is recommended to consult with a tax professional or reference the guidelines provided by the relevant tax authority for accurate and up-to-date information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my business personal property tax in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign business personal property tax and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit business personal property tax online?

With pdfFiller, the editing process is straightforward. Open your business personal property tax in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for the business personal property tax in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your business personal property tax in minutes.

What is business personal property tax?

Business personal property tax is a tax levied on tangible assets that are used in a business, such as equipment, furniture, machinery, and inventory.

Who is required to file business personal property tax?

Business owners and companies who own tangible assets used in their business are required to file business personal property tax.

How to fill out business personal property tax?

To fill out business personal property tax, one must gather information on all tangible assets used in the business, determine their value, and report this information to the relevant tax authority.

What is the purpose of business personal property tax?

The purpose of business personal property tax is to generate revenue for local governments by taxing the tangible assets owned by businesses.

What information must be reported on business personal property tax?

Information such as the description, cost, and value of all tangible assets used in the business must be reported on the business personal property tax form.

Fill out your business personal property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Personal Property Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.