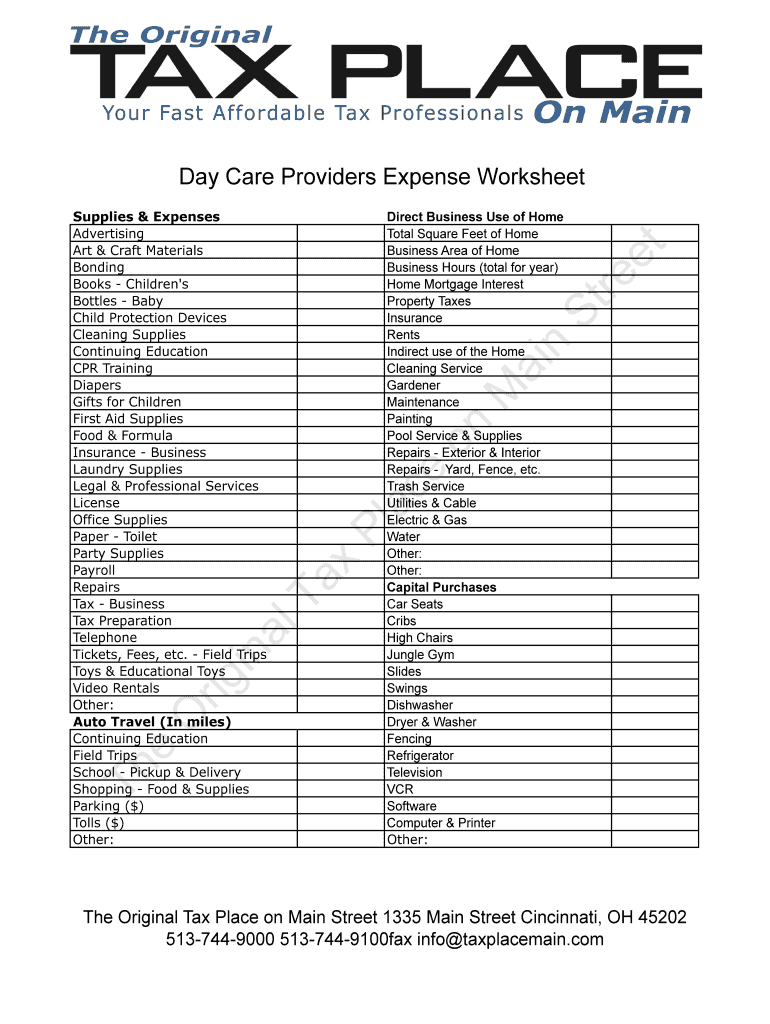

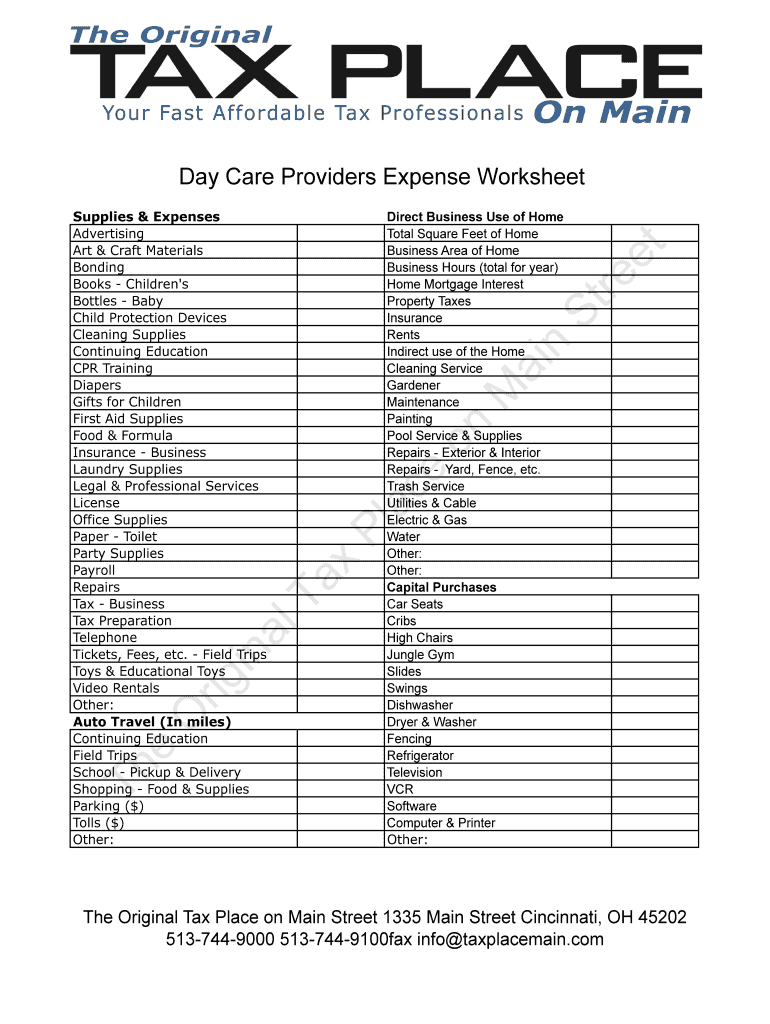

Get the free Day Care Providers Expense Worksheet - The Original Tax

Show details

TheOriginaceonMainSt redirect Business Use of Home Total Square Feet of Home Business Area of Home Business Hours (total for year) Home Mortgage Interest Property Taxes Insurance Rents Indirect use

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign day care providers expense

Edit your day care providers expense form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your day care providers expense form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit day care providers expense online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit day care providers expense. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out day care providers expense

How to fill out day care providers expense:

01

Gather all necessary information: Start by collecting all relevant financial records, such as receipts, invoices, and payment records. These will be crucial for accurately filling out the expense report.

02

Identify the expense categories: Categorize the expenses into different categories, such as supplies, food, utilities, transportation, and staff salaries. This will help in tracking and organizing expenses effectively.

03

Calculate total expenses: Add up all the expenses in each category to find the total amount spent during the reporting period. This will give an overview of the overall expenditure.

04

Record income and reimbursement: Note down any income received from parents or reimbursement received from government assistance programs. Include this information separately in the expense report.

05

Break down expenses by child: If you are a multi-child care provider, it may be beneficial to allocate the expenses based on individual children. This can help ensure accurate reporting for each child's expenses.

06

Fill out the expense report: Use a spreadsheet software or accounting software to fill out the expense report. Input all the relevant information, including expense categories, amounts, dates, and any additional notes required.

07

Review and double-check: Before submitting the expense report, review all the entries to ensure accuracy and completeness. Double-check calculations and cross-reference with supporting documents to avoid any errors or discrepancies.

08

Submit the expense report: Once you are confident that the expense report is accurate, submit it to the appropriate authority. This could be a parent, a government agency, or any other organization that requires this information.

Who needs day care providers expense:

01

Parents: Day care providers' expense reports are typically required by parents to track their child's expenses and calculate their annual childcare tax credits or deductions.

