Get the free Financial Advisors Florida - naifa-florida

Show details

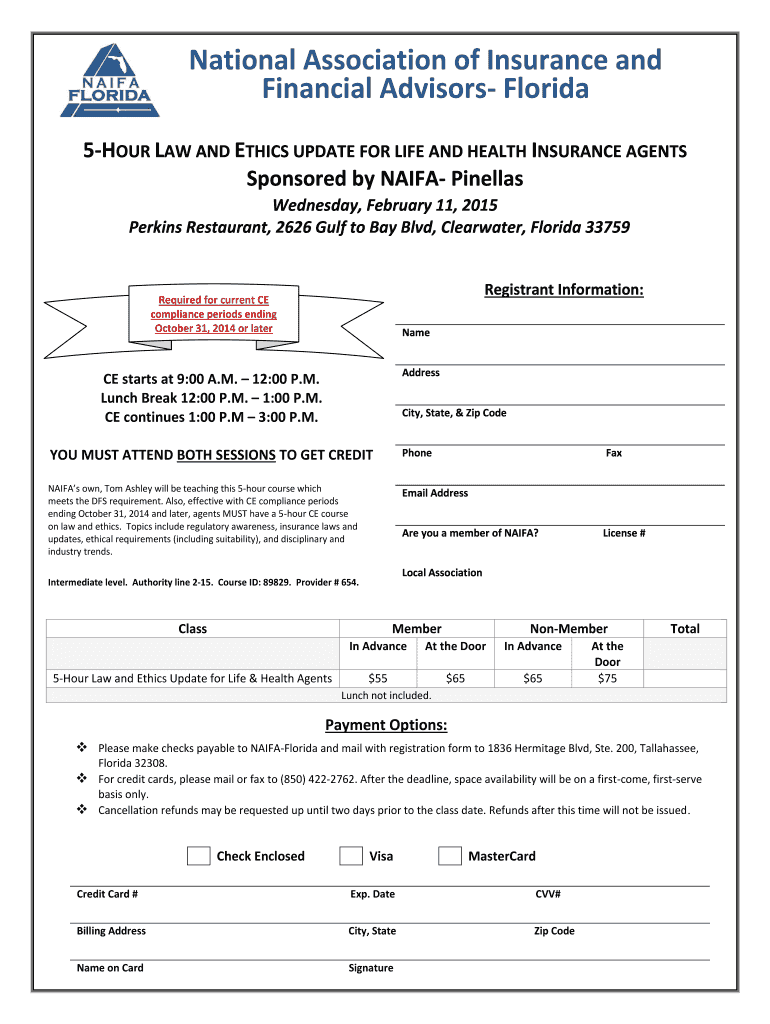

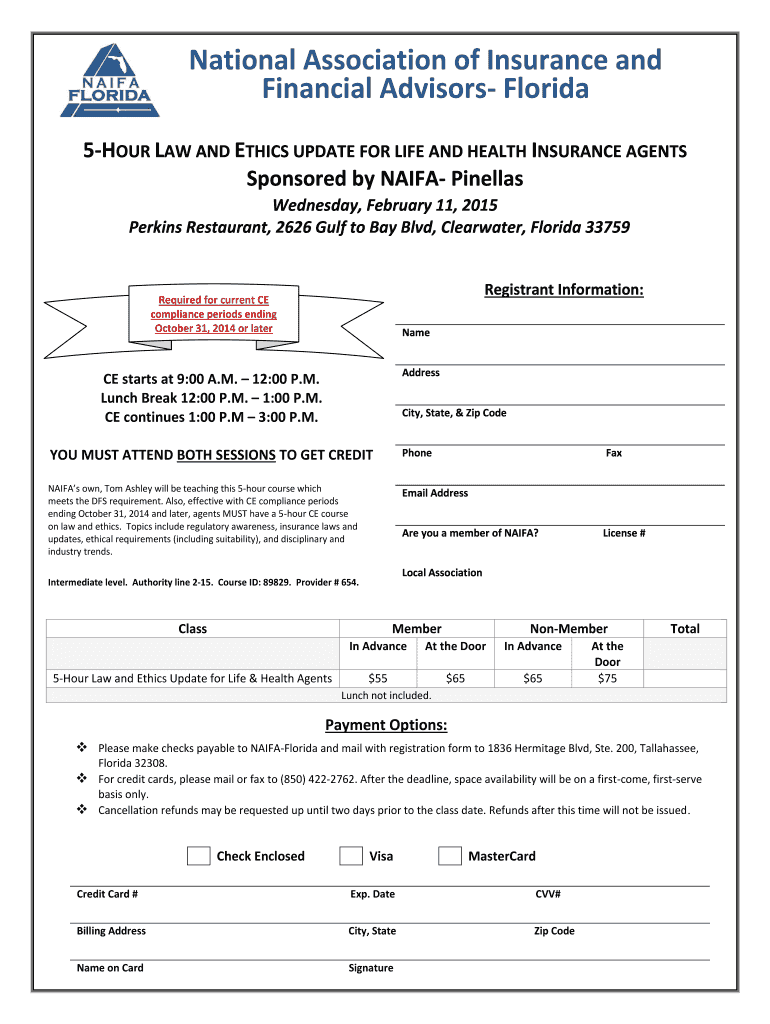

National Association of Insurance and Financial Advisors Florida 5HOUR LAW AND ETHICS UPDATE FOR LIFE AND HEALTH INSURANCE AGENTS Sponsored by HAIFA Pinellas Wednesday, February 11, 2015, Perkins

