Get the free Form 843 Motion to Modify Prr Pccc final

Show details

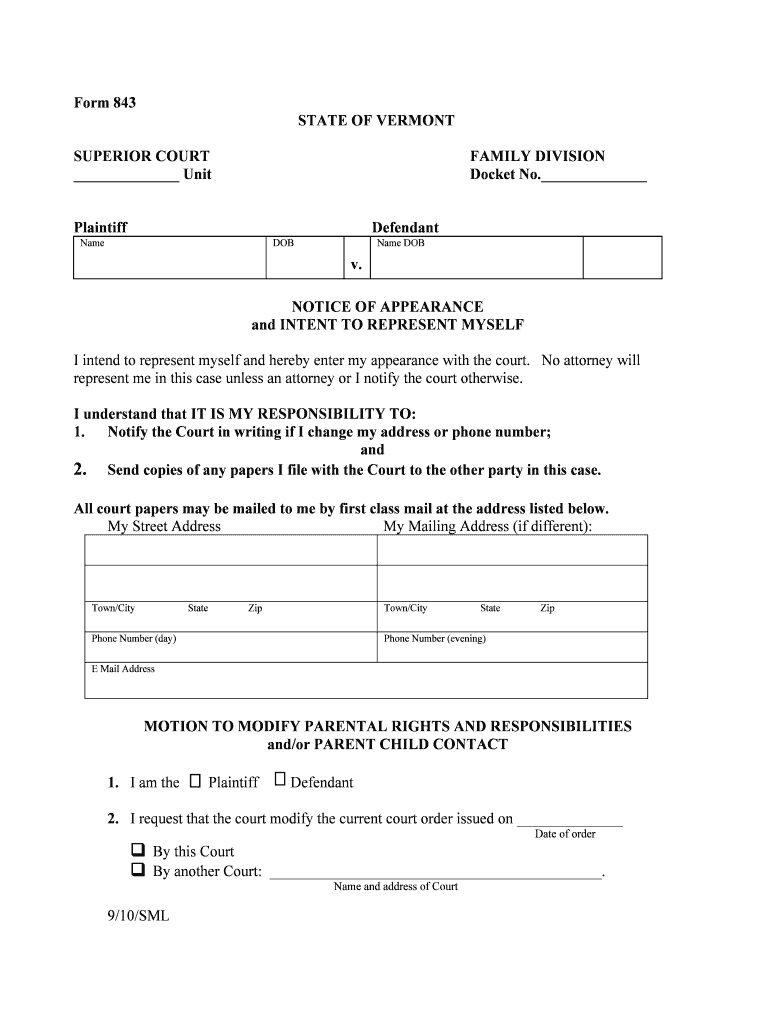

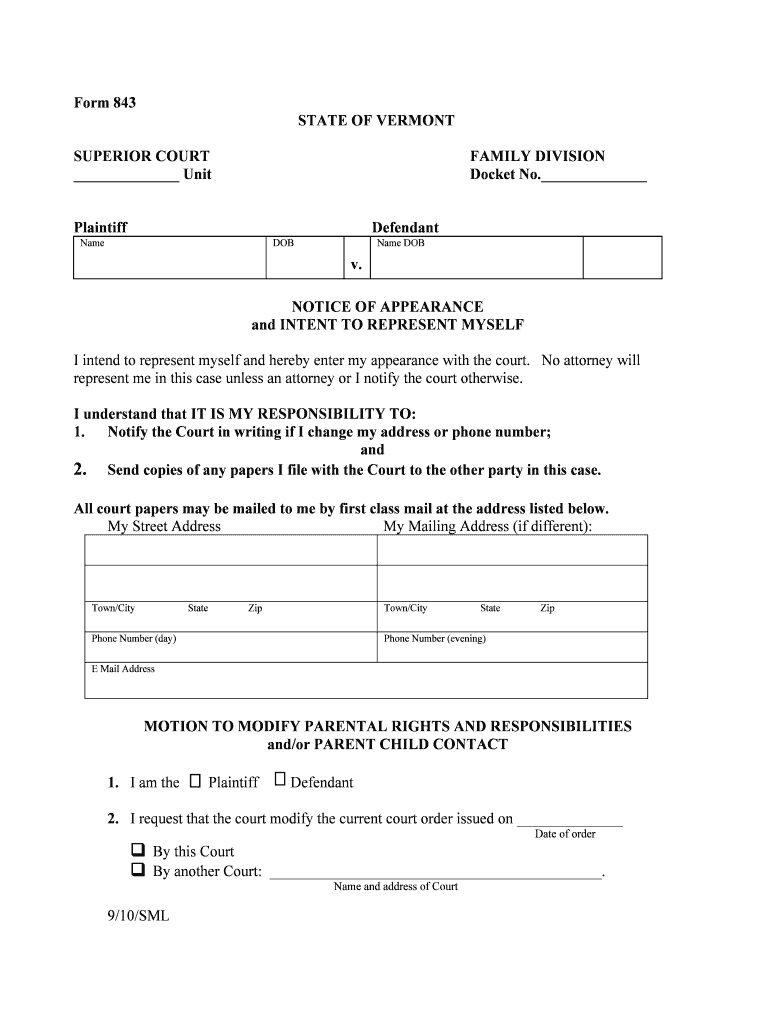

Form 843 STATE OF VERMONT SUPERIOR COURT Unit FAMILY DIVISION Docket No. Plaintiff Name Defendant Name DOB v. NOTICE OF APPEARANCE and INTENT TO REPRESENT MYSELF I intend to represent myself and hereby

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 843 motion to

Edit your form 843 motion to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 843 motion to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 843 motion to online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 843 motion to. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 843 motion to

How to fill out form 843 motion to:

01

Begin by carefully reading the instructions provided with the form. This will give you a clear understanding of what information needs to be included and how to correctly fill out the form.

02

Start by providing your personal information, such as your full name, address, and contact details. Make sure to double-check the accuracy of the information entered.

03

Identify the tax period or periods for which you are seeking a refund or abatement. This could be for a specific year or a range of years, depending on your circumstances.

04

Clearly state the reason for your request in the space provided. Be concise and provide supporting documentation if necessary. Make sure to explain why you believe you are entitled to a refund or abatement.

05

If applicable, indicate any specific tax laws or regulations that support your claim. This can help strengthen your case and increase the likelihood of a favorable outcome.

06

Include any supporting documentation that substantiates your claim. This may include copies of tax returns, invoices, receipts, or any other relevant documents. Make sure to organize these documents in a clear and logical manner.

07

Review the completed form for accuracy and ensure that all required fields have been filled out. Make any necessary corrections or additions before submitting the form.

08

Make copies of the completed form and all supporting documents for your records. It's always a good idea to have a copy of everything submitted for future reference.

09

