Get the free Fixed Deferred Annuity Application

Show details

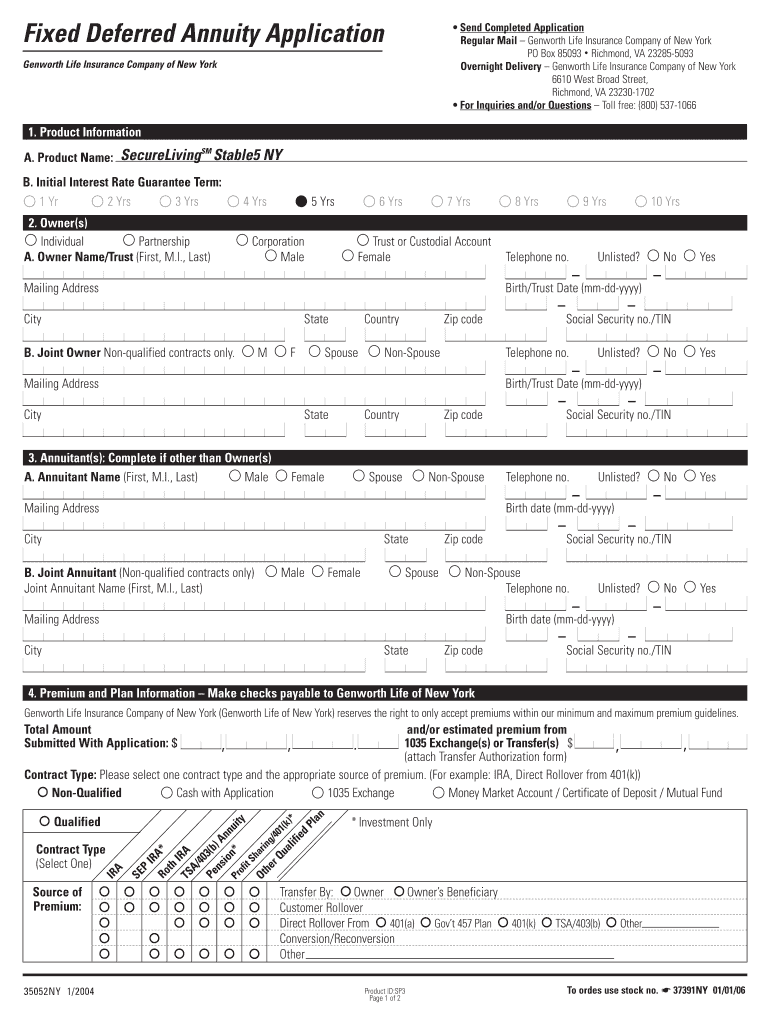

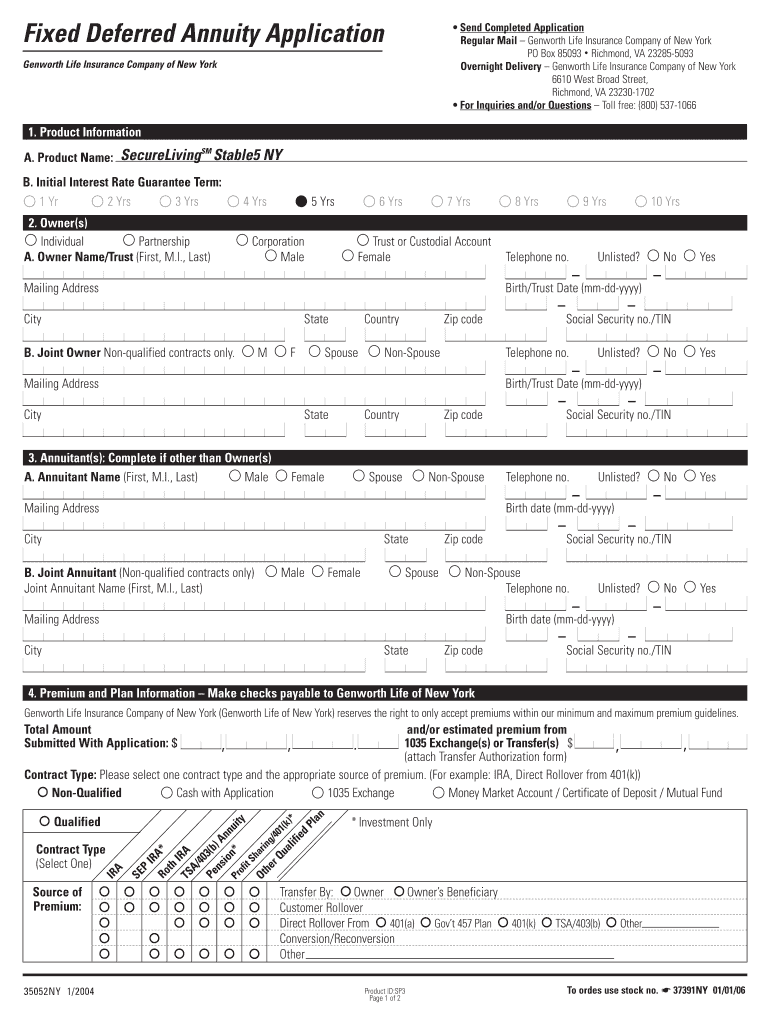

This document serves as an application for a Fixed Deferred Annuity with Genworth Life Insurance Company of New York, providing necessary details for the annuity contract and related policies.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fixed deferred annuity application

Edit your fixed deferred annuity application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fixed deferred annuity application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fixed deferred annuity application online

Follow the steps below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fixed deferred annuity application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fixed deferred annuity application

How to fill out Fixed Deferred Annuity Application

01

Obtain the Fixed Deferred Annuity Application form from the insurance provider.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide details about the annuity contract, including the amount you wish to invest and the payment frequency.

04

Indicate the beneficiaries you wish to name on the annuity.

05

Review any health questions or additional disclosures required by the insurer.

06

Sign and date the application form.

07

Submit the completed application form to the insurance provider for processing.

Who needs Fixed Deferred Annuity Application?

01

Individuals looking to secure a stable source of income for retirement.

02

People who want to grow their savings tax-deferred until they withdraw funds.

03

Those seeking a low-risk investment option with guaranteed returns.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a deferred annuity and a regular annuity?

There are several types of annuities, and most are actually deferred. That simply means the annuity doesn't start paying out right away: your income payments are deferred for at least one year. Otherwise, it would be an immediate annuity.

What is a real life application of a deferred annuity?

The most common example of a deferred annuity is a retirement fund where the investor is not yet ready to retire. They defer their withdrawals (payments) until they retire. In the mean time, the fund earns interest. The fund continues to earn interest as the investor withdraws money from the fund.

What does "fixed deferred" mean?

Fixed refers to the fact that you will earn a fixed interest rate, and deferred means you can defer income payments to a time of your choosing.

What is an annuity application form?

An annuity application form allows prospective annuity buyers to purchase annuities from their insurance carrier online. A free online annuity application form can make the application process a little easier for you and your clients.

What is a fixed deferred annuity?

