Get the free OUT OF STATE TRUST ACCOUNT AFFIDAVIT - devcoag coag

Show details

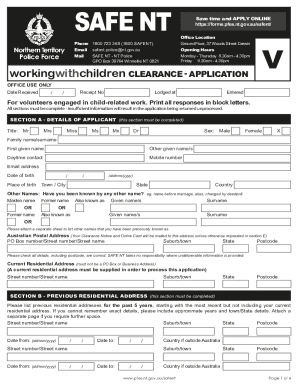

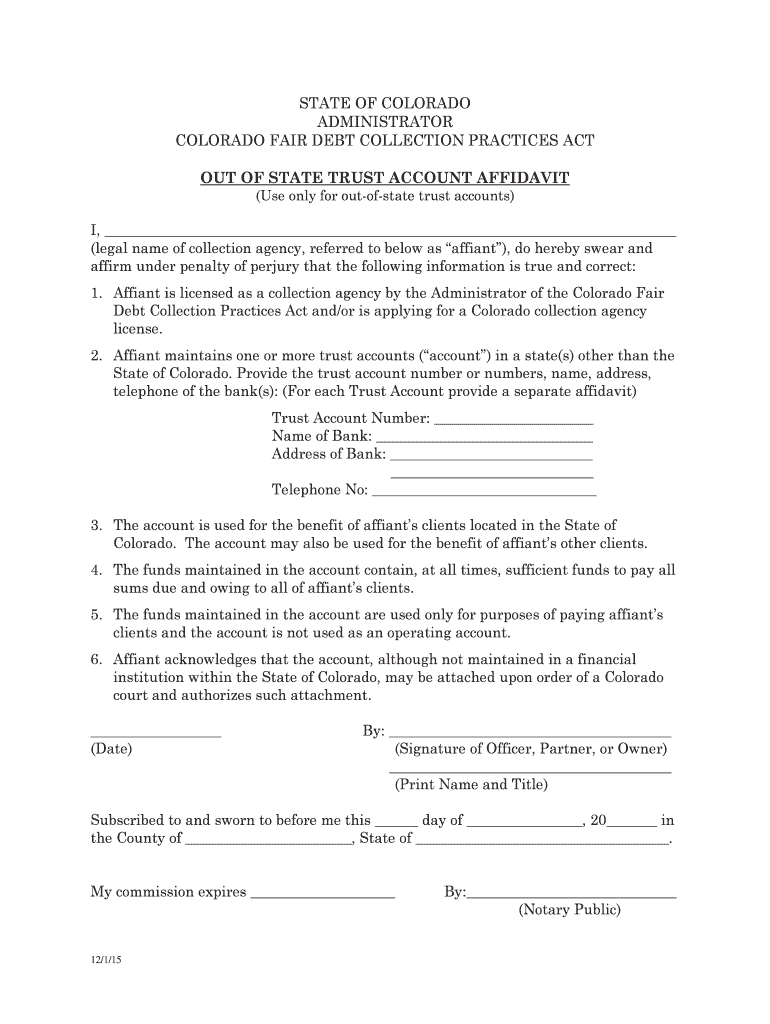

STATE OF COLORADO ADMINISTRATOR COLORADO FAIR DEBT COLLECTION PRACTICES ACT OUT OF STATE TRUST ACCOUNT AFFIDAVIT (Use only for outofstate trust accounts) I, (legal name of collection agency, referred

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign out of state trust

Edit your out of state trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your out of state trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing out of state trust online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit out of state trust. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out out of state trust

How to fill out out of state trust:

01

Research state laws: Start by familiarizing yourself with the laws and requirements regarding trusts in the state where the trust is being formed. Each state has its own regulations and guidelines that need to be followed.

02

Determine the type of trust: Decide what type of trust you want to create. It could be a revocable trust, irrevocable trust, living trust, or any other type that suits your needs.

03

Choose a trustee: Select a trustworthy individual or institution to act as the trustee for your out of state trust. This person or organization will be responsible for managing the trust assets and carrying out your wishes.

04

Draft the trust document: Consult with an attorney who specializes in estate planning to help you draft the trust document. Ensure that all the necessary information is included, such as the names of beneficiaries, the assets being placed in the trust, and any specific instructions or conditions.

05

Sign and notarize the trust document: Once the trust document is drafted, review it carefully and make any necessary changes. Then, sign the document in the presence of a notary public to ensure its legal validity.

06

Fund the trust: Transfer the assets that you want to include in the trust to the trustee. This could include real estate, financial accounts, investments, or any other assets that you wish to protect and pass on to your beneficiaries.

07

Update beneficiaries and document location: Ensure that you provide updated information regarding the trust beneficiaries, as well as the location of the trust document, to your trustee and any other relevant parties.

08

Periodic review and updates: It's important to periodically review and update your out of state trust to reflect any changes in your personal circumstances, such as marriage, divorce, birth of children, or changes in your financial situation. Consult with your attorney to make any necessary adjustments.

Who needs out of state trust?

01

Individuals with properties/assets in different states: If you own properties or assets in multiple states, an out of state trust can help streamline the management and distribution of these assets, ensuring that they are properly accounted for according to the laws of each state.

02

Snowbirds or frequent travelers: If you spend significant time in different states, having an out of state trust can provide peace of mind by ensuring that your assets are protected and managed consistently, regardless of your physical location.

03

Families with beneficiaries in different states: If your beneficiaries are located in different states, an out of state trust can facilitate the distribution of assets, making the process smoother and more efficient.

04

Individuals looking for privacy and asset protection: An out of state trust can provide increased privacy and asset protection by minimizing the risk of probate, as well as protecting assets from potential creditors or lawsuits.

05

Estate planning across state lines: If you have complex estate planning needs that involve multiple states, an out of state trust can be a valuable tool for ensuring that your wishes are carried out appropriately in each jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in out of state trust?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your out of state trust and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I sign the out of state trust electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your out of state trust in seconds.

How can I edit out of state trust on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing out of state trust, you can start right away.

What is out of state trust?

Out of state trust is a trust that is formed and administered outside of the state where the trustee resides.

Who is required to file out of state trust?

Individuals who are residents of a state but have a trust established in another state may be required to file out of state trust.

How to fill out out of state trust?

To fill out out of state trust, individuals must gather information about the trust, including its assets, beneficiaries, and income, and report this information to the appropriate state tax authorities.

What is the purpose of out of state trust?

The purpose of out of state trust is to ensure that individuals with trusts established in other states comply with state tax laws and report any income generated by the trust.

What information must be reported on out of state trust?

Information that must be reported on out of state trust includes details about the trust's assets, income, beneficiaries, and distributions.

Fill out your out of state trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Out Of State Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.