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial advisors florida

Edit your financial advisors florida form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial advisors florida form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financial advisors florida online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit financial advisors florida. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial advisors florida

How to Fill Out Financial Advisors Florida:

01

Research and Identify your Financial Goals: Before seeking out a financial advisor in Florida, it is essential to determine what your financial goals are. Whether it is retirement planning, investment strategies, or debt management, having a clear understanding of your objectives will help you find the right advisor.

02

Evaluate Their Expertise and Credentials: When choosing a financial advisor in Florida, it is crucial to consider their expertise and credentials. Look for advisors who are registered with the Florida Office of Financial Regulation or hold certifications like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

03

Check for Experience and Track Record: Assess the experience and track record of potential financial advisors in Florida. Consider how long they have been in the industry and ask for references or testimonials from previous clients. This will give you insight into their ability to handle your financial needs.

04

Schedule an Initial Consultation: Once you have narrowed down your options, schedule an initial consultation with the financial advisors in Florida you are considering. This meeting will give you the opportunity to ask questions, understand their approach and philosophy, and ensure their services align with your goals.

05

Discuss Fees and Compensation Structure: During the consultation, inquire about the financial advisor's fees and compensation structure. Understanding how they charge for their services, whether it is through flat fees, hourly rates, or a percentage of assets under management, will help you make an informed decision.

06

Review and Sign the Contract: If you are satisfied with the financial advisor's services and compensation structure, review the contract thoroughly before signing. Ensure that you understand the terms and conditions, including any potential conflicts of interest or limitations on their services.

07

Maintain Ongoing Communication: Once you have enlisted the services of a financial advisor in Florida, it is crucial to maintain regular communication. Regular check-ins and discussions about your financial progress, changes in circumstances, or new goals will help your advisor tailor their strategies to your evolving needs.

Who Needs Financial Advisors Florida:

01

Individuals with Complex Financial Situations: If you have a complex financial situation, such as significant assets, multiple income streams, or intricate investment portfolios, a financial advisor in Florida can provide expertise and guidance to effectively manage and optimize your financial affairs.

02

Business Owners: For business owners in Florida, a financial advisor can assist with various financial aspects, including tax planning, business succession planning, employee benefits, and risk management. They can help business owners navigate the complexities of managing personal and business finances.

03

Pre-Retirees and Retirees: Whether you are nearing retirement or already retired, a financial advisor in Florida can help navigate the unique challenges this life stage presents. From retirement income planning and tax optimization to estate planning and long-term care considerations, a financial advisor can provide tailored guidance to ensure a secure retirement.

04

Professionals with Limited Time or Expertise: Many professionals in Florida have demanding careers that leave them with limited time or expertise to effectively manage their finances. A financial advisor can help alleviate this burden by providing comprehensive financial planning and investment management services, allowing professionals to focus on their careers.

05

Individuals Going Through Life Transitions: Life events such as marriage, divorce, having children, or inheriting wealth can significantly impact your financial situation. A financial advisor in Florida can help navigate these transitions by providing guidance and strategies to adapt your financial plan accordingly.

Remember, while financial advisors in Florida can provide valuable guidance, it is essential to conduct thorough research and choose an advisor that aligns with your needs and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send financial advisors florida to be eSigned by others?

When you're ready to share your financial advisors florida, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I sign the financial advisors florida electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your financial advisors florida in seconds.

How do I fill out financial advisors florida on an Android device?

Complete financial advisors florida and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is financial advisors florida?

Financial advisors in Florida are professionals who provide financial guidance and advice to individuals, businesses, and organizations on investment opportunities, retirement planning, and wealth management.

Who is required to file financial advisors florida?

Financial advisors in Florida who are registered or licensed with the state regulatory authority are required to file financial reports as per the state laws and regulations.

How to fill out financial advisors florida?

To fill out financial advisors reports in Florida, advisors need to provide detailed information about their financial activities, investments, and clients as required by the state regulatory authority.

What is the purpose of financial advisors florida?

The purpose of financial advisors reports in Florida is to ensure transparency in the financial industry, protect investors, and maintain the integrity of the financial markets.

What information must be reported on financial advisors florida?

Financial advisors in Florida must report information such as assets under management, fees charged, client demographics, investment strategies, and any disciplinary history.

Fill out your financial advisors florida online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Advisors Florida is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.