Get the free Form 29B

Show details

This document reports changes in the substantial shareholder interest of Genting Malaysia Berhad as required under the Companies Act 1965, detailing acquisitions, transactions, and interests related

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 29b

Edit your form 29b form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 29b form via URL. You can also download, print, or export forms to your preferred cloud storage service.

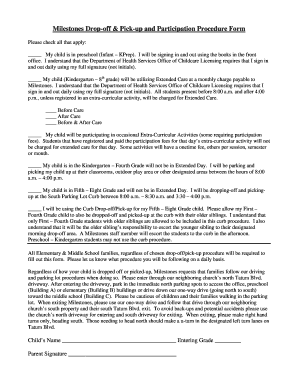

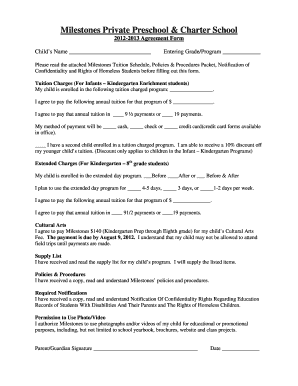

Editing form 29b online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 29b. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 29b

How to fill out Form 29B

01

Obtain Form 29B from the relevant authority or agency.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal details in the designated sections including your name, address, and contact information.

04

Provide accurate information about the vehicle, such as make, model, and registration number.

05

Specify the reason for filling out the form, such as transfer of ownership or request for duplication.

06

Ensure all required fields are completed and no information is left blank.

07

Review the completed form for accuracy before submission.

08

Submit the form to the designated office along with any required documents and fees.

Who needs Form 29B?

01

Individuals looking to transfer ownership of a vehicle.

02

Owners requesting a duplicate registration certificate.

03

Persons updating vehicle information with the relevant agency.

Fill

form

: Try Risk Free

People Also Ask about

Who needs to file form 29B?

Form 29B Applicability Every Company where the income is less than 15% of the book profit is required to obtain a report from a Chartered Accountant in Form 29B.

What is the penalty for not filing Form 29B?

Form 29B is to be filed online on Income Tax Portal. According to section 271B of the Income Tax Act, the penalty for late filing of Form 29B is Rs. 1,50,000 or 0.5% of the total sales, turnover or gross receipts of the business, whichever is lower.

Who is required to file form 3CEB?

Applicability of Form 3CEB Regardless of the value of international transactions, businesses are required to file this form. However, for domestic transactions, filing is mandated only if the value exceeds Rs. 20 crore in a fiscal year.

How to download 29B?

Visit the Income Tax's official site and enter your User ID and Password to log in. Select E-file > Income Tax Forms > File Income Tax Forms on the Dashboard. Choose Form 29B from the form tiles. This form is used to certify the book profits of your company as per Section 115JB of the Income Tax Act.

How to accept form 29B online?

Step 1: Log in to the e-Filing portal using your user ID and password. Step 2: On your Dashboard, click Pending Actions > Worklist. Step 3: Click Accept or Reject the request for filing Form 29B.

Who needs to file an income tax return in India?

If your taxable income exceeds Rs. 5 lakh in a financial year or you have paid advance tax, you also need to file an ITR. When filing tax returns, you also have to pay your due taxes as decided by your applicable income tax slabs.

How to claim mat credit?

As per section 115JAA, if in any year a company pays its tax liability as per MAT, then it can claim MAT credit being the excess MAT paid over the normal tax liability. In this case, as the liability of MAT is higher, and, hence, the company will be entitled to claim MAT credit of Rs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 29B?

Form 29B is a legal document used in India for the transfer of ownership of a vehicle, specifically for the registration of vehicles that are no longer under the ownership of the dealer.

Who is required to file Form 29B?

Form 29B must be filed by the registered owner of the vehicle when they sell or transfer the vehicle to another individual or entity, as part of the vehicle registration transfer process.

How to fill out Form 29B?

To fill out Form 29B, the seller must provide details such as the vehicle registration number, chassis number, engine number, the name and address of the buyer, and other relevant information. The form should be signed by the seller and submitted to the appropriate authority.

What is the purpose of Form 29B?

The purpose of Form 29B is to officially document the transfer of ownership of a vehicle from the seller to the buyer, ensuring that the buyer can register the vehicle in their name and that the seller is no longer held responsible for the vehicle.

What information must be reported on Form 29B?

Form 29B requires reporting of information such as the vehicle model, registration number, the name and address of both the seller and buyer, chassis number, engine number, and the date of transfer.

Fill out your form 29b online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 29b is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.