Get the free Wills, Trusts & Estates Certification - floridabar

Show details

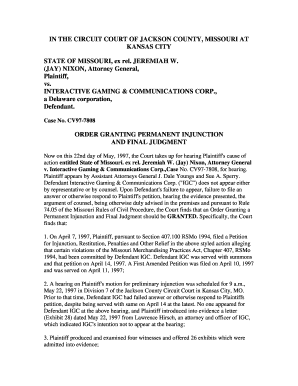

The Florida Bar Continuing Legal Education Committee and the

Real Property, Probate and Trust Law Section present

Wills, Trusts & Estates Certification

Review and Advance Practice Update

COURSE CLASSIFICATION:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wills trusts amp estates

Edit your wills trusts amp estates form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wills trusts amp estates form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wills trusts amp estates online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wills trusts amp estates. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wills trusts amp estates

How to fill out wills trusts amp estates:

01

Gather all necessary documents: Start by collecting all important documents such as property titles, insurance policies, investment statements, and personal identification documents. These will help you accurately assess your assets and liabilities.

02

Choose an executor: Select someone you trust to oversee the distribution of your assets and handle other legal matters after your passing. Discuss your decision with them and ensure they are willing to take on the role.

03

Determine beneficiaries: Make a list of individuals or organizations you wish to include as beneficiaries in your will, trust, or estate plan. Consider specific assets, percentages, or conditions for each beneficiary.

04

Consult with an attorney: Seek the assistance of a skilled attorney specializing in wills, trusts, and estates. They will guide you through the legal process, ensure all necessary documentation is completed correctly, and help minimize potential disputes.

05

Create a will or trust: Decide whether a will or trust suits your needs best. A will is a legal document that specifies how your assets will be distributed upon your death. A trust, on the other hand, can provide more control over the distribution of assets and offer tax benefits.

06

Appoint guardians: If you have minor children, it is crucial to appoint legal guardians who will take care of them in case something happens to you. Discuss your intentions with the individuals you wish to appoint and make sure they are willing to take on this responsibility.

07

Review and update regularly: Life circumstances may change over time, so regularly review and update your wills, trusts, and estate plans as necessary. Births, deaths, marriages, divorces, or significant financial changes are examples of events that might necessitate updates.

Who needs wills trusts amp estates:

01

Individuals with substantial assets: People who possess significant estate values, multiple properties or businesses, and various investments should consider wills, trusts, and estates. These legal tools can help efficiently manage and distribute assets according to their wishes while minimizing potential estate taxes.

02

Parents: Parents with minor children should have wills, trusts, or estate plans in place. These documents can specify who will take care of their children if both parents pass away, as well as how financial assets should be managed for the children's well-being.

03

Blended families: Individuals in blended families should have wills, trusts, and estate plans to ensure clear instructions on how assets should be distributed among their spouse, children from previous relationships, and stepchildren.

04

Business owners: Business owners should consider wills, trusts, and estate plans to address succession planning. These legal arrangements can ensure a smooth transition of the business to a chosen successor or facilitate the sale of the business if desired.

05

Charitable individuals: Those who have a desire to leave a legacy by supporting charitable organizations or causes can utilize wills, trusts, and estate plans to ensure their assets are donated to their preferred charities effectively.

It is always recommended to consult with an attorney specializing in wills, trusts, and estates to ensure that your specific needs and circumstances are appropriately addressed.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit wills trusts amp estates from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including wills trusts amp estates, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send wills trusts amp estates to be eSigned by others?

When your wills trusts amp estates is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I fill out wills trusts amp estates on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your wills trusts amp estates by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is wills trusts amp estates?

Wills trusts amp estates refer to legal documents and arrangements that outline the distribution of a person's assets and belongings after their death.

Who is required to file wills trusts amp estates?

Individuals who have created a will, trust, or estate plan are required to file wills trusts amp estates.

How to fill out wills trusts amp estates?

Wills trusts amp estates can be filled out with the assistance of an attorney or legal advisor who specializes in estate planning.

What is the purpose of wills trusts amp estates?

The purpose of wills trusts amp estates is to ensure that a person's assets are distributed according to their wishes and to provide for the future financial security of their loved ones.

What information must be reported on wills trusts amp estates?

Information such as details of assets, beneficiaries, trustees, and any specific instructions for asset distribution must be reported on wills trusts amp estates.

Fill out your wills trusts amp estates online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wills Trusts Amp Estates is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.