Get the free Spouse Contributions - Australian Catholic Superannuation

Show details

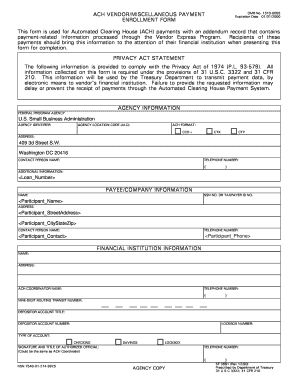

Super Spouse Contributions Use this form to make contributions to Australian Catholic Superannuation on behalf of your spouse. PO Box 656, Bur wood NSW 1805 Simply complete this form using a dark

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign spouse contributions - australian

Edit your spouse contributions - australian form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your spouse contributions - australian form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing spouse contributions - australian online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit spouse contributions - australian. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out spouse contributions - australian

How to fill out spouse contributions - Australian:

01

Obtain the necessary forms: To fill out spouse contributions in Australia, you will need to get the appropriate forms from the Australian Taxation Office (ATO). You can download these forms from their website or request them by mail.

02

Provide personal details: Start by entering your personal details, such as your name, tax file number, and residential address, on the spouse contributions form. It's important to double-check that all the information you provide is accurate and up-to-date.

03

Indicate the financial year: Specify the financial year for which you are making the spouse contributions. The financial year in Australia runs from July 1st to June 30th, so ensure that you select the correct period.

04

Report the amount of spouse contributions made: In this section, you'll need to provide the exact amount of money that you have contributed to your spouse's superannuation during the specified financial year. Superannuation refers to the retirement savings scheme in Australia.

05

Complete the declaration: Towards the end of the form, you will find a declaration section. Read the statements carefully and ensure that you understand them before signing the declaration. By signing, you are affirming that the information you have provided is accurate to the best of your knowledge.

Who needs spouse contributions - Australian?

01

Married individuals: Spouse contributions are relevant for married individuals in Australia who wish to contribute to their spouse's superannuation fund. This can help boost their partner's retirement savings and potentially provide them with certain tax advantages.

02

Couples with a low-income spouse: Spouse contributions can be particularly beneficial for couples where one spouse has a significantly lower income or is not working. By making contributions to their spouse's superannuation, the higher-earning partner can potentially receive a tax offset and help their spouse increase their retirement savings.

03

Individuals seeking tax advantages: Making spouse contributions can offer tax advantages, such as a potential tax offset for the contributing spouse. It's important to consult with a tax professional or financial advisor to understand the specific tax implications and advantages in your situation.

In summary, filling out spouse contributions in Australia involves obtaining the necessary forms, providing personal details, reporting the amount of contributions made, and completing the declaration. Spouse contributions are relevant for married individuals and couples with a low-income spouse who want to boost their partner's retirement savings and potentially benefit from tax advantages.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify spouse contributions - australian without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your spouse contributions - australian into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send spouse contributions - australian to be eSigned by others?

When you're ready to share your spouse contributions - australian, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out spouse contributions - australian on an Android device?

Use the pdfFiller app for Android to finish your spouse contributions - australian. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is spouse contributions - australian?

Spouse contributions in Australia refer to voluntary superannuation contributions made on behalf of a spouse.

Who is required to file spouse contributions - australian?

Spouse contributions in Australia can be made by a spouse on behalf of their partner to boost their superannuation savings.

How to fill out spouse contributions - australian?

To fill out spouse contributions in Australia, individuals can make voluntary contributions to their partner's superannuation fund and claim a tax offset if eligible.

What is the purpose of spouse contributions - australian?

The purpose of spouse contributions in Australia is to help boost the retirement savings of a partner who may have lower incomes or is not working.

What information must be reported on spouse contributions - australian?

When reporting spouse contributions in Australia, individuals must provide details of the contributions made, the recipient spouse's superannuation fund details, and eligibility for any tax offsets.

Fill out your spouse contributions - australian online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Spouse Contributions - Australian is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.