Get the free Payroll Adjustment Process

Show details

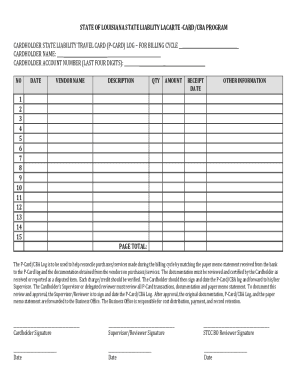

Payroll Adjustment Process AllPayrollAdjustmentsmustincludesufficientdocumentationdescribingwhytheadjustment(s)visaing submitted. Payrolladjustmentsshouldnotbesubmittedasaroutinecourseofbusiness.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payroll adjustment process

Edit your payroll adjustment process form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll adjustment process form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payroll adjustment process online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit payroll adjustment process. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payroll adjustment process

How to fill out a payroll adjustment process:

01

Gather necessary information: Collect all relevant data needed for the payroll adjustment, such as employee details, current payroll records, and specific adjustments to be made.

02

Review and understand company policies: Familiarize yourself with the company's policies and procedures regarding payroll adjustments to ensure compliance and accuracy.

03

Determine the reason for the adjustment: Identify the reason for the payroll adjustment, whether it be a correction of an error, retroactive pay, changes in employee deductions, or any other applicable situations.

04

Calculate the adjustments: Use the gathered information and any relevant documentation to calculate the precise adjustments required. This may involve recalculating wages, taxes, deductions, or any other relevant payroll components.

05

Document the adjustments: Create clear and detailed documentation of the payroll adjustments made. This includes noting the reason for the adjustment, the specific changes made, and the affected time period.

06

Double-check for accuracy: Verify all calculations and ensure that the adjustments accurately reflect the intended changes. Mistakes in payroll adjustments can lead to discrepancies and potential issues with employees' pay.

07

Seek necessary approvals: Depending on the company's internal processes, you may need to seek approvals, such as from a supervisor or the payroll department, before finalizing the adjustments.

08

Implement the adjustments: Apply the calculated adjustments to the affected payroll records or systems. This may involve updating employee records, making changes in the payroll software, or any other relevant actions.

09

Communicate with relevant parties: If the payroll adjustments affect employees, communicate the changes to them in a clear and concise manner. Provide any necessary explanations or clarifications and address any concerns they may have.

Who needs a payroll adjustment process?

01

Employers and HR professionals: They need a payroll adjustment process to ensure accurate and timely adjustments to employee pay when necessary. This helps maintain employee satisfaction and adherence to legal and regulatory requirements.

02

Employees: A payroll adjustment process is needed to ensure employees receive accurate and fair compensation. It allows them to correct errors, address retroactive payments, and make necessary adjustments to their payroll records.

03

Accounting and finance departments: These departments rely on a well-defined payroll adjustment process to maintain accurate financial records and ensure compliance with accounting standards. Payroll adjustments directly impact financial statements and must be accounted for correctly.

04

Auditors and regulators: A payroll adjustment process is crucial for audits and regulatory compliance. Auditors rely on accurate payroll records and adjustments to assess a company's financial integrity and ensure compliance with applicable laws and regulations.

05

Payroll software providers: Companies that offer payroll software services need a payroll adjustment process to provide their clients with effective tools and solutions. A streamlined process ensures accurate calculations, easy adjustments, and overall client satisfaction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit payroll adjustment process from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your payroll adjustment process into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I sign the payroll adjustment process electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your payroll adjustment process in seconds.

How do I edit payroll adjustment process on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign payroll adjustment process on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is payroll adjustment process?

Payroll adjustment process refers to the process of making changes to an employee's compensation or benefits.

Who is required to file payroll adjustment process?

Employers are required to file payroll adjustment processes for their employees.

How to fill out payroll adjustment process?

Payroll adjustment processes can be filled out by using the designated form provided by the employer or payroll department.

What is the purpose of payroll adjustment process?

The purpose of payroll adjustment process is to ensure that employees are compensated correctly and all necessary adjustments are made.

What information must be reported on payroll adjustment process?

Information such as the employee's name, employee ID, changes in compensation or benefits, effective date of the changes, and reason for adjustment must be reported on payroll adjustment process.

Fill out your payroll adjustment process online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Adjustment Process is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.