Get the free savings and investing

Show details

This document serves as a teacher's guide for a lesson on savings and investing, providing resources, teaching strategies, student activities, and quizzes to enhance understanding of financial goals,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign savings and investing

Edit your savings and investing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your savings and investing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit savings and investing online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit savings and investing. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out savings and investing

How to fill out savings and investing

01

Set a clear savings goal: Determine the purpose of your savings, such as an emergency fund, vacation, or retirement.

02

Create a budget: Analyze your income and expenses to identify how much you can save each month.

03

Open a savings account: Choose an account with a good interest rate and no monthly fees to park your savings.

04

Automate your savings: Set up automatic transfers from your checking account to your savings account.

05

Research investment options: Look into stocks, bonds, mutual funds, or ETFs that align with your risk tolerance and goals.

06

Start with low-cost investment options: Consider index funds or robo-advisors for a diversified investment approach.

07

Regularly review and adjust: Monitor your savings and investment performance and adjust your strategy as needed.

Who needs savings and investing?

01

Individuals aiming for financial security: Anyone wanting to safeguard against unexpected expenses.

02

Young professionals: Those looking to build wealth for the future through investments.

03

Families planning for major expenses: Such as education costs for children or buying a home.

04

Retirees: Individuals needing to secure a steady income stream through savings and investments during retirement.

05

Entrepreneurs: Those wishing to save for business ventures or investments to grow their businesses.

Fill

form

: Try Risk Free

People Also Ask about

What is better, savings or investment?

If you're looking for safety and easy access to your funds, a savings account is the right choice. If you're willing to take on some risk for potentially higher returns, an investment account may be the better option for long-term growth.

How does saving and investing work?

Saving tends to be for the short term, while investing is for longer term. In the short term, it's a good idea to build up 'rainy day' cash savings you can easily withdraw if you need to. Longer term, you might want to consider investing as a way of growing your money.

How much will I have if I invest $1000 a month for 30 years?

Investing $1,000 per month for 30 years at a 6% rate of return hypothetically will give you an investment portfolio worth more than $1 million. This result is hypothetical because it doesn't take into account taxes, fees, varying rates of return and other variables, such as extended market downturns.

What is the savings and investment?

Saving is the act of setting aside money in Bank Accounts and Deposits. To invest means to allocate assets in various market securities. While savings generate lower but safer returns, investments involve risks but can generate significantly higher returns.

Why is savings and investment important?

Saving money is the stepping stone to achieving financial security. To have control over your finances, develop a smart savings habit, to secure your current as well as future financial life. Develop the habit to automate your savings and investments to reduce the temptation of unplanned expenses.

How to turn $100 into $1000 investing?

High-Yield Savings Accounts. It may seem a bit safe, but a high-yield savings account could turn your $100 into $1,000 just by leaving it alone. Invest in the Stock Market. Start a Blog. Use Robo-Advisors. Invest in Cryptocurrency. Start an E-Commerce Business. Grow a YouTube Audience. Collect Dividends.

What is savings vs investing?

The biggest difference between saving and investing is the level of risk taken. Saving typically results in earning a lower return but with virtually no risk. In contrast, investing allows you the opportunity to earn a higher return, but you take on the risk of loss in order to do so.

What is saving and investing?

You'll likely need both to achieve your financial goals. Saving is the act of putting money somewhere safe for use in an emergency or for a short-term goal. Investing involves purchasing securities that have the potential to return more than savings over time but also come with higher risk.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is savings and investing?

Savings refers to the portion of income that is not spent on consumption and is set aside for future use. Investing involves using savings to purchase assets or securities with the expectation of earning a return over time.

Who is required to file savings and investing?

Individuals and entities that earn income, have financial transactions, or engage in investment activities are typically required to file information related to savings and investing, such as tax returns or financial statements.

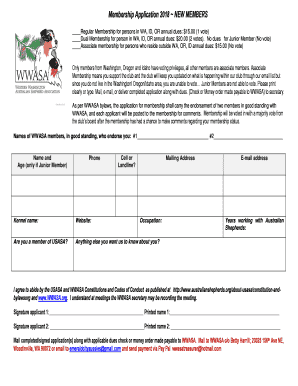

How to fill out savings and investing?

To fill out savings and investing forms, individuals should gather all relevant financial information, including income, expenses, assets, and investment transactions. They then input this information into the required forms, ensuring accuracy and completeness.

What is the purpose of savings and investing?

The purpose of savings is to provide financial security for future needs, emergencies, or goals, while investing aims to grow wealth over time through the appreciation of assets or earning returns.

What information must be reported on savings and investing?

Individuals generally need to report income earned, amounts saved, types of investments held, investment income, capital gains or losses, and any related expenses when filing savings and investing information.

Fill out your savings and investing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Savings And Investing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.