Get the free SALARY REDIRECTION AGREEMENT - simplicityHR

Show details

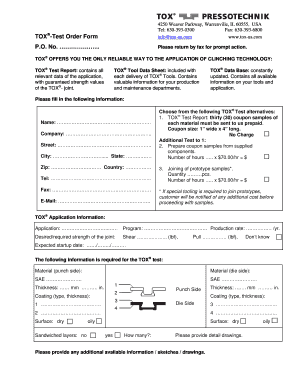

SALARY REDIRECTION AGREEMENT EMPLOYER: EMPLOYER TAX ID NUMBER: AFFILIATE NAME/LOCATION: AFFILIATE TAX ID NUMBER: Flex One FSA? (CHECK ONE) Yes No CAFETERIA PLAN YEAR: / / / / 1 1 15 12 31 15 OPEN

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign salary redirection agreement

Edit your salary redirection agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your salary redirection agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing salary redirection agreement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit salary redirection agreement. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out salary redirection agreement

How to fill out salary redirection agreement:

01

Begin by carefully reviewing the salary redirection agreement form provided by your employer. Make sure you understand all the terms and conditions mentioned in the agreement.

02

Provide your personal information such as full name, address, Social Security Number, and contact details accurately in the designated spaces on the form.

03

Understand the different options available for redirecting your salary. This could include directing a set amount or a percentage of your salary towards retirement savings, healthcare expenses, or other eligible benefits.

04

Consult with your employer's HR department or a financial advisor, if necessary, to understand the potential benefits and tax implications associated with different salary redirection options.

05

Indicate your preferred salary redirection option accurately in the agreement form. This may involve selecting specific benefit plans, retirement accounts, or providers for redirecting your salary.

06

If required, provide any additional documentation or supporting forms, such as beneficiary designation forms for retirement accounts.

07

Review the completed agreement form thoroughly to ensure all the provided information is correct. Make any necessary corrections or adjustments before submitting the form.

08

Sign and date the salary redirection agreement form, confirming that all the information provided is true and accurate to the best of your knowledge.

09

Submit the completed form to your employer or the designated department responsible for processing salary redirection agreements. Retain a copy of the form for your records.

Who needs a salary redirection agreement?

01

Employees who wish to allocate a portion of their salary towards retirement savings.

02

Individuals who want to use salary redirection for healthcare expenses, such as contributing to a health savings account (HSA) or flexible spending account (FSA).

03

Employees who want to redirect their salary towards other eligible benefits, such as life insurance premiums, childcare expenses, or education savings plans.

04

Individuals looking to optimize their tax planning and take advantage of any employer-matching contributions or pre-tax deductions offered through salary redirection.

Note: It is recommended to consult with your employer or a financial advisor to fully understand the options and implications of a salary redirection agreement based on your specific circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit salary redirection agreement online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your salary redirection agreement to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my salary redirection agreement in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your salary redirection agreement and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit salary redirection agreement straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit salary redirection agreement.

What is salary redirection agreement?

A salary redirection agreement is a legal document between an employer and an employee that allows the employee to direct a portion of their salary towards specific benefits or retirement accounts.

Who is required to file salary redirection agreement?

Both the employer and the employee are required to sign and file the salary redirection agreement.

How to fill out salary redirection agreement?

The salary redirection agreement should be filled out with the names of the employer and employee, the amount or percentage of salary to be redirected, and the specific benefits or accounts the salary will be directed towards.

What is the purpose of salary redirection agreement?

The purpose of a salary redirection agreement is to allow employees to save for retirement or other benefits in a tax-efficient manner.

What information must be reported on salary redirection agreement?

The salary redirection agreement must include the names of the employer and employee, the amount or percentage of salary being redirected, and the specific benefits or accounts the salary will be directed towards.

Fill out your salary redirection agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Salary Redirection Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.