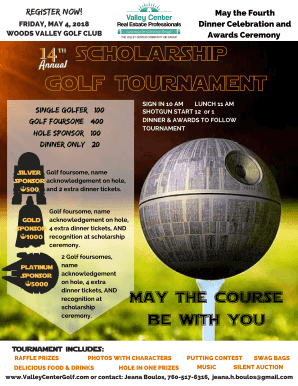

Get the free Special Division, Class 3 Non-Authenticity Deduction Form

Show details

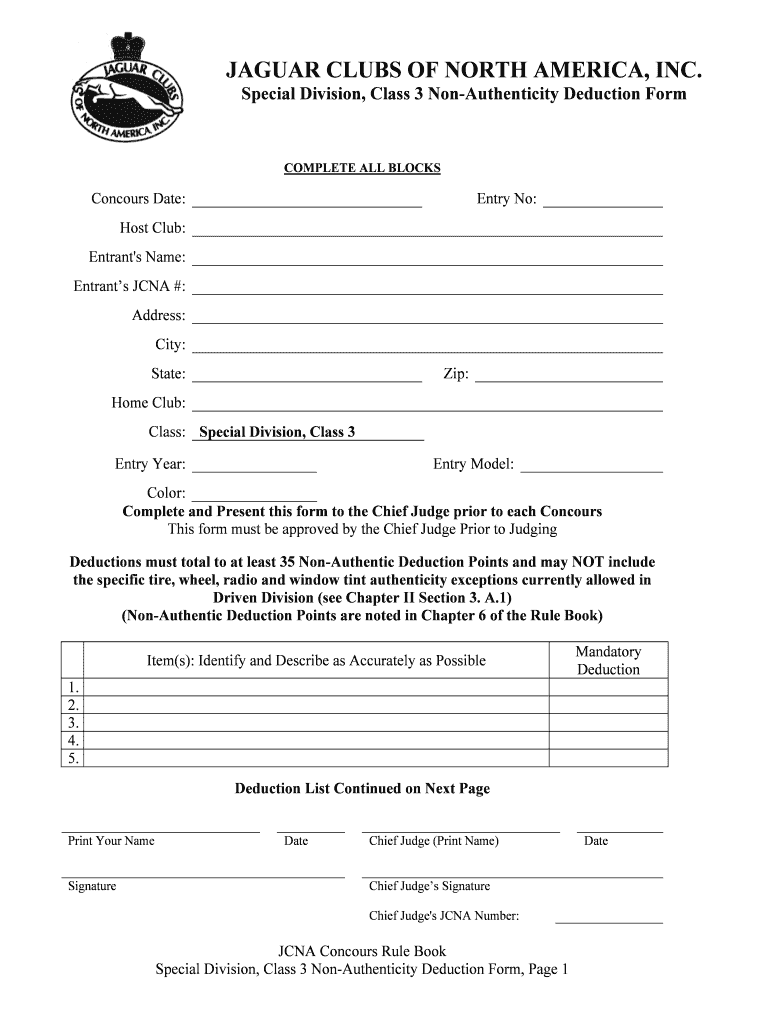

This document is a form used by entrants to report non-authenticity deductions for Concours events organized by the Jaguar Clubs of North America. It includes sections to fill in personal, vehicle,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign special division class 3

Edit your special division class 3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your special division class 3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing special division class 3 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit special division class 3. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out special division class 3

How to fill out Special Division, Class 3 Non-Authenticity Deduction Form

01

Obtain the Special Division, Class 3 Non-Authenticity Deduction Form from the relevant authority or website.

02

Read the instructions carefully before filling out the form.

03

Fill in your personal information at the top of the form, such as your name, address, and identification number.

04

Provide the details regarding the specific item or service for which you are applying the non-authenticity deduction.

05

Clearly state the reasons for seeking the non-authenticity deduction, including any supporting evidence or documentation.

06

Review the filled form for accuracy and ensure that all required fields are completed.

07

Sign and date the form at the designated area.

08

Submit the form to the appropriate office or online platform as per the provided guidelines.

Who needs Special Division, Class 3 Non-Authenticity Deduction Form?

01

Individuals or businesses that are claiming a deduction related to non-authenticity of an item or service that falls under Class 3.

02

Taxpayers who are seeking to reduce their taxable income through legitimate claims of non-authentic items.

Fill

form

: Try Risk Free

People Also Ask about

What is the longest IRS refund can take?

IRS tax refund schedule Filing and delivery typeEstimated delivery time (from date return is accepted to receipt of tax refund) E-file with direct deposit Up to 3 weeks Paper file with direct deposit 4 to 8 weeks E-file with refund check in the mail 4 weeks Paper file with refund check in the mail 4 to 8 weeks1 more row • May 28, 2025

What is the IRS Form Publication 17?

Publication 17 covers the general rules for filing a federal income tax return. It supplements the information contained in your tax form instruction booklet. It explains the tax law to make sure you pay only the tax you owe and no more.

Why did I receive a letter from the IRS?

It may be about a specific issue on your federal tax return or account, or may tell you about changes to your account, ask you for more information, or request a payment. You can handle most of this correspondence without calling or visiting an IRS office if you follow the instructions in the document.

Which deduction is calculated first when determining taxable income?

Once you report all of your income on your Form 1040 and Schedule 1. Subtract either the standard deduction or itemized deductions (whichever lowers your taxes the most). The resulting amount is taxable income.

How to fill out form 3949 warr?

Complete if you are reporting an individual. Include their name, street address, city, state, ZIP code, social security number or taxpayer identification number, occupation, date of birth, marital status, name of spouse (if married), and email address. Include as much information as you know.

Why did I get a form 3531 from the IRS?

If the IRS wants you to perform some correction to your return before they will process it, they often send Form 3531 or Letter 143C with their requests for action. The most common task they request is a simple signing of the return. But, sometimes their requests are impossible to follow or complete.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Special Division, Class 3 Non-Authenticity Deduction Form?

The Special Division, Class 3 Non-Authenticity Deduction Form is a tax form used to report deductions related to goods that are not verified as authentic.

Who is required to file Special Division, Class 3 Non-Authenticity Deduction Form?

Taxpayers who claim deductions for expenses related to non-authentic goods are required to file the Special Division, Class 3 Non-Authenticity Deduction Form.

How to fill out Special Division, Class 3 Non-Authenticity Deduction Form?

To fill out the form, taxpayers must provide personal information, details of the non-authentic goods, and the corresponding deduction amounts according to the guidelines provided by the tax authority.

What is the purpose of Special Division, Class 3 Non-Authenticity Deduction Form?

The purpose of the form is to allow taxpayers to accurately report and claim deductions for losses incurred from dealing with non-authentic goods.

What information must be reported on Special Division, Class 3 Non-Authenticity Deduction Form?

The form must include the taxpayer's identification details, description of the non-authentic goods, evidence of authenticity (or lack thereof), and the amounts being claimed as deductions.

Fill out your special division class 3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Special Division Class 3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.