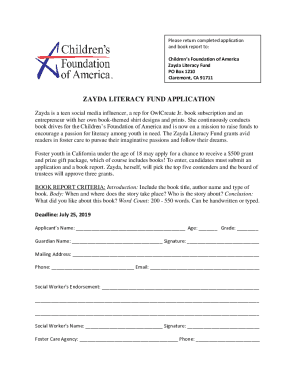

Get the free Application for Commercial Credit - icecargocomau

Show details

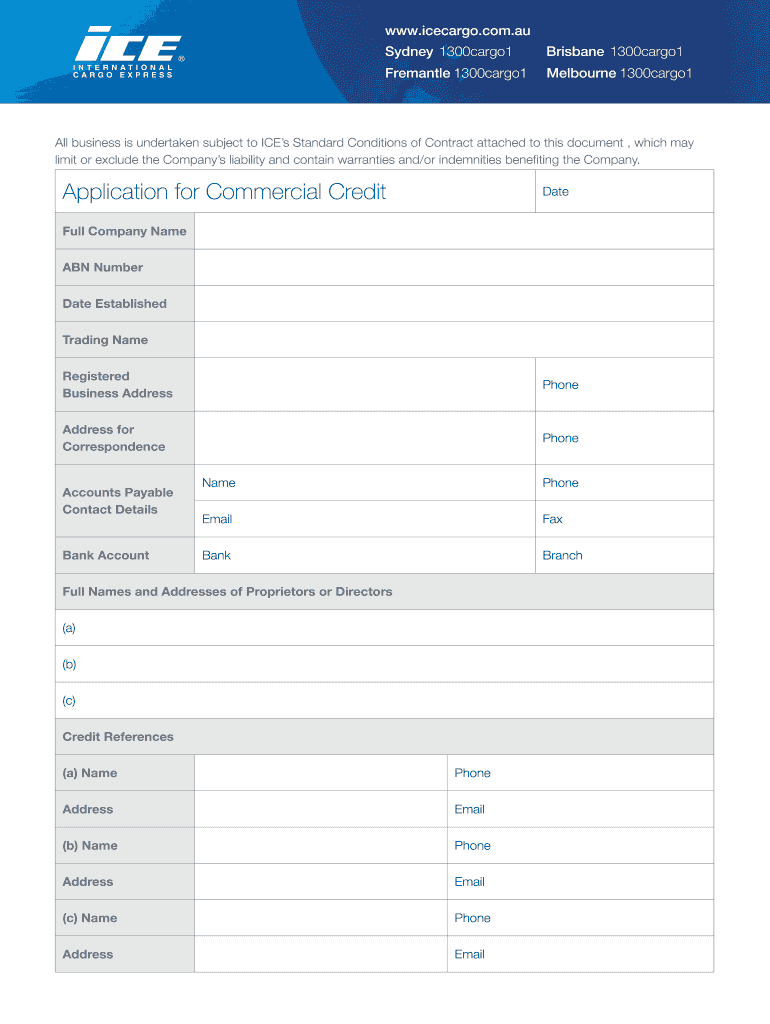

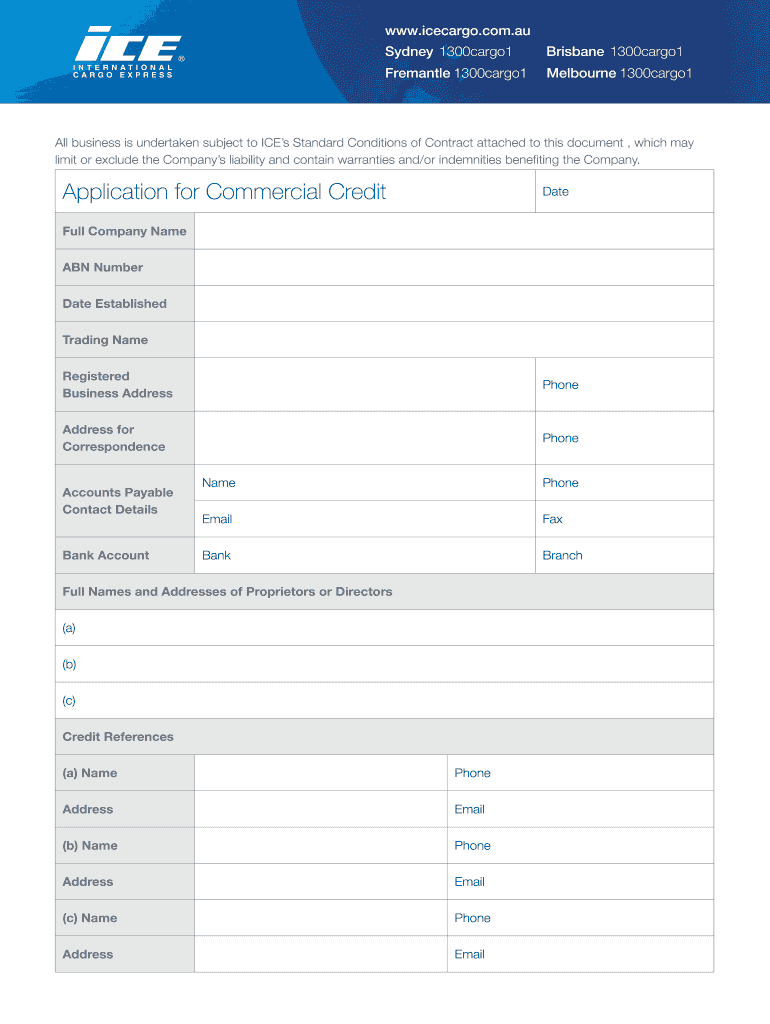

WWW.icecargo.com.AU Sydney 1300cargo1 Brisbane 1300cargo1 Fremantle 1300cargo1 Melbourne 1300cargo1 All business is undertaken subject to ICEs Standard Conditions of Contract attached to this document,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for commercial credit

Edit your application for commercial credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for commercial credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for commercial credit online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for commercial credit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for commercial credit

How to fill out an application for commercial credit:

01

Gather all necessary documents: Before starting the application process, gather all the required documents such as financial statements, tax returns, business licenses, and any other relevant paperwork. This will ensure that you have all the necessary information at hand when filling out the application.

02

Fill in personal and business information: Start by providing personal details such as name, address, contact information, and social security number. Then, include your business information, such as the legal name, address, type of business entity, and employer identification number (EIN).

03

Provide financial information: The application will require detailed financial information about your business, including your annual revenue, profit and loss statements, balance sheets, and cash flow statements. It is important to be accurate and provide updated financial information to increase your chances of approval.

04

Describe your business: The application will often ask you to provide a brief description of your business, its industry, years in operation, number of employees, and any key strengths or advantages that differentiate your business from competitors. This helps the lender assess the viability and potential success of your business.

05

Present collateral and assets: If the commercial credit requires collateral, provide details about the assets you are willing to pledge as security. These could include real estate, equipment, inventory, or accounts receivable. Be prepared to provide documentation supporting the value of these assets.

06

Provide references and contacts: Many credit applications ask for references, including suppliers, vendors, and other business associates who can vouch for your reliability and creditworthiness. Make sure to provide accurate contact information for these references and inform them beforehand that they may be contacted by the lender.

07

Review and submit the application: After completing the application, carefully review all the information provided to ensure accuracy. Any errors or inconsistencies could delay the approval process or even result in rejection. Once you are satisfied with the application, submit it either electronically or in person to the lender's designated department.