Submit the form and any required attachments to the appropriate tax authority. Follow any specific instructions provided for submission, such as mailing address or online submission portal.

Who needs form 843 motion to:

01

Individuals who believe they have overpaid their taxes and are seeking a refund.

02

Businesses or organizations that have paid taxes that they believe were not owed or were overpaid.

03

Individuals or businesses seeking an abatement or reduction of penalties, interest, or any additional amount assessed by the tax authority.

04

Taxpayers who have encountered errors or mistakes made by the tax authority and are seeking correction.

It's important to consult with a tax professional or seek legal advice to ensure the proper completion and submission of form 843 motion to.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 843 motion to to be eSigned by others?

To distribute your form 843 motion to, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete form 843 motion to online?

pdfFiller has made it easy to fill out and sign form 843 motion to. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I complete form 843 motion to on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your form 843 motion to from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is form 843 motion to?

Form 843 is used for claiming a refund or requesting an abatement of certain types of taxes, interest, penalties, and additions to tax.

Who is required to file form 843 motion to?

Taxpayers who believe they are entitled to a refund or abatement of certain taxes, interest, penalties, or additions to tax.

How to fill out form 843 motion to?

Form 843 must be filled out completely and accurately, providing all the necessary information and supporting documentation.

What is the purpose of form 843 motion to?

The purpose of form 843 is to claim a refund or request an abatement of certain tax liabilities.

What information must be reported on form 843 motion to?

Form 843 requires information about the taxpayer, the tax period, the type of tax, the amount being claimed, and the reason for the claim.

Fill out your form 843 motion to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 843 Motion To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.