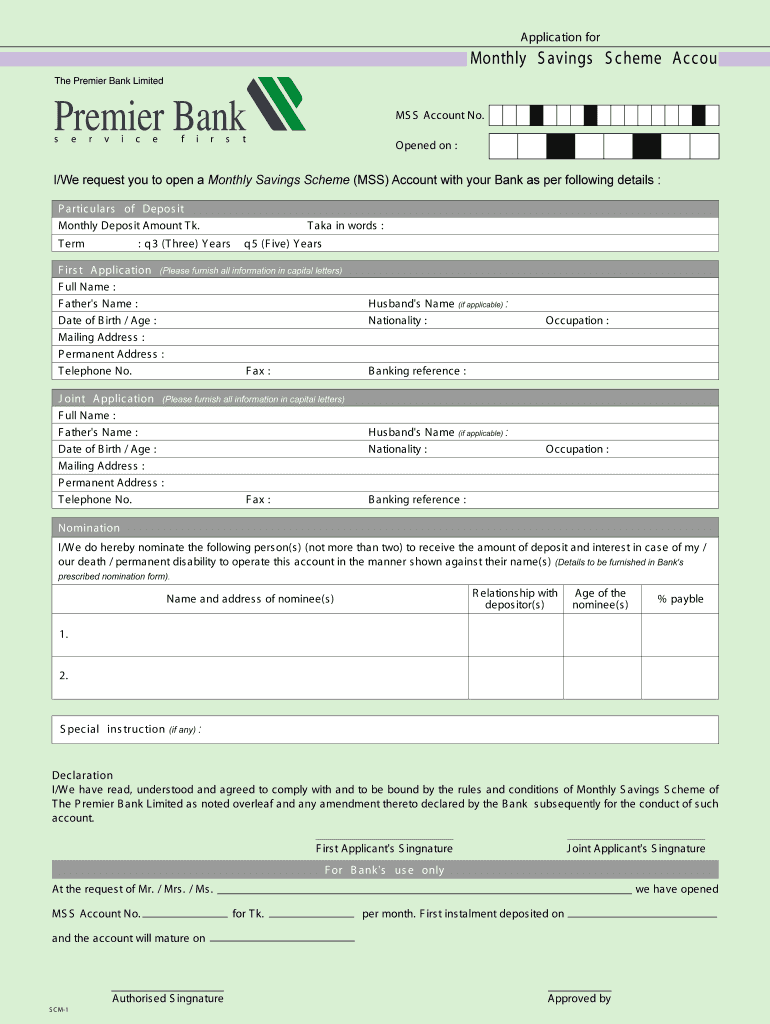

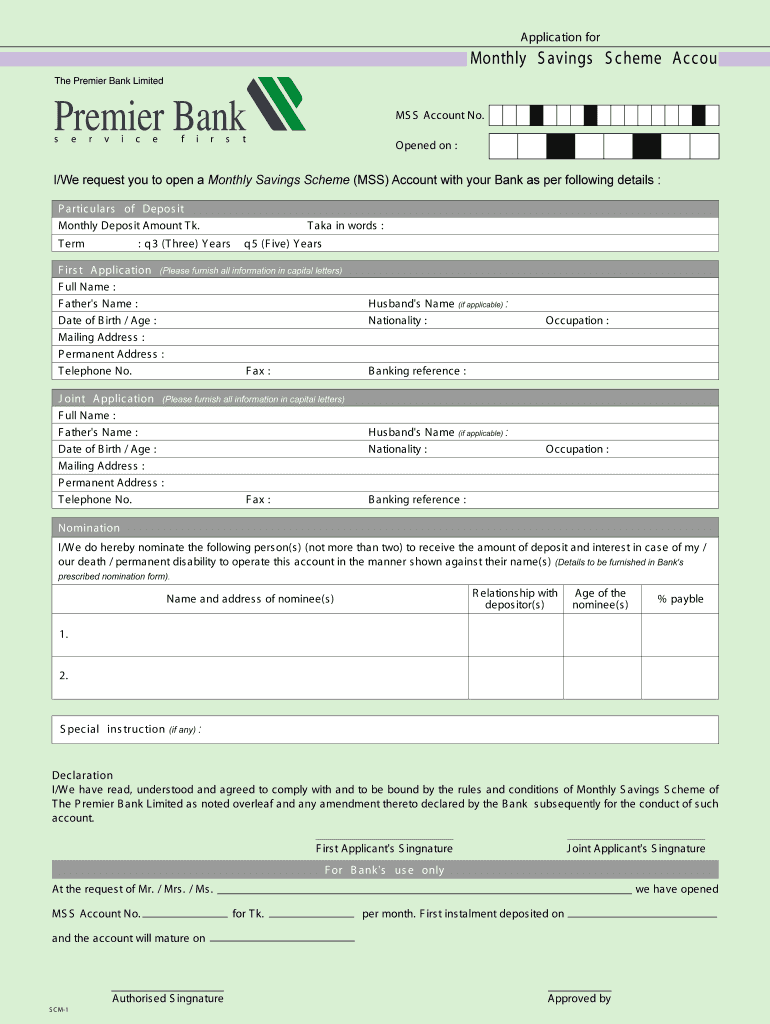

Get the free Application for Monthly Savings Scheme Account

Show details

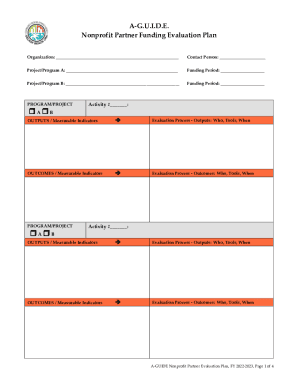

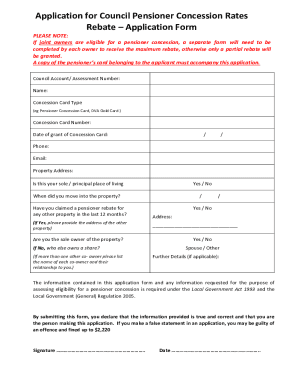

This document is an application form to open a Monthly Savings Scheme Account at The Premier Bank Limited, detailing personal information, deposit particulars, and nomination details.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for monthly savings

Edit your application for monthly savings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for monthly savings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for monthly savings online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application for monthly savings. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for monthly savings

How to fill out Application for Monthly Savings Scheme Account

01

Obtain the Application form from your bank or download it from their website.

02

Fill in your personal details such as name, address, and contact information in the designated fields.

03

Provide any identification details required, such as your Social Security Number or national ID.

04

Specify the type of Monthly Savings Scheme you wish to apply for.

05

Indicate the amount you plan to deposit monthly.

06

Fill in the nomination section if you're designating someone as a beneficiary.

07

Review all the information for accuracy.

08

Sign and date the application form.

09

Submit the completed application form to your bank, either in person or online.

Who needs Application for Monthly Savings Scheme Account?

01

Individuals looking to save money on a regular basis.

02

People aiming to build a financial safety net.

03

Those who want to benefit from interest earnings on their savings.

04

Individuals who are planning for future expenses like education or home purchase.

Fill

form

: Try Risk Free

People Also Ask about

How does a monthly savings account work?

Interest accumulates daily. Your balance is lower at the start of the term and grows after each monthly deposit. This means your daily interest calculation will also slowly increase. Interest is paid to your account at the end of the term.

Which bank is best for a monthly income scheme?

Fixed Deposit Monthly Income Scheme Interest Rates BankTenureInterest Rates (p.a.) HDFC Bank FD 7 days to 14 days 2.75% Axis Bank FD 7 days to 14 days 3.00% State Bank of India FD 7 days to 45 days 3.05% Kotak Bank FD 7 days to 10 days 2.75%3 more rows

Can I withdraw MIS before maturity?

Yes, you can avail the premature withdrawal facility after one year. If you withdraw before three years, you will be charged a 2% penalty. A 1% penalty will be applicable on withdrawing after three years. Can I nominate someone in my Post Office MIS account?

What is a monthly saving scheme?

