Get the free 3 Gross Monthly Income Use pre-tax income

Show details

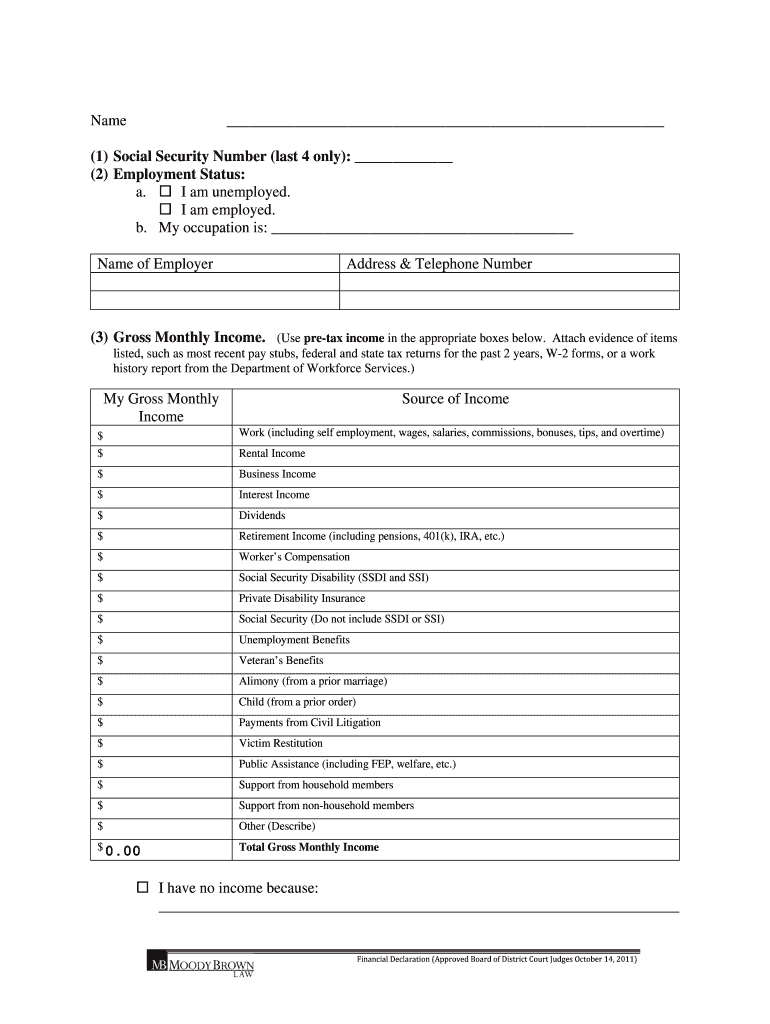

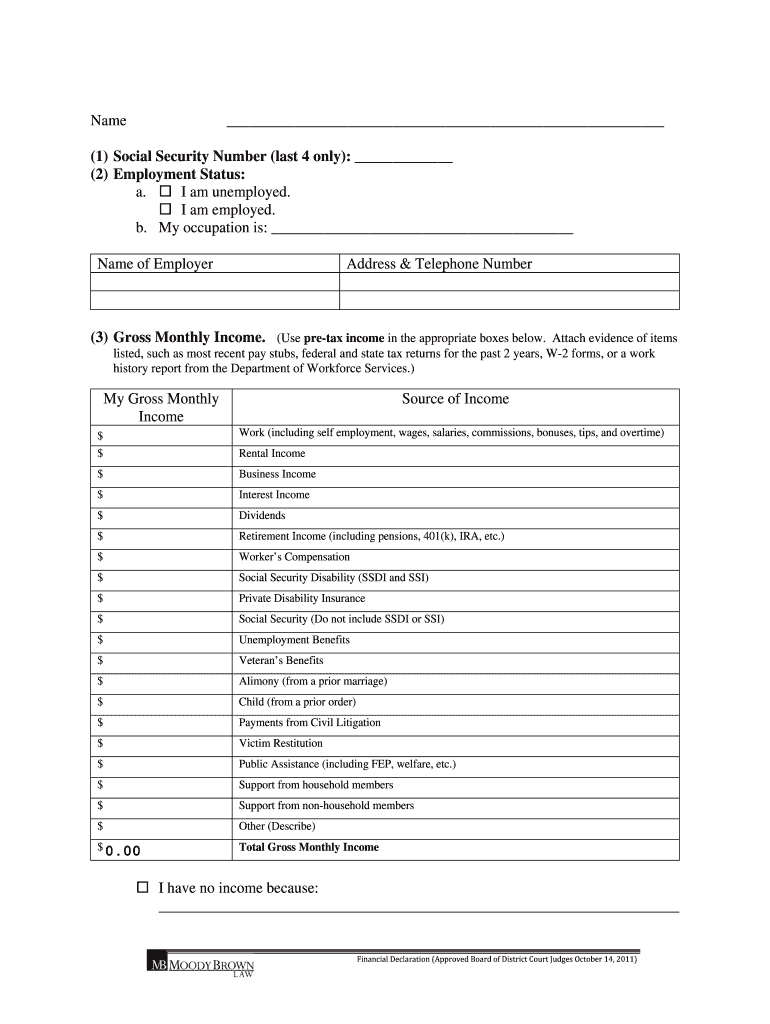

Name (1) Social Security Number (last 4 only): (2) Employment Status: a. I am unemployed. I am employed. b. My occupation is: Name of Employer Address & Telephone Number (3) Gross Monthly Income.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 3 gross monthly income

Edit your 3 gross monthly income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 3 gross monthly income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 3 gross monthly income online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 3 gross monthly income. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 3 gross monthly income

How to Fill Out 3 Gross Monthly Income:

01

Gather necessary information: Collect all relevant financial documents, such as paystubs, tax returns, and any other sources of income. Make sure you have accurate and up-to-date information regarding your earnings.

02

Calculate total monthly income: Add up all your sources of income, including wages, salaries, bonuses, commissions, rental income, etc. This will give you your gross monthly income before any deductions or taxes are applied.

03

Subtract any pre-tax deductions: Some individuals may have pre-tax deductions, such as retirement contributions or health insurance premiums. Subtract these deductions from your total monthly income to determine your adjusted gross monthly income.

04

Consider additional income sources: If you have any additional sources of income, such as investments or side gigs, make sure to include them in your calculations. These additional earnings can significantly impact your overall gross monthly income.

05

Account for irregular income: If your income varies from month to month, due to factors like commission-based work or seasonal employment, calculate an average income based on your previous months' earnings. This will provide a more accurate representation of your gross monthly income.

06

Review and verify: Double-check all the calculations and figures to ensure accuracy. Mistakes in reporting income can have significant consequences, so it's crucial to be thorough in this step.

Who Needs 3 Gross Monthly Income:

01

Job seekers: When applying for a new job, employers often request information on your income. Providing your gross monthly income can help employers gauge your financial stability and determine fair compensation for the position.

02

Lenders or creditors: When applying for a loan or credit, financial institutions often require details about your income. Supplying your gross monthly income gives lenders a clearer picture of your ability to repay the borrowed amount.

