Get the free TD1SK

Show details

Este formulario es utilizado por su empleador o pagador para determinar la cantidad de sus deducciones fiscales provinciales.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign td1sk

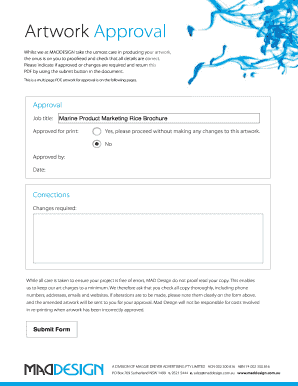

Edit your td1sk form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your td1sk form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit td1sk online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit td1sk. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out td1sk

How to fill out TD1SK

01

Obtain the TD1SK form from the Canada Revenue Agency website or local tax office.

02

Fill out your personal information in the designated fields, including your name, address, and social insurance number.

03

Indicate your residency status and other relevant information regarding your income.

04

Claim any applicable tax credits and deductions that you qualify for on the form.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form before submitting it to your employer or the relevant tax authority.

Who needs TD1SK?

01

Individuals working or earning income in Saskatchewan who want to claim personal tax credits or deductions.

02

New employees in Saskatchewan who need to provide this form to their employer for proper tax withholding.

03

Anyone whose tax situation has changed and needs to update their TD1SK to reflect new claims for tax credits.

Fill

form

: Try Risk Free

People Also Ask about

What is a TD1 form in Canada?

The TD1 form determines how much income tax should be deducted from an employee's paycheck annually. It's filled out when someone starts a new job or their personal situation changes, like getting married or moving to another province, such as Quebec or Ontario.

What is the difference between T1 and T4 in Canada?

The T1 is a form filled out by employees and business owners, then submitted to the CRA. If you're wondering how to pay taxes in Canada, the T1 form is a crucial part of the process. The T4 form, on the other hand, is filled out by employers and distributed to employees.

Who should file a T1 in Canada?

Who should fill out a T1? Anyone who will owe taxes should complete a T1. Business owners, such as sole proprietors and partnerships, are also required to complete the T1 business form.

What is the basic personal amount for Saskatchewan in 2025?

On December 5, 2024, the Government of Saskatchewan announced an increase to the Basic Personal Amount from $18,491 to $19,491, effective January 1, 2025.

What is Releve 19 in English?

The Relevé 19 (RL-19) slip reports the advance payments of tax credits you received during the year for the following programs: The work premium, the adapted work premium, or the supplement to the work premium. Childcare expenses. Home-support services for seniors.

What is the 90% rule in Canada?

In addition, you can claim the remaining federal non-refundable tax credits in full if the Canadian-source income you are reporting for the part of the year that you were not a resident of Canada is 90% or more of your net world income for that part of the year.

Who is eligible for the $7,500 tax credit in Canada?

To be eligible for the $7,500 Multigenerational Home Renovation Tax Credit in Canada, you usually need to meet the following criteria: You must be a homeowner in Canada. The resident of the renovated unit must be a family member who is a senior or an adult with a disability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TD1SK?

TD1SK is a form used by individuals in Saskatchewan, Canada, to determine the amount of tax to be deducted from their income.

Who is required to file TD1SK?

Individuals who receive income and want to claim personal tax credits or deductions in Saskatchewan are required to file TD1SK.

How to fill out TD1SK?

To fill out TD1SK, individuals need to provide personal information such as their name, address, and social insurance number, and claim any applicable personal tax credits and deductions.

What is the purpose of TD1SK?

The purpose of TD1SK is to help employers determine the correct amount of provincial income tax to deduct from employees' paychecks.

What information must be reported on TD1SK?

TD1SK requires individuals to report their name, address, social insurance number, and any claimed personal tax credits, such as basic personal amount, spouse or common-law partner amount, and other relevant deductions.

Fill out your td1sk online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

td1sk is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.