02

Government agencies: Some government assistance programs require day care providers to submit expense reports to receive reimbursement or subsidy payments.

03

Licensing authorities: Day care providers may need to submit expense reports to licensing authorities as part of their ongoing compliance and audit processes. These reports help ensure that the provider is utilizing the funds appropriately and maintaining financial transparency.

04

Accountants or tax professionals: Day care providers may consult accountants or tax professionals who require the expense reports to correctly manage the provider's financial records and prepare tax returns.

Overall, filling out day care providers' expense reports requires careful organization, attention to detail, and adherence to any specific reporting requirements put forth by parents, government agencies, or licensing authorities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute day care providers expense online?

Completing and signing day care providers expense online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an eSignature for the day care providers expense in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your day care providers expense and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out day care providers expense using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign day care providers expense and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is day care providers expense?

Day care providers expense refers to the costs incurred by individuals or organizations who provide day care services for children.

Who is required to file day care providers expense?

Day care providers are required to file their expenses if they want to claim them as deductions on their taxes.

How to fill out day care providers expense?

To fill out day care providers expenses, you need to gather all receipts and invoices related to the expenses, categorize them accordingly, and report the total amount on the appropriate tax form.

What is the purpose of day care providers expense?

The purpose of day care providers expense is to track and report the costs associated with providing day care services, and potentially claim them as deductions on taxes.

What information must be reported on day care providers expense?

Information that must be reported on day care providers expense includes the total amount spent on supplies, rent, utilities, and other expenses directly related to providing day care services.

Fill out your day care providers expense online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Day Care Providers Expense is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.