Get the free SaLes aNd use tax report - wbrcouncilorg

Show details

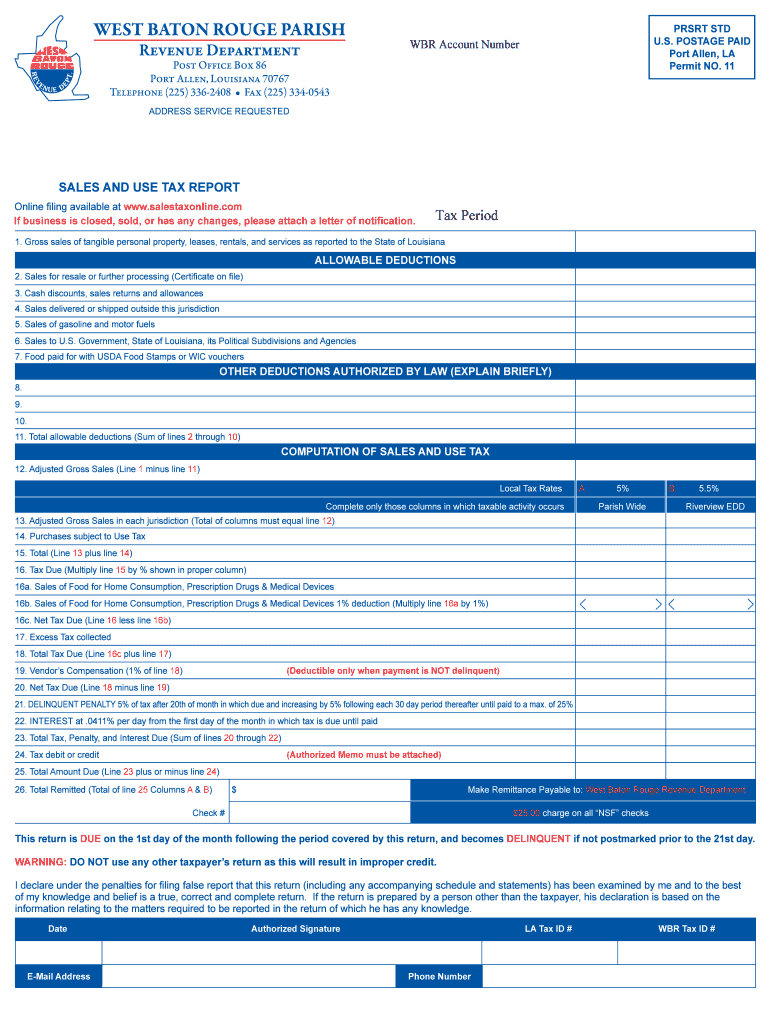

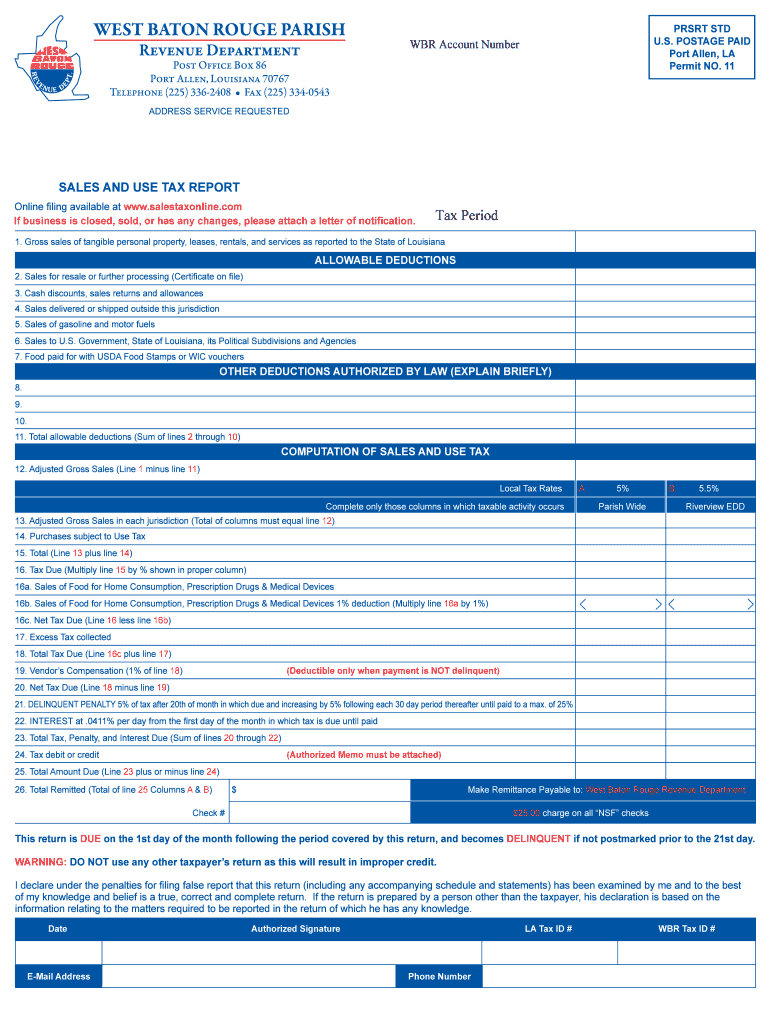

Part std u.s. postage paid Port Allen, LA Permit NO. 11 WAR Account Number Post Office Box 86 Port Allen, Louisiana 70767 Telephone (225) 3362408 Fax (225) 3340543 ADDRESS SERVICE REQUESTED Sales

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sales and use tax

Edit your sales and use tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sales and use tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sales and use tax online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sales and use tax. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sales and use tax

How to fill out sales and use tax:

01

Gather all the necessary sales and purchase records: Before you start filling out the sales and use tax form, make sure you have all the relevant sales and purchase records handy. This includes sales receipts, invoices, and any other documentation related to the sales you've made during the reporting period.

02

Identify taxable and nontaxable sales: Different states and jurisdictions have specific rules regarding what is considered taxable and nontaxable. It's important to understand these rules to accurately determine the taxable amount on your sales and use tax form. Consult the guidelines provided by your local tax authority or seek professional advice if needed.

03

Calculate the tax liability: Once you have identified the taxable sales, calculate the amount of sales tax owed for the reporting period. This is usually done by applying the applicable sales tax rate to the total taxable sales amount. It's crucial to use the correct tax rate for your jurisdiction to avoid any discrepancies or penalties.

04

Report the information on the tax form: Use the designated sales and use tax form provided by your tax authority to report the calculated tax liability. The form may require you to provide details such as the total taxable sales, the sales tax rate, and the calculated amount of sales tax owed. Enter the information accurately and double-check for any errors before submitting the form.

05

Keep meticulous records: It's important to maintain detailed records of your sales and use tax filings for future reference and potential audits. This includes copies of the completed tax forms, supporting documentation, and any correspondence with the tax authority. Storing these records securely can help you stay organized and resolve any tax-related issues that may arise.

Who needs sales and use tax:

01

