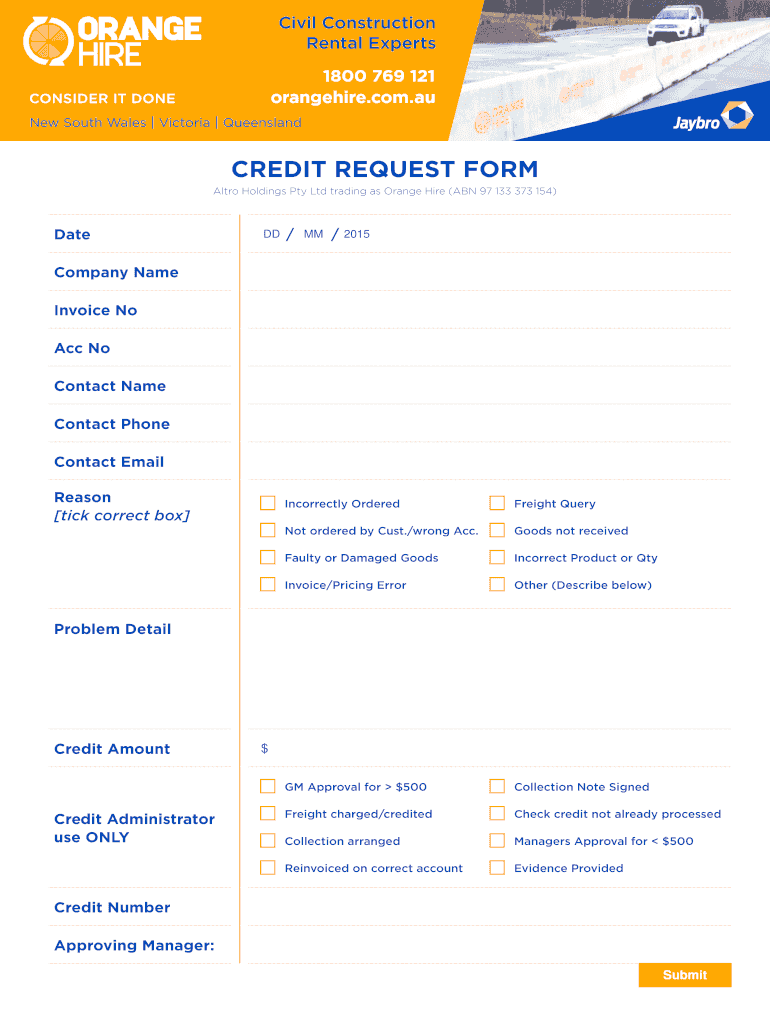

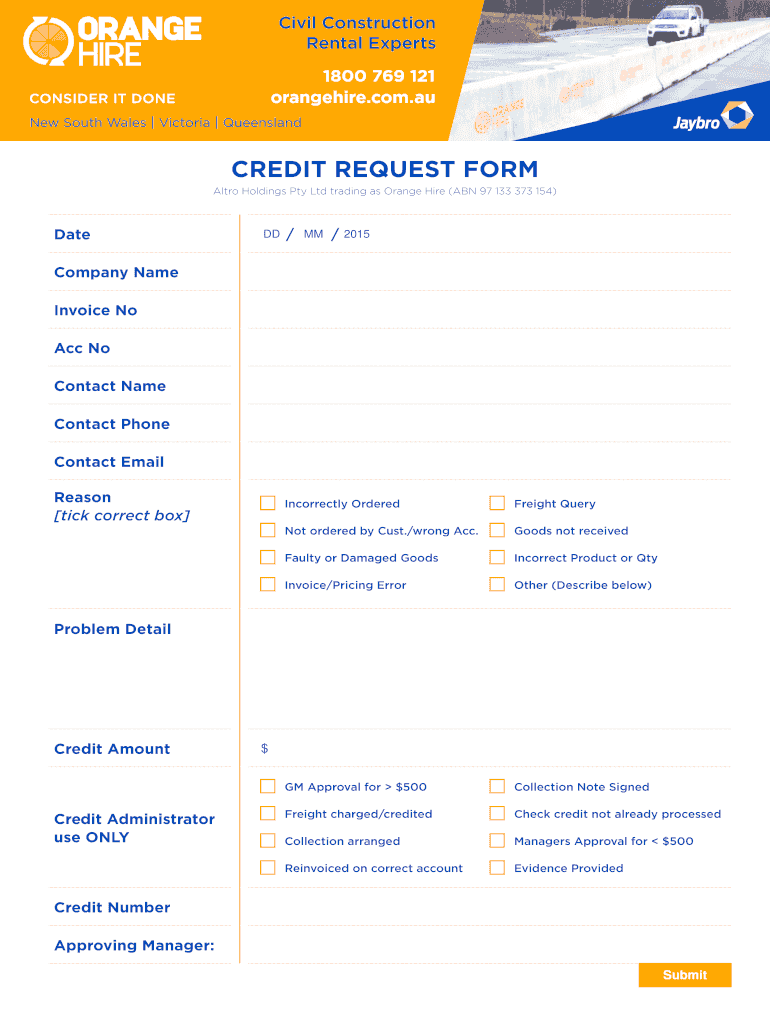

Get the free Credit request form - Orange Hire

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit request form

Edit your credit request form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit request form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit request form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit credit request form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit request form

How to fill out a credit request form?

01

Begin by reading the instructions: Before starting to fill out a credit request form, it is important to carefully read the instructions provided. These instructions will guide you on how to complete the form accurately and efficiently.

02

Provide personal information: The credit request form will typically require you to provide your personal information, such as your full name, contact details, social security number, and date of birth. Make sure to enter this information accurately to avoid any potential discrepancies.

03

Employment and income details: The form may also ask for information regarding your employment status and income sources. You will likely be asked to provide details about your current employer, job position, and monthly or yearly income. Ensure that you provide accurate and up-to-date information to improve your chances of approval.

04

Financial information: The credit request form may require you to disclose certain financial information, such as your current debts, monthly expenses, and assets. It is important to be honest and thorough in providing this information, as it helps lenders assess your financial stability and repayment capability.

05

Specify the requested credit amount: Indicate the specific amount of credit you are requesting on the form. This will allow the lender to evaluate whether the requested amount aligns with their lending criteria and your financial profile.

06

Attach supporting documents: Depending on the lender's requirements, you may be asked to provide additional supporting documents along with the credit request form. These documents may include bank statements, pay stubs, tax returns, or any other relevant financial records.

07

Review and submit the form: Once you have completed all the necessary sections of the credit request form, carefully review the information you have provided to ensure accuracy and completeness. Make any necessary corrections before submitting the form to the lender.

Who needs a credit request form?

01

Individuals seeking a loan: Those who need financial assistance for various purposes, such as purchasing a home, a vehicle, or funding an education, may need to fill out a credit request form. This form is typically required by lenders to evaluate the creditworthiness of the applicant and determine whether they qualify for the requested loan.