Monthly Income Scheme (MIS) is designed to offer a guaranteed monthly income as per the interest rate ranging from 3% to 5.60% pa. As a person invests a sum of money for a set time period, he/she will receive a monthly income and interest on total investment upon maturity.

What is the monthly income saving scheme?

Post Office Monthly Income Scheme provides guaranteed monthly returns, safe investment, 5-year lock-in, and is suitable for risk-averse investors. Post Office Monthly Income Scheme (POMIS) is a secure government-backed savings plan ideal for those seeking a steady income.

What is a savings scheme?

Introduction. In simple language, savings means the money one has saved, especially through a bank or official scheme. Savings scheme means a scheme designed to encourage savings by making small deposits.

What is a monthly savings plan?

A monthly savings plan is one of the most popular types of savings plans. Under this plan, you receive guaranteed1 income every month after a specific period of premium payments. You receive the monthly income during the income period or maturity and can use it for your monthly needs.

What is a savings scheme?

A savings scheme is an agreement you conclude with yourself. In practice, there is a fixed transfer from your use account to a mutual fund or savings account. The usual arrangement is to have monthly deductions, usually on the pay date.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Monthly Savings Scheme Account?

The Application for Monthly Savings Scheme Account is a formal document that individuals need to fill out to open a Monthly Savings Scheme account, which allows them to save a fixed amount monthly for a defined period at a specified interest rate.

Who is required to file Application for Monthly Savings Scheme Account?

Individuals who wish to invest in a Monthly Savings Scheme account and benefit from regular monthly savings and interest accumulation are required to file this application.

How to fill out Application for Monthly Savings Scheme Account?

To fill out the Application for Monthly Savings Scheme Account, you need to provide personal details such as your name, address, contact information, identity proof, and the amount you wish to save monthly, along with signing the application form.

What is the purpose of Application for Monthly Savings Scheme Account?

The purpose of the Application for Monthly Savings Scheme Account is to facilitate individuals in systematically saving money on a monthly basis while earning interest on their savings.

What information must be reported on Application for Monthly Savings Scheme Account?

The application must report personal identification information, address details, monthly contribution amount, chosen account duration, nominee details, and any other relevant financial information as required by the financial institution.

Fill out your application for monthly savings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Monthly Savings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.