Who needs an application for commercial credit?

01

Small business owners: Entrepreneurs who own small businesses may need to apply for commercial credit to finance day-to-day operations, purchase equipment or inventory, or fund expansion plans.

02

Startups and new ventures: New businesses often require commercial credit to establish themselves, acquire initial capital, and cover operational expenses until they become self-sustainable or generate consistent revenues.

03

Established companies: Even established companies may need commercial credit to finance growth initiatives, invest in research and development, or seize market opportunities that require additional funding beyond their current resources.

In summary, anyone operating a business, ranging from startups to established companies, may need to fill out an application for commercial credit to access funds for various business needs. It is essential to provide accurate and updated information to increase the chances of approval and secure the necessary financing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my application for commercial credit directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your application for commercial credit and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Where do I find application for commercial credit?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific application for commercial credit and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I execute application for commercial credit online?

Easy online application for commercial credit completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

What is application for commercial credit?

An application for commercial credit is a formal request from a business to a lender for financial assistance in the form of a loan or line of credit specifically for commercial purposes.

Who is required to file application for commercial credit?

Businesses or companies that require additional funding to support their operations or expansion may be required to file an application for commercial credit.

How to fill out application for commercial credit?

To fill out an application for commercial credit, businesses need to provide detailed information about their financial history, current financial situation, and the specific purpose for which the credit is needed. This may include submitting financial statements, tax returns, and other relevant documents.

What is the purpose of application for commercial credit?

The purpose of an application for commercial credit is to demonstrate the business's ability to repay the borrowed funds and to secure financial assistance to support its operations or growth.

What information must be reported on application for commercial credit?

On an application for commercial credit, businesses must typically report details about their financial history, current revenue and expenses, assets and liabilities, ownership structure, and other relevant financial information.

Fill out your application for commercial credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Commercial Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.