02

Small business owners: Entrepreneurs and small business owners often require credit to finance their operations or invest in business growth. They may need to fill out a credit request form to provide lenders with relevant information about their business, financial stability, and repayment ability.

03

Individuals applying for credit cards: When applying for a credit card, individuals are often required to fill out a credit request form. This form allows credit card issuers to assess the applicant's creditworthiness, set a credit limit, and determine the terms and conditions for credit card usage.

04

Individuals seeking financial assistance: Those who require financial assistance due to unexpected circumstances, such as medical emergencies or unexpected expenses, may need to fill out a credit request form to apply for a personal loan. This form helps lenders assess the applicant's ability to repay the loan and determine the terms and interest rates applicable.

05

Existing borrowers seeking credit line increases: Existing borrowers who wish to increase their credit limit or request additional funds may need to fill out a credit request form. This form allows lenders to evaluate the borrower's payment history, credit utilization, and overall financial situation before making a decision on the credit line increase.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit request form to be eSigned by others?

To distribute your credit request form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute credit request form online?

pdfFiller has made it simple to fill out and eSign credit request form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for the credit request form in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your credit request form in seconds.

What is credit request form?

The credit request form is a document used to request credit from a lender or creditor.

Who is required to file credit request form?

Anyone seeking credit from a lender or creditor is required to file a credit request form.

How to fill out credit request form?

To fill out a credit request form, you need to provide personal information, financial details, and the amount of credit you are requesting.

What is the purpose of credit request form?

The purpose of a credit request form is to provide the lender or creditor with all the necessary information to evaluate the borrower's creditworthiness and make a decision on whether or not to grant the credit.

What information must be reported on credit request form?

The credit request form must include personal information, financial details, employment history, credit history, and the amount of credit being requested.

Fill out your credit request form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Request Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.