Get the free Electronic Filing Instructions

Show details

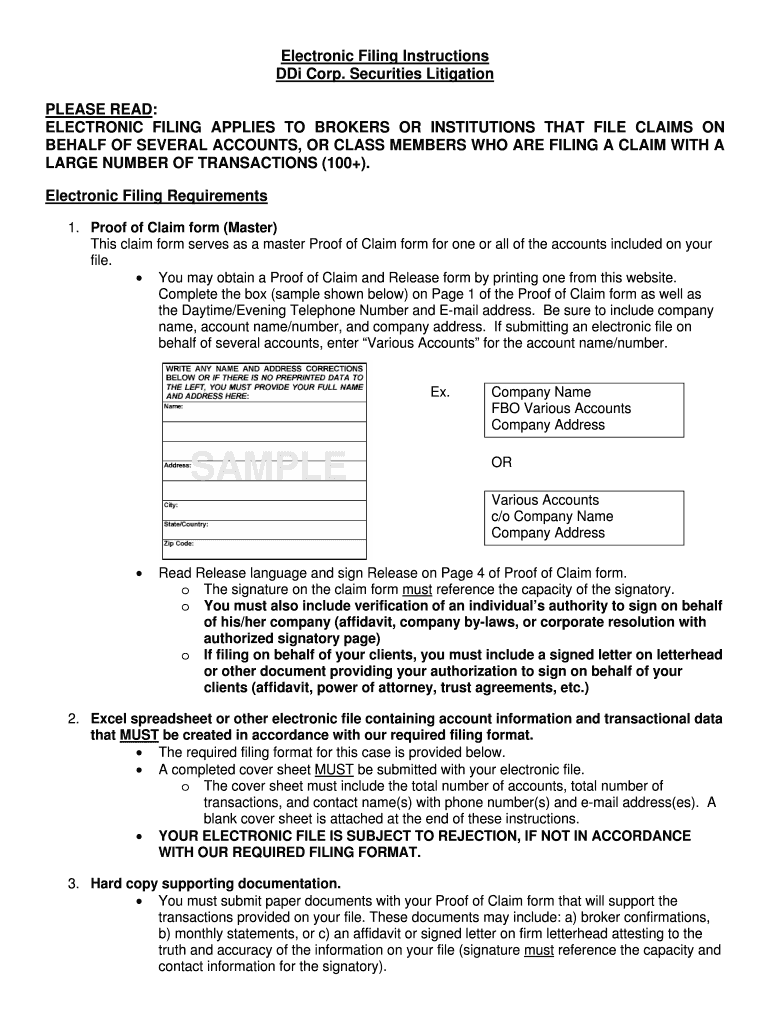

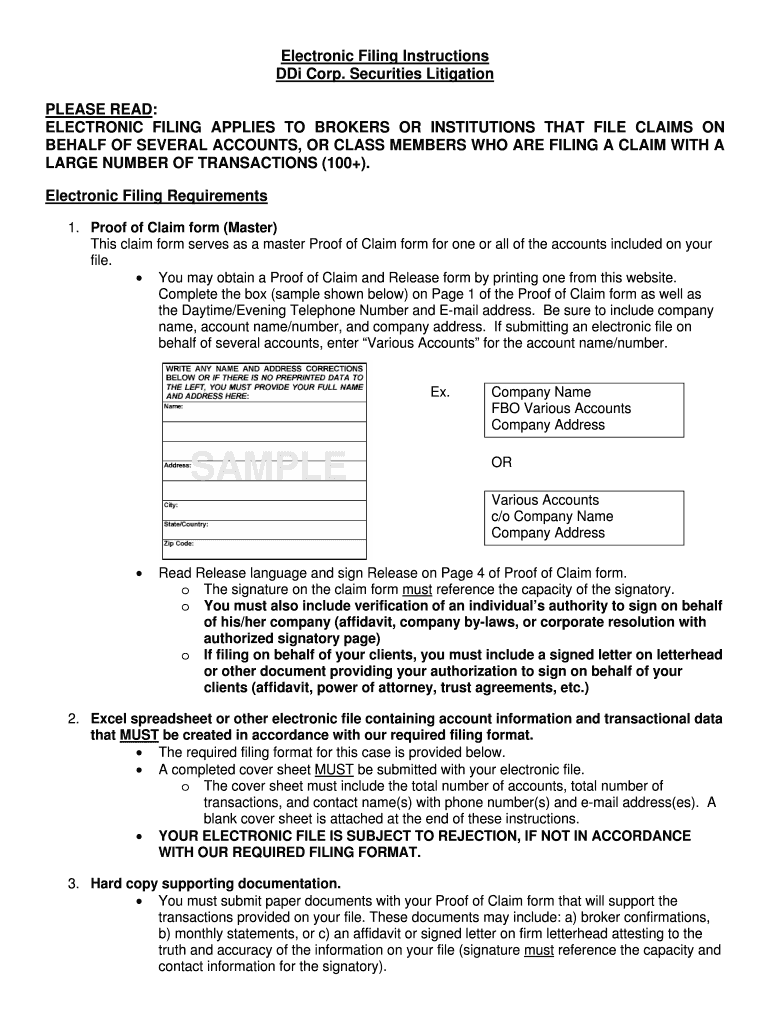

This document provides detailed electronic filing instructions for brokers or institutions filing claims on behalf of multiple accounts in the DDi Corp. Securities Litigation. It outlines the requirements

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign electronic filing instructions

Edit your electronic filing instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your electronic filing instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit electronic filing instructions online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit electronic filing instructions. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out electronic filing instructions

How to fill out Electronic Filing Instructions

01

Gather all necessary documents and information required for filing.

02

Access the electronic filing platform designated for your submissions.

03

Follow the prompts to begin the e-filing process, selecting the appropriate forms as needed.

04

Input your personal and financial information accurately into the designated fields.

05

Review all entered information for accuracy and ensure that all required fields are completed.

06

Attach any necessary supporting documents as specified in the filing instructions.

07

Submit the electronic filing and save a copy of the confirmation for your records.

Who needs Electronic Filing Instructions?

01

Individuals filing their taxes electronically.

02

Businesses submitting tax returns or other required information to the IRS or relevant authorities.

03

Tax preparers who file on behalf of clients.

04

Organizations applying for exemptions or grants that require electronic submissions.

Fill

form

: Try Risk Free

People Also Ask about

Does the IRS require electronic filing?

As of tax year 2023, if you have 10 or more information returns, you must file them electronically. This includes Forms W-2, e-filed with the Social Security Administration. Find details on the final e-file regulations and requirements for Forms W-2.

How to make an electronic filing system?

How do you implement a computerized filing system? Decide who will have ownership of your filing system. Get organized. Use subfolders. Decide on a naming convention and stick to it. Integrate paper and electronic documents. Create a plan for file backup and data recovery. Train your team on how the filing system works.

What are the 5 basic filing systems?

