Get the free Small Business Loan Fund for Minorities Women and

Show details

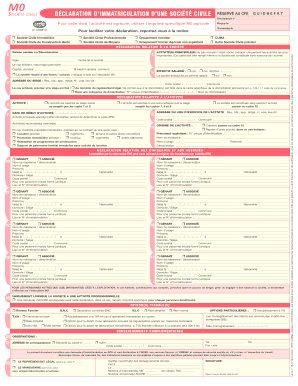

Small Business Loan Fund for Minorities, Women and Veterans 1. Individual Applying Full Home Address Individuals SSN Home Phone # 2. Name of Applicant Business Legal Structure: sole proprietorship

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small business loan fund

Edit your small business loan fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small business loan fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing small business loan fund online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit small business loan fund. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small business loan fund

How to fill out small business loan fund:

01

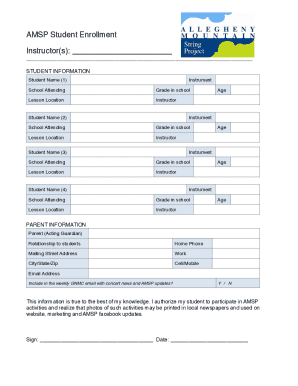

Start by gathering all necessary documents such as your business plan, financial statements, tax returns, and any other supporting documents that may be required by the lender.

02

Research different lenders and their loan programs to find the best fit for your business. Consider factors such as interest rates, repayment terms, and eligibility criteria.

03

Once you have chosen a lender, review their application requirements and guidelines thoroughly. Make sure you understand all the information they need from you.

04

Begin filling out the loan application form accurately and honestly. Provide all the necessary information about your business, including its legal structure, ownership, financial history, and future projections.

05

Include any additional documents or statements requested by the lender, such as personal guarantees, collateral information, or business licenses.

06

Be prepared to explain your reasons for seeking the loan fund and how it will be used to benefit your business. Highlight any potential risks and demonstrate a solid repayment plan.

07

Double-check all the information provided in the application before submitting it. Ensure that there are no errors or inconsistencies that could hinder the approval process.

08

Submit the completed loan application and required documents to the lender according to their specified instructions. It may be advisable to keep copies of all documentation for your records.

09

After submitting the application, be prepared to wait for a response from the lender. This can take anywhere from a few days to several weeks depending on their review and approval process.

10

If approved, carefully review the loan terms and conditions before accepting the loan fund. Make sure you understand the interest rate, repayment schedule, and any associated fees.

11

Once the loan fund is disbursed, use the funds responsibly and according to your stated purpose. Keep track of your loan repayments and ensure timely payments to maintain a good relationship with the lender.

12

Finally, regularly assess your business's financial situation and adjust your loan repayment plan if necessary. Stay proactive in managing your finances to ensure successful loan repayment.

Who needs small business loan fund?

01

Small business owners who require additional working capital to fund their business operations or expansion plans.

02

Entrepreneurs who want to start a new business venture and need financial support to cover initial setup costs.

03

Business owners looking to purchase new equipment, inventory, or real estate to support their operations.

04

Companies experiencing temporary cash flow issues and seeking short-term financial assistance to bridge the gap.

05

Startups in need of seed capital to launch their ideas and turn them into viable businesses.

06

Businesses looking to consolidate their debt and/or improve their credit score.

07

Owners seeking to acquire an existing business or franchise and require funds for the purchase.

08

Entrepreneurs looking to innovate and develop new products or services but require capital for research and development.

09

Companies aiming to expand their marketing efforts or penetrate new markets and need financing for their marketing campaigns.

10

Businesses faced with unexpected expenses or emergencies requiring immediate financial support.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my small business loan fund directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your small business loan fund and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Where do I find small business loan fund?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific small business loan fund and other forms. Find the template you want and tweak it with powerful editing tools.

Can I sign the small business loan fund electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is small business loan fund?

Small business loan fund is a financial resource provided to small businesses to help them grow and expand.

Who is required to file small business loan fund?

Small business owners who have received a loan from a small business loan fund are required to file.

How to fill out small business loan fund?

To fill out a small business loan fund, you need to provide information about the loan amount, purpose of the loan, and repayment terms.

What is the purpose of small business loan fund?

The purpose of small business loan fund is to support small businesses in achieving their goals and expanding their operations.

What information must be reported on small business loan fund?

The information that must be reported on a small business loan fund includes loan amount, purpose of the loan, repayment terms, and any other relevant details.

Fill out your small business loan fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Business Loan Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.