Get the free Annual Fund Gift Acknowledgment

Show details

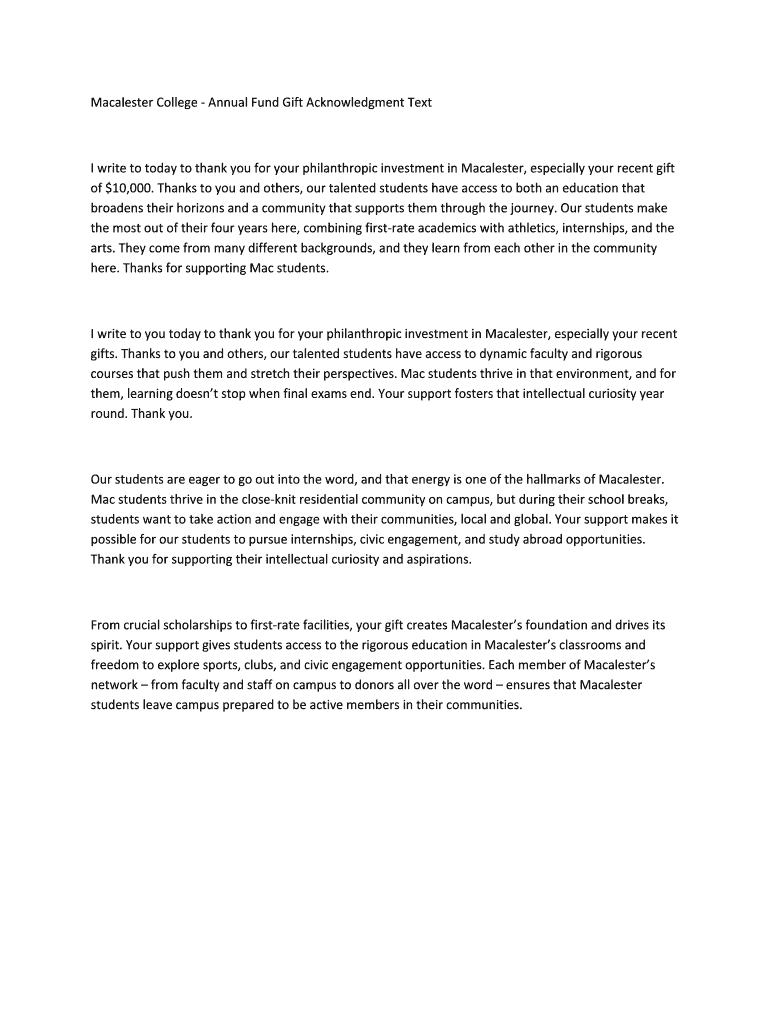

This document serves as a thank you letter for donations made to various educational institutions, expressing gratitude for the contributor's support and highlighting the impact of their gifts on

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual fund gift acknowledgment

Edit your annual fund gift acknowledgment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual fund gift acknowledgment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annual fund gift acknowledgment online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit annual fund gift acknowledgment. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

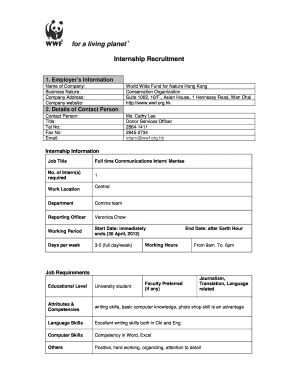

How to fill out annual fund gift acknowledgment

How to fill out Annual Fund Gift Acknowledgment

01

Start by gathering the donor's information, including their name, address, and donation amount.

02

Verify the date of the donation to ensure accuracy in acknowledgment.

03

Choose a suitable format for the acknowledgment letter (e.g., formal letter, email).

04

Write a warm greeting addressing the donor by name.

05

Express gratitude for their donation and highlight its impact on the organization.

06

Include specific details about how the funds will be used or any projects they support.

07

Add any relevant tax information, such as a statement that the donation is tax-deductible.

08

Close with another expression of thanks and provide contact information for any further questions.

09

Sign the acknowledgment letter and send it promptly.

Who needs Annual Fund Gift Acknowledgment?

01

Individuals or organizations that have made a charitable donation to a non-profit organization.

02

Non-profit organizations that need to acknowledge and track donations for tax purposes.

03

Donors who wish to have a formal acknowledgment for their records.

Fill

form

: Try Risk Free

People Also Ask about

How do you politely respond to a gift?

How can you receive a gift gracefully in English? Oh, that's so kind/nice of you. Oh, you didn't have to do that. Wow! What a thoughtful present. That's so thoughtful of you. Thank you so much. It's lovely / wonderful / fantastic. It's something I have always wanted. Thank you!

How do you acknowledge a donation gift?

Gift acknowledgement letters are important for two reasons. First, they provide proof so donors can claim a U.S. tax exemption. Second, they let you thank donors for their generosity, helping you build a relationship for future support.

What is an example of a written acknowledgement for a charitable contribution?

The following is an example of a written acknowledgment where a charity accepts contributions in the name of one of its activities: "Thank you for your contribution of $250 to (Organization) made in the name of its Kids & Families program. No goods or services were provided in exchange for your donation."

How do you acknowledge a gift from a family foundation?

Please know how grateful we at the name of org are that your parents/aunt entrusted us to accept this donation to outline how the gift will benefit your org. Your parent's legacy will live on through their generosity. Thanks to donors like your parents, last year we were able to elaborate on all your amazing work.

What is a nice message for donations?

“Your donation is sincerely appreciated. Your generosity will truly make a difference in the lives of others.” “Please consider donating today to support our mission. Your contribution is crucial and greatly valued.”

How to acknowledge gifts from donor-advised funds?

You can acknowledge their generosity in much the same way you thank your other donors — with just a few differences. Thank the donor who recommended the grant, not Fidelity Charitable. Eliminate all references to the gift being tax-deductible. Use a thank-you as an opportunity to drive future engagement.

How do you acknowledge a gift from a foundation?

The acknowledgment letter serves as the donor's record, and it fulfills the organization's obligation to the IRS. This acknowledgment should include the customary information such as gift date and gift amount, basic language referencing that this gift was made in honor of someone, and the honoree's name.

How do you thank a foundation for a donation?

Generic donation thank you quotes “Thank you so much for your donation. “We know you have a lot of choices when it comes to donating, and we are so grateful that you chose to donate to our cause. “We have a lot of work to do, and your generous donation helps us get that important work done.”

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Annual Fund Gift Acknowledgment?

Annual Fund Gift Acknowledgment is a document that recognizes and thanks donors for their contributions to an annual fundraising campaign, ensuring that they are acknowledged for their generosity.

Who is required to file Annual Fund Gift Acknowledgment?

Typically, nonprofit organizations and institutions that receive donations are required to file Annual Fund Gift Acknowledgments to maintain transparency and accountability to their donors.

How to fill out Annual Fund Gift Acknowledgment?

To fill out an Annual Fund Gift Acknowledgment, the organization needs to include details such as the donor's name, the amount of the gift, the date of the gift, and any specific designation or intent for the donation.

What is the purpose of Annual Fund Gift Acknowledgment?

The purpose of Annual Fund Gift Acknowledgment is to formally recognize and appreciate the support of donors, to provide them with documentation that may be used for tax purposes, and to encourage future donations.

What information must be reported on Annual Fund Gift Acknowledgment?

The information that must be reported includes the donor's name, donation amount, date of the gift, a statement of whether any goods or services were provided in return for the gift, and the organization's tax identification number.

Fill out your annual fund gift acknowledgment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Fund Gift Acknowledgment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.