Get the free Preparing Business Taxation Computations FA 2003 BTC

Show details

Preparing Business Taxation Computations (FA 2003) (BTC) (2003 standards) December 2004 Suggested Answers SECTION 1, Task 1.1 Balance b/fwd Proceeds/MV Balancing charge Balancing allowance General

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign preparing business taxation computations

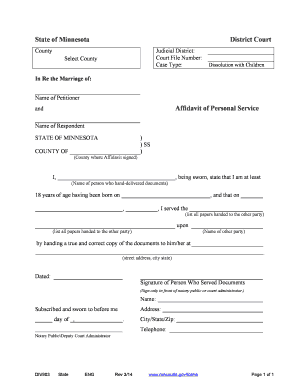

Edit your preparing business taxation computations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your preparing business taxation computations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

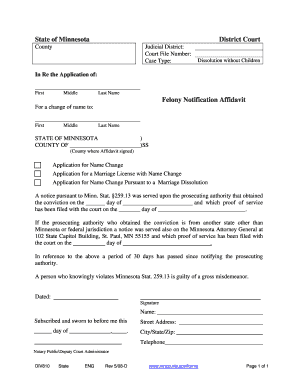

Editing preparing business taxation computations online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit preparing business taxation computations. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

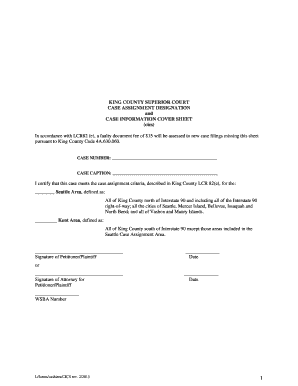

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

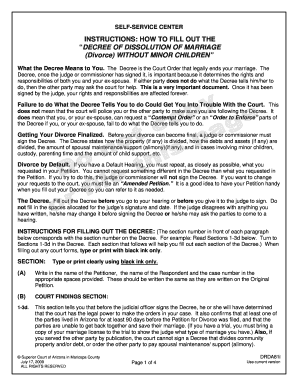

How to fill out preparing business taxation computations

How to Fill Out Preparing Business Taxation Computations:

01

Understand the legal requirements: Before filling out any taxation computations for your business, it is crucial to have a clear understanding of the tax laws and regulations that apply to your specific business. This includes knowing which forms and schedules need to be filled out and understanding the different tax deductions and credits available to you.

02

Gather all necessary financial documents: To accurately complete the business taxation computations, you will need to gather all relevant financial documents, such as income statements, balance sheets, receipts, and any other documentation related to your business expenses and income. This will help you ensure that all income sources and expenses are accounted for and accurately reported.

03

Organize and categorize your financial information: Once you have gathered all the necessary financial documents, it is important to organize and categorize them appropriately. This may involve creating separate folders or files for different types of income and expenses, ensuring that everything is easily accessible when it is time to fill out the computations.

04

Review and reconcile financial records: Before starting the actual computations, take the time to review and reconcile your financial records. This will help identify any discrepancies or errors that may affect the accuracy of the computations. Make sure that all transactions are properly recorded and that all necessary adjustments are made before proceeding.

05

Complete the necessary tax forms and schedules: Using the gathered financial information and knowledge of the tax laws, start filling out the required tax forms and schedules. Be sure to provide accurate and detailed information for each entry, ensuring that all calculations are correct. Take advantage of any available tax deductions and credits that apply to your business to potentially reduce your tax liability.

06

Double-check for accuracy: Once you have completed filling out the taxation computations, take the time to double-check all the entries for accuracy. Look for any potential errors or omissions that may have been overlooked during the process. A thorough review will help minimize the chances of mistakes and potential audits.

07

File the tax forms and keep copies: After ensuring the accuracy of the computations, it's time to file the tax forms with the appropriate tax authorities. Whether you choose to file electronically or by mail, make sure to follow the instructions provided by the tax authority. Additionally, keep copies of all relevant documents and forms for future reference and potential audits.

Who Needs Preparing Business Taxation Computations:

01

Small Business Owners: Small business owners who are responsible for managing their own taxes typically need to prepare business taxation computations. This includes individuals who operate sole proprietorships, partnerships, or LLCs.

02

Corporate Entities: Companies that are registered as corporations are required to prepare and file business taxation computations. This applies to both privately held corporations and publicly traded companies.

03

Freelancers and Self-Employed Individuals: Freelancers and self-employed individuals who generate income through their services or business activities need to prepare business taxation computations. This includes professionals such as consultants, artists, writers, and independent contractors.

04

Non-Profit Organizations: Non-profit organizations that generate income through their activities, such as fundraising events or services provided, are also required to prepare and file business taxation computations.

Overall, any individual or entity engaged in business activities that generate income or incur deductible expenses will likely need to prepare business taxation computations. It is important to consult with a tax professional or accountant to ensure compliance with tax laws and regulations specific to your business.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my preparing business taxation computations in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your preparing business taxation computations and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I fill out the preparing business taxation computations form on my smartphone?

Use the pdfFiller mobile app to complete and sign preparing business taxation computations on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit preparing business taxation computations on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign preparing business taxation computations on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is preparing business taxation computations?

Preparing business taxation computations involves calculating the tax liability of a business based on its income, expenses, deductions, and credits.

Who is required to file preparing business taxation computations?

Businesses, including corporations, partnerships, and sole proprietorships, are required to file business taxation computations.

How to fill out preparing business taxation computations?

Preparing business taxation computations typically involves gathering financial records, completing tax forms, and submitting the required documentation to the relevant tax authorities.

What is the purpose of preparing business taxation computations?

The purpose of preparing business taxation computations is to determine the amount of tax owed by a business and ensure compliance with tax laws.

What information must be reported on preparing business taxation computations?

Information such as income, expenses, deductions, credits, and any other relevant financial data must be reported on preparing business taxation computations.

Fill out your preparing business taxation computations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Preparing Business Taxation Computations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.