Get the free Film Tax Credit Production Economic Impact Report 09FORM

Show details

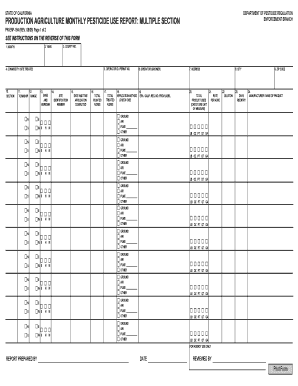

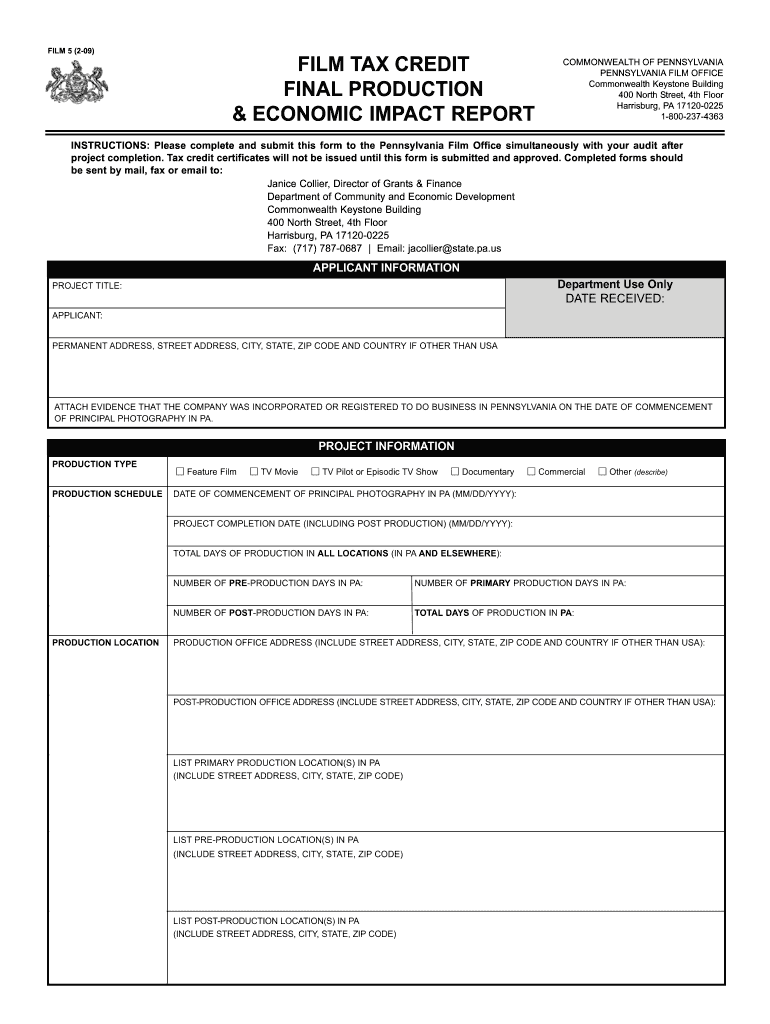

FILM 5 (209) FILM TAX CREDIT FINAL PRODUCTION & ECONOMIC IMPACT REPORT COMMONWEALTH OF PENNSYLVANIA FILM OFFICE Commonwealth Keystone Building 400 North Street, 4th Floor Harrisburg, PA 171200225

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign film tax credit production

Edit your film tax credit production form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your film tax credit production form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit film tax credit production online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit film tax credit production. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out film tax credit production

How to fill out film tax credit production:

01

Begin by gathering all necessary documentation and information such as production budgets, expenditure reports, and shooting schedules.

02

Research and familiarize yourself with the specific requirements and guidelines for film tax credit production in your jurisdiction. Different regions may have different eligibility criteria and application processes.

03

Complete the application form accurately and thoroughly, providing all required details about your production, including the title, genre, production start and end dates, and estimated budget.

04

Provide supporting documents and evidence to substantiate your application, such as proof of expenditures, employment records, shooting locations, and any relevant permits or licenses.

05

Pay attention to deadlines and submission requirements. Make sure to submit the application within the specified timeframe and include all requested materials.

06

Double-check your application to ensure all sections are completed correctly and all necessary attachments are included. Any errors or missing information could lead to delays or rejection of your application.

07

If applicable, consult with a film tax credit specialist or accountant who can provide guidance on maximizing your tax credits and ensuring compliance with any additional regulations.

08

Submit your completed application and supporting documents as instructed, whether it's through an online portal or by mail. Keep records of your submission for future reference.

09

Be prepared for a potential review process, where government authorities may assess your application and request additional information or clarification. Cooperate fully and promptly in providing any requested documentation.

10

Once your application is approved, follow any additional instructions regarding the claiming of tax credits, including required reporting and documentation. Keep accurate records of all eligible expenses and maintain proper accounting practices.

Who needs film tax credit production?

01

Film production companies or independent filmmakers who are looking to offset the costs of their production and potentially receive financial incentives.

02

Film studios and major production houses that engage in large-scale productions and seek to maximize their returns by taking advantage of film tax credits.

03

Local governments or jurisdictions that offer film tax credit incentives as a means to attract and promote film and television productions, boosting their local economy and creating job opportunities in the industry.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send film tax credit production to be eSigned by others?

When you're ready to share your film tax credit production, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out the film tax credit production form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign film tax credit production and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I fill out film tax credit production on an Android device?

Use the pdfFiller app for Android to finish your film tax credit production. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is film tax credit production?

Film tax credit production is a tax incentive provided by the government to encourage film production in a certain location.

Who is required to file film tax credit production?

Production companies or film producers are required to file film tax credit production.

How to fill out film tax credit production?

Film tax credit production can be filled out by submitting relevant information about the film production to the tax authorities.

What is the purpose of film tax credit production?

The purpose of film tax credit production is to attract filmmakers to a specific location and boost the local economy.

What information must be reported on film tax credit production?

Information such as production costs, location details, and employment data must be reported on film tax credit production.

Fill out your film tax credit production online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Film Tax Credit Production is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.