Get the free AUTOMATIC CONTRIBUTION AUTHORIZATION

Show details

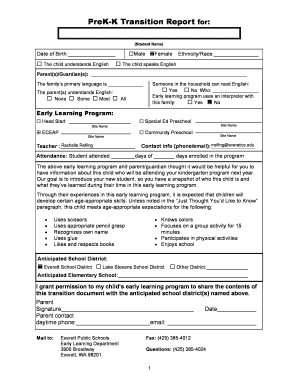

This document authorizes Security Bank to debit a contributor's checking or savings account for regular contributions to Trinity Lutheran Church, including instructions about cancellation and changes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign automatic contribution authorization

Edit your automatic contribution authorization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your automatic contribution authorization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing automatic contribution authorization online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit automatic contribution authorization. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out automatic contribution authorization

How to fill out AUTOMATIC CONTRIBUTION AUTHORIZATION

01

Obtain the AUTOMATIC CONTRIBUTION AUTHORIZATION form from your employer or the designated financial institution.

02

Carefully read the instructions provided with the form to ensure you understand the process.

03

Fill in your personal information, including your name, address, and Social Security number.

04

Specify the contribution amount you wish to authorize and the frequency of these contributions (e.g., weekly, monthly).

05

Provide the necessary banking information, including your bank account number and routing number if applicable.

06

Sign and date the form to validate your authorization.

07

Submit the completed form to the appropriate department or individual as instructed.

Who needs AUTOMATIC CONTRIBUTION AUTHORIZATION?

01

Employees who wish to have regular contributions deducted from their paycheck.

02

Individuals looking to set up automatic contributions to a retirement account, savings plan, or investment account.

03

Anyone participating in a workplace benefits program that includes automatic contribution options.

Fill

form

: Try Risk Free

People Also Ask about

What is EACA and QACA?

An EACA can allow automatically enrolled participants to withdraw their contributions within 30 to 90 days of the first contribution. A qualified automatic contribution arrangement (QACA) is a type of automatic enrollment 401(k) plan that automatically passes certain kinds of annual required testing.

How does automatic enrollment work?

This is called 'automatic enrolment'. Your employer must automatically enrol you into a pension scheme and make contributions to your pension if all of the following apply: you're classed as a 'worker' you're aged between 22 and State Pension age.

What is an automatic Roth contribution?

Some 401(k) plans permit automatic Roth conversions, allowing you to make after-tax contributions that automatically convert to Roth within your accounts. A mega backdoor Roth IRA conversion takes advantage of the IRS's total 401(k) contribution limit.

What is the difference between safe harbor and Qaca?

QACA safe harbor plans A QACA safe harbor plan differs from a traditional safe harbor plan in that it must include both automatic enrollment and automatic escalation regardless of the date of establishment or if they meet an exception to the MAP requirements under the SECURE 2.0 Act.

What is automatic contribution?

Automatic contribution arrangements allow employers to "enroll" eligible employees in the retirement plan automatically unless the employee affirmatively elects not to participate.

What are the advantages of automatic contribution increase?

Auto-enrollment removes the need for employees to take the initiative. Automatic contribution escalation. This helps employees save more over time by automatically increasing their contribution rates annually. However, it relies on employees being enrolled in the plan in the first place.

How does EACA work?

Eligible automatic contribution arrangements (EACAs) establish a default percentage of an employee's pay to be automatically contributed to a retirement account. EACAs apply when employees do not provide explicit instructions regarding pretax contributions to a qualified retirement account provided by an employer.

What is an automatic contribution?

Automatic contribution arrangements allow employers to "enroll" eligible employees in the retirement plan automatically unless the employee affirmatively elects not to participate. "Enroll" means that the employer contributes part of the employee's wages to the retirement plan on the employee's behalf.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is AUTOMATIC CONTRIBUTION AUTHORIZATION?

AUTOMATIC CONTRIBUTION AUTHORIZATION is a process that allows employees to authorize automatic deductions from their salary for contributions, typically to retirement plans or savings accounts.

Who is required to file AUTOMATIC CONTRIBUTION AUTHORIZATION?

Employees who wish to participate in automatic contribution plans offered by their employers are required to file AUTOMATIC CONTRIBUTION AUTHORIZATION.

How to fill out AUTOMATIC CONTRIBUTION AUTHORIZATION?

To fill out AUTOMATIC CONTRIBUTION AUTHORIZATION, employees typically need to provide personal details, select the amount or percentage to be deducted, and sign the form to authorize the deductions.

What is the purpose of AUTOMATIC CONTRIBUTION AUTHORIZATION?

The purpose of AUTOMATIC CONTRIBUTION AUTHORIZATION is to facilitate saving and retirement planning by enabling employees to automatically contribute a portion of their earnings without having to manually manage the transactions.

What information must be reported on AUTOMATIC CONTRIBUTION AUTHORIZATION?

Information that must be reported includes the employee's name, employee identification number, the contribution amount or percentage, the frequency of contributions, and any relevant account information for where the funds will be directed.

Fill out your automatic contribution authorization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Automatic Contribution Authorization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.