Get the free Cost Basis Method Election Form - Foresters Financial

Show details

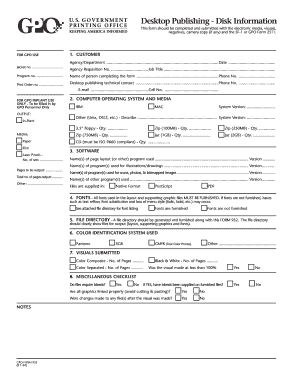

Cost Basis Method Election Form For Retirement Accounts (excluding Education Savings Accounts and money market accounts) Use this form to elect or change the cost basis calculation method on your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cost basis method election

Edit your cost basis method election form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cost basis method election form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cost basis method election online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cost basis method election. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cost basis method election

How to fill out cost basis method election:

01

Determine which cost basis method you would like to elect: The cost basis method election allows you to choose between the specific identification or average cost basis methods for tracking the cost basis of your investments. Consider your investment strategy and consult with your financial advisor to determine which method is most suitable for your needs.

02

Obtain the necessary forms: Contact your brokerage firm or financial institution to request the required forms for making the cost basis method election. These forms may vary depending on the institution, so ensure you obtain the correct ones.

03

Read the instructions carefully: Before filling out the forms, thoroughly review the provided instructions. Familiarize yourself with the requirements, deadlines, and any additional information that may be necessary for completing the cost basis method election.

04

Complete the forms accurately: Provide the requested information on the forms accurately and legibly. Common details that may be required include your name, account number, tax identification number, and the specific cost basis method you are electing. Be sure to double-check your entries to avoid errors or omissions.

05

Sign and date the forms: Once you have completed the forms, sign and date them as required. This serves as your official acknowledgment and agreement to elect the chosen cost basis method. Failure to sign and date the forms may result in your election not being processed.

06

Submit the forms: Send the completed and signed forms to the designated address provided in the instructions. It is recommended to make copies of the filled-out forms for your records before sending them. Consider mailing the forms via certified mail to ensure delivery and retain proof of submission.

Who needs cost basis method election?

01

Investors with taxable investment accounts: The cost basis method election applies to individuals and entities that hold taxable investment accounts. This includes those who buy and sell stocks, bonds, mutual funds, ETFs, or other securities subject to capital gains or losses.

02

Individuals seeking to optimize tax planning: The selection of an appropriate cost basis method can impact your tax liability when you sell or dispose of investments. By electing the most suitable method, you can potentially minimize your capital gains tax obligation or optimize your deductions.

03

Those with specific investment strategies: Some investors may have specific investment strategies that require the use of a particular cost basis method. For instance, those who frequently trade stocks or engage in options trading may prefer the specific identification method, while long-term investors may find the average cost method more suitable.

04

Individuals with multiple accounts or investments: If you have multiple investment accounts across various financial institutions or hold a diverse portfolio, making a cost basis method election can help streamline your record-keeping and simplify tax reporting.

05

Investors who want greater control over cost basis tracking: Electing a cost basis method allows you to have greater control over how your cost basis is determined. This can be particularly beneficial for investors who want to track the performance of individual investments separately or utilize tax-efficient strategies.

Remember, it is advisable to consult with a tax professional or financial advisor to fully understand the implications of electing a specific cost basis method and determine the optimal choice for your individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cost basis method election for eSignature?

When your cost basis method election is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit cost basis method election in Chrome?

Install the pdfFiller Google Chrome Extension to edit cost basis method election and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit cost basis method election on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as cost basis method election. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is cost basis method election?

Cost basis method election is the selection of a method for determining the cost basis of an asset for tax purposes.

Who is required to file cost basis method election?

Taxpayers who have acquired assets and need to determine the cost basis of those assets for tax reporting purposes are required to file cost basis method election.

How to fill out cost basis method election?

Cost basis method election can be filled out by submitting the necessary forms to the IRS or tax authorities, indicating the chosen method for determining the cost basis of assets.

What is the purpose of cost basis method election?

The purpose of cost basis method election is to establish a consistent and accurate method for determining the cost basis of assets, which is essential for accurate tax reporting and compliance.

What information must be reported on cost basis method election?

Cost basis method election typically requires information such as the taxpayer's identification details, description of the asset, acquisition date, original cost, and chosen method for determining cost basis.

Fill out your cost basis method election online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cost Basis Method Election is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.