Get the free General Obligation Bonds, Series 2013B

Show details

This document is the official statement regarding the issuance of $91,825,000 General Obligation Bonds, Series 2013B by Administrative School District No. 1 (Bend-La Pine) to finance capital projects

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign general obligation bonds series

Edit your general obligation bonds series form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your general obligation bonds series form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit general obligation bonds series online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit general obligation bonds series. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

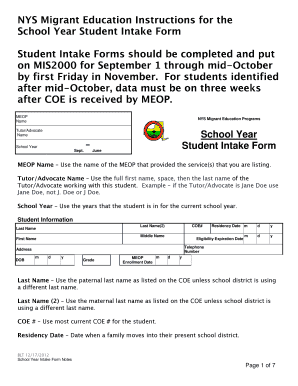

How to fill out general obligation bonds series

How to fill out General Obligation Bonds, Series 2013B

01

Obtain the General Obligation Bonds, Series 2013B application form.

02

Review the eligibility criteria for the bonds to ensure compliance.

03

Provide information about the issuing authority, including its name and purpose.

04

Fill in the required financial data, including budget projections and funding sources.

05

Include detailed information on the projects to be financed by the bonds.

06

Disclose any outstanding debts and existing obligations of the issuing authority.

07

Attach all necessary supporting documentation, such as financial statements and project plans.

08

Sign and date the application form, ensuring all information is accurate.

09

Submit the completed application to the appropriate regulatory body or agency.

Who needs General Obligation Bonds, Series 2013B?

01

Municipalities seeking to finance public projects such as schools, roads, or infrastructure improvements.

02

Government entities looking to raise funds through public investments.

03

Local governments aiming to support community development initiatives.

04

Investors interested in purchasing bonds for steady income and tax-exempt interest.

Fill

form

: Try Risk Free

People Also Ask about

Do general obligation bonds pay interest?

For detailed information about a specific bond, refer to its official statement, which will typically be available on the MSRB's EMMA website. Typically general obligation bonds are issued by a state or local government that pledges its full faith, credit and taxing power to pay principal and interest.

What is the difference between a general obligation bond and a revenue bond?

Munis can generally be classified into two camps — general obligation bonds and revenue bonds. General obligation, or GO, bonds are backed by the general revenue of the issuing municipality, while revenue bonds are supported by a specific revenue source, such as income from a toll road or sewer system.

Are bonds a debt obligation?

A bond is a debt obligation, like an Iou. Investors who buy corporate bonds are lending money to the company issuing the bond. In return, the company makes a legal commitment to pay interest on the principal and, in most cases, to return the principal when the bond comes due, or matures.

What is a general obligation bond?

Definition: General Obligation (GO) bonds are a form of long-term borrowing in which the state issues municipal securities and pledges its full faith and credit to their repayment. Bonds are repaid over many years through semi-annual debt service payments.

What does it mean to issue general obligation bonds?

Definition: General Obligation (GO) bonds are a form of long-term borrowing in which the state issues municipal securities and pledges its full faith and credit to their repayment. Bonds are repaid over many years through semi-annual debt service payments.

Are general obligation bonds good?

Historically, GO bonds were considered more secure than revenue bonds. Because they were considered less risky, they offered lower yields.

What is an example of a general obligation bond?

Examples of the types of projects funded by general obligation bonds are the construction of public schools and highway systems. They are called “general obligation” bonds because they are not backed by a specific revenue producing project or asset. Instead, they are backed by the “full faith and credit” of the issuer.

What is the risk of general obligation bonds?

Both general obligation and revenue bonds share certain investment risks, including, but not limited to, market risk (the risk that prices will fluctuate), credit risk (the possibility that the issuer will not be able to make payments), liquidity risk (muni markets may be illiquid and result in depressed sales prices),

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is General Obligation Bonds, Series 2013B?

General Obligation Bonds, Series 2013B are municipal bonds issued by a government entity, typically to finance public projects, with the repayment obligation backed by the issuing authority's full faith and credit.

Who is required to file General Obligation Bonds, Series 2013B?

Entities that issued the General Obligation Bonds, Series 2013B, usually state or local governments, are required to file relevant documentation and disclosures regarding these bonds.

How to fill out General Obligation Bonds, Series 2013B?

To fill out the form for General Obligation Bonds, Series 2013B, the issuing authority must provide details such as the bond's purpose, interest rate, terms, and any relevant financial disclosures.

What is the purpose of General Obligation Bonds, Series 2013B?

The purpose of General Obligation Bonds, Series 2013B is typically to raise funds for public infrastructure projects or other public needs, such as schools, roads, or public facilities.

What information must be reported on General Obligation Bonds, Series 2013B?

The information reported must include the bond's principal amount, interest rate, maturity date, purpose of issuance, and other financial and legal considerations relevant to the bond.

Fill out your general obligation bonds series online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

General Obligation Bonds Series is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.