Tips for Organizing Your Computer Filing System To make an efficient filing system, consider what files you need to organize. Choose a location, such as your desktop or Documents folder. Create folders to separate your files based on usage, type, importance, or other. Keep your files backed up regularly.

Who signs the ero signature?

The ERO prints Form 8879, the IRS e-file Signature Authorization, and the Practitioner or Self-Select PIN Consent to Disclosure form. The taxpayer/spouse needs to sign Form 8879 (IRS e-file Signature Authorization).

What are the 5 simple steps for filing taxes?

So, let's walk step by step through how to file taxes — with zero worry. Step 1: Check Whether You Need to File. First things first: Do you even have to file taxes? Step 2: Gather Your Tax Documents. Step 3: Pick a Filing Status. Step 4: Take Advantage of Deductions and Credits. Step 5: File Your Taxes.

Does the IRS have an electronic filing system?

Filing your return electronically is faster, safer, and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

How to create a digital filing system?

How do you implement a computerized filing system? Decide who will have ownership of your filing system. Get organized. Use subfolders. Decide on a naming convention and stick to it. Integrate paper and electronic documents. Create a plan for file backup and data recovery. Train your team on how the filing system works.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Electronic Filing Instructions?

Electronic Filing Instructions refer to the guidelines and procedures required for submitting documents electronically to regulatory or government agencies.

Who is required to file Electronic Filing Instructions?

Individuals or organizations that are mandated by regulatory bodies to submit their documents electronically must file Electronic Filing Instructions.

How to fill out Electronic Filing Instructions?

To fill out Electronic Filing Instructions, users should follow the provided guidelines, ensuring all required fields are completed accurately and submitted in the specified format.

What is the purpose of Electronic Filing Instructions?

The purpose of Electronic Filing Instructions is to streamline the submission process, ensuring that filings are received efficiently and in compliance with regulatory requirements.

What information must be reported on Electronic Filing Instructions?

Information that must be reported typically includes the filer’s identification details, the nature of the documents being filed, any applicable reference numbers, and a signature or verification of authenticity.

Fill out your electronic filing instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Electronic Filing Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.