Money in a fixed deferred annuity earns interest at a rate the insurer sets. The rate is fixed (won't change) for some period, usually a year. After that rate period ends, the insurance company will set another fixed interest rate for the next rate period.

How much does a $100,000 deferred annuity pay per month?

A $100,000 annuity can provide you with a monthly income of between roughly $525 and just over $1,000, depending on your age, the payout structure and the features you select. That income can be a helpful foundation in retirement, especially when combined with Social Security benefits or other investments.

What is a deferred fixed term annuity?

Unlike the other forms of annuity, a deferred annuity doesn't pay income straight away. Instead payments start from an agreed time in the future. You might also be able to change the annuity into a lump sum fund to increase the pension benefit options open to you.

How does SPDA work?

A single premium deferred annuity (SPDA) is a purchase in which you pay a lump sum to an insurance company and, in return, receive income payments starting at a future date. For example, you could purchase $50,000 in an SPDA at age 50 and receive monthly payments when you turn 65.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Fixed Deferred Annuity Application?

A Fixed Deferred Annuity Application is a financial document used to apply for a fixed deferred annuity, which is a type of investment product that provides a guaranteed rate of return over a specified period, allowing the investor to defer payments until a later date.

Who is required to file Fixed Deferred Annuity Application?

Individuals looking to purchase a fixed deferred annuity or financial professionals acting on behalf of clients seeking to invest in such products are required to file the Fixed Deferred Annuity Application.

How to fill out Fixed Deferred Annuity Application?

To fill out a Fixed Deferred Annuity Application, one must provide personal information such as name, address, and social security number, specify the amount to invest, select the payment frequency, and acknowledge the terms and conditions of the annuity.

What is the purpose of Fixed Deferred Annuity Application?

The purpose of the Fixed Deferred Annuity Application is to formally initiate the investment process, ensuring that the applicant understands the terms of the annuity and agrees to the investment under the specified conditions.

What information must be reported on Fixed Deferred Annuity Application?

The information that must be reported on a Fixed Deferred Annuity Application includes the applicant's personal details, investment amount, intended investment duration, beneficiary information, and any other disclosures required by the issuing insurance company.

Fill out your fixed deferred annuity application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fixed Deferred Annuity Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.