Businesses: Most businesses, regardless of their size or industry, are required to collect and remit sales and use tax. This includes retail stores, restaurants, service providers, manufacturers, and online sellers. Even if you operate a small business, it's essential to understand and comply with the sales and use tax regulations in your jurisdiction.

02

Online sellers: With the growth of e-commerce, many online sellers now have to navigate the complexities of sales and use tax. If you sell products or services online, you may need to register with the appropriate tax authority and collect sales tax from customers in certain states or jurisdictions. Understanding the rules and requirements for online sales tax is crucial to avoid penalties.

03

Consumers: While the responsibility of reporting and remitting sales tax typically falls on businesses, consumers may sometimes need to pay use tax. This usually applies when taxable goods or services are purchased from out-of-state retailers who do not collect sales tax at the time of the transaction. It's important for consumers to be aware of their obligations and report any applicable use tax to their tax authority.

Note: The specific requirements and regulations related to sales and use tax can vary depending on your location. It's recommended to consult with a tax professional or your local tax authority for accurate and up-to-date information applicable to your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my sales and use tax in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your sales and use tax directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit sales and use tax on an Android device?

You can make any changes to PDF files, such as sales and use tax, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I fill out sales and use tax on an Android device?

On an Android device, use the pdfFiller mobile app to finish your sales and use tax. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is sales and use tax?

Sales and use tax is a type of tax that is imposed on the sale of goods and services. It is typically charged by the seller at the time of purchase.

Who is required to file sales and use tax?

Businesses that sell goods and services are generally required to file sales and use tax.

How to fill out sales and use tax?

To fill out sales and use tax, businesses need to report their total sales and calculate the tax due based on the applicable tax rate.

What is the purpose of sales and use tax?

The purpose of sales and use tax is to generate revenue for the government and fund public services and programs.

What information must be reported on sales and use tax?

Businesses must report their total sales, taxable sales, exempt sales, and any applicable credits or deductions.

Fill out your sales and use tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sales And Use Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.