03

Budgeting and financial planning: Knowing your gross monthly income is essential for creating an effective budgeting strategy. It helps individuals understand their income-to-expenses ratio and make informed financial decisions.

04

Tax purposes: Gross monthly income is necessary for filing income taxes accurately. It determines your tax bracket and affects the amount of taxes owed or refunded at the end of the year.

05

Government assistance programs: Some government assistance programs require applicants to disclose their gross monthly income to determine eligibility. By providing this information, individuals can access various benefits and support systems.

In conclusion, filling out the 3 gross monthly income involves gathering and calculating all relevant sources of income, subtracting any pre-tax deductions, considering additional income sources, and accounting for irregular income. It is crucial for job seekers, lenders, budgeting purposes, tax filing, and eligibility for certain government assistance programs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 3 gross monthly income to be eSigned by others?

Once your 3 gross monthly income is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for signing my 3 gross monthly income in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your 3 gross monthly income right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I fill out 3 gross monthly income on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your 3 gross monthly income, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is 3 gross monthly income?

3 gross monthly income is the total income earned before deductions and taxes are applied for a period of three months.

Who is required to file 3 gross monthly income?

Individuals or businesses who need to report their total income for a three-month period may be required to file 3 gross monthly income.

How to fill out 3 gross monthly income?

To fill out 3 gross monthly income, you need to list all sources of income for the three-month period and calculate the total amount before any deductions or taxes are applied.

What is the purpose of 3 gross monthly income?

The purpose of 3 gross monthly income is to provide a clear snapshot of total income earned over a three-month period for reporting and tax purposes.

What information must be reported on 3 gross monthly income?

All sources of income, including salaries, bonuses, dividends, and any other earnings, must be reported on 3 gross monthly income.

Fill out your 3 gross monthly income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

3 Gross Monthly Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.