Get the free sbi home insurance

Show details

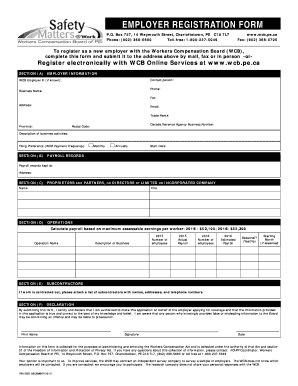

SBI General Insurance Company Limited Call (Toll Free) 1800 22 1111 1800 102 1111 www.sbigeneral.in LONG TERM HOME INSURANCE POLICY Proposal Form FOR OFFICE USE Quote No. Inward No. Receipt No. Receipt

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sbi home insurance form

Edit your 1800 22 1111 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1800221111 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sbi home insurance online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sbi home insurance. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sbi home insurance

How to fill out sbi home insurance:

Gather all necessary documents:

01

Proof of ownership of the property (title deed, lease agreement, etc.)

02

Proof of identification (ID card, passport, etc.)

03

Existing home insurance policy (if applicable)

04

Any relevant documentation related to previous claims

Contact SBI Insurance:

01

Visit the official website of SBI Insurance or call their customer service helpline to initiate the process.

02

Provide the required information to the SBI Insurance representative, such as your personal details and property information.

Choose the appropriate coverage:

01

Discuss your insurance needs with the SBI Insurance representative to determine the coverage options available.

02

Consider factors like property value, location, amenities, and specific risks that need to be covered.

Fill out the application form:

01

Obtain the application form from the SBI Insurance representative or download it from their website.

02

Fill in all the necessary details accurately, including personal information, property details, and desired coverage.

Submit the required documents:

01

Attach all the necessary documents mentioned earlier to your application form.

02

Make sure all documents are clear, legible, and up-to-date.

Review and sign:

01

Carefully review the filled-out application form and all attached documents.

02

Sign the form using your legal signature.

Pay the premium:

01

Determine the premium amount based on the coverage chosen and payment frequency (monthly, annually, etc.).

02

Make the payment through the provided payment options, such as check, online transfer, or debit/credit card.

Who needs sbi home insurance:

Homeowners:

01

Individuals or families who own a residential property, such as a house or apartment, can benefit from sbi home insurance.

02

It provides financial protection against various risks, including fire, theft, natural disasters, and liability.

Renters:

01

Even if you do not own the property, it is essential for renters to consider sbi home insurance.

02

It covers the belongings and personal liabilities of tenants in case of unforeseen events like fire, burglary, or accidents.

Landlords:

01

Property owners who rent out their residences can protect their investment with sbi home insurance.

02

It provides coverage for the structure, loss of rental income, and potential legal liabilities related to the property.

Homebuyers:

01

Individuals in the process of buying a new home or property can benefit from sbi home insurance.

02

Securing insurance beforehand ensures financial protection during the home buying process and immediately after ownership transfer.

Overall, anyone who wants to protect their home, belongings, and financial stability should consider sbi home insurance, regardless of their role or relationship to the property.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find sbi home insurance?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific sbi home insurance and other forms. Find the template you need and change it using powerful tools.

How do I complete sbi home insurance online?

pdfFiller has made filling out and eSigning sbi home insurance easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for the sbi home insurance in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your sbi home insurance in seconds.

What is sbi home insurance?

SBI home insurance is an insurance policy provided by the State Bank of India (SBI) that offers protection to individuals against damages or losses to their homes.

Who is required to file sbi home insurance?

Anyone who owns a home and wants to protect it from potential risks and damages can opt for SBI home insurance.

How to fill out sbi home insurance?

To fill out SBI home insurance, you need to visit the official website of the State Bank of India and follow the steps mentioned in the application process. It usually involves providing personal information, details about the property, and selecting the desired coverage options.

What is the purpose of sbi home insurance?

The purpose of SBI home insurance is to provide financial security to homeowners by covering the damages or losses caused to their homes due to various perils, such as fire, theft, natural disasters, etc.

What information must be reported on sbi home insurance?

The information required to be reported on SBI home insurance includes personal details of the homeowner, property address, property value, details of existing security systems, previous insurance history, and other relevant information as requested in the application form.

Fill out your sbi home insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sbi Home Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.