Get the free Traditional 403b to Roth IRA Conversion Form

Show details

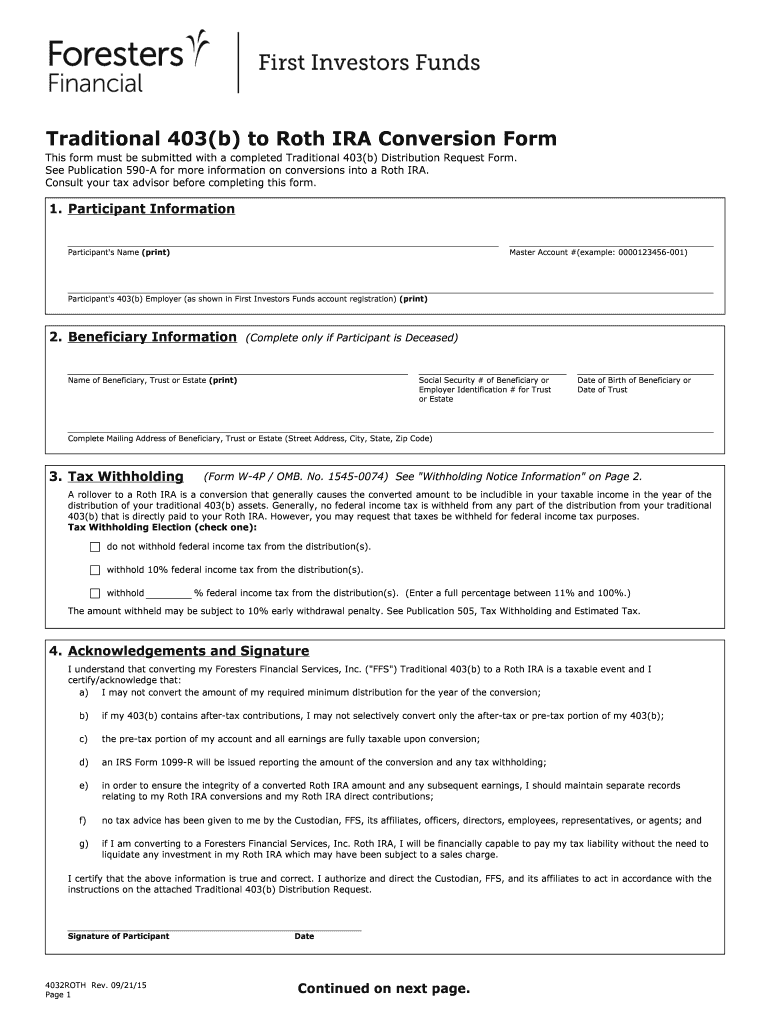

Traditional 403(b) to Roth IRA Conversion Form This form must be submitted with a completed Traditional 403(b) Distribution Request Form. See Publication 590A for more information on conversions into

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign traditional 403b to roth

Edit your traditional 403b to roth form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your traditional 403b to roth form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit traditional 403b to roth online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit traditional 403b to roth. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out traditional 403b to roth

To fill out a traditional 403b to Roth conversion, follow these steps:

01

Review your eligibility: Check if you meet the eligibility criteria for a traditional 403b to Roth conversion. Generally, individuals with a traditional 403b account are eligible to convert it to a Roth IRA if they have a Roth IRA account already open.

02

Determine tax implications: Understand the tax implications of converting your traditional 403b to a Roth IRA. Converting to a Roth IRA means paying taxes on the amount converted, so consider consulting a tax professional to assess the potential impact on your finances.

03

Contact your plan administrator: Reach out to the administrator of your traditional 403b plan. Obtain the necessary forms or instructions to initiate a conversion. They will guide you through the process and provide specific details based on their plan requirements.

04

Complete the required forms: Fill out the designated forms accurately and provide any required information. Ensure that you understand the information you are providing and seek assistance if needed. Double-check for any signatures or additional documents that may be necessary for the conversion process.

05

Specify the amount to convert: Determine the amount you wish to convert from your traditional 403b to a Roth IRA. You have the flexibility to convert the entire balance or only a portion, depending on your financial goals and tax considerations.

06

Verify tax withholding: Confirm if you want to withhold taxes from the converted amount or opt to pay the taxes separately when filing your tax return. This decision may depend on your personal financial circumstances and preferences.

07

Submit the forms and monitor the conversion: Submit the completed forms to the plan administrator and keep a copy for your records. Monitor the progress of the conversion to ensure it is executed correctly and timely.

Who needs a traditional 403b to Roth conversion?

01

Pre-retirees seeking tax-efficient retirement planning: Individuals who anticipate being in a higher tax bracket during retirement can benefit from a traditional 403b to Roth conversion. By paying taxes upfront on the converted amount, they can create a tax-free income stream in retirement.

02

People looking to diversify their retirement savings: Converting a traditional 403b to a Roth IRA allows for greater diversity in retirement savings. By having funds in both traditional and Roth accounts, individuals can manage their tax liability strategically during retirement.

03

High-income earners ineligible for Roth IRA contributions: Certain individuals may have income limitations that prevent them from contributing directly to a Roth IRA. By converting a traditional 403b to a Roth IRA, they can still take advantage of the benefits offered by a Roth account.

In summary, the process of filling out a traditional 403b to Roth conversion involves reviewing eligibility, understanding tax implications, contacting your plan administrator, completing necessary forms, specifying the amount to convert, verifying tax withholding, and monitoring the progress. This conversion is beneficial for pre-retirees, those seeking retirement savings diversification, and high-income earners ineligible for direct Roth IRA contributions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify traditional 403b to roth without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like traditional 403b to roth, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I get traditional 403b to roth?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the traditional 403b to roth. Open it immediately and start altering it with sophisticated capabilities.

How can I edit traditional 403b to roth on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing traditional 403b to roth.

What is traditional 403b to roth?

Traditional 403b to Roth is a conversion process where funds from a traditional 403b retirement account are transferred to a Roth retirement account.

Who is required to file traditional 403b to roth?

Individuals who want to convert funds from a traditional 403b account to a Roth account are required to file the traditional 403b to Roth conversion.

How to fill out traditional 403b to roth?

To fill out traditional 403b to Roth, individuals must contact their retirement account provider to initiate the conversion process and follow the required paperwork and steps provided by the provider.

What is the purpose of traditional 403b to roth?

The purpose of traditional 403b to Roth conversion is to potentially benefit from tax advantages offered by a Roth account, such as tax-free withdrawals in retirement.

What information must be reported on traditional 403b to roth?

Individuals must report the amount of funds converted from the traditional 403b account to the Roth account, as well as any tax implications associated with the conversion.

Fill out your traditional 403b to roth online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Traditional 403b To Roth is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.