Get the free United of Omaha Medicare Supplement Insurance Policy

Show details

Este documento proporciona información sobre la póliza de suplemento de Medicare de United of Omaha y describe cómo ayuda a cubrir ciertos gastos elegibles que no son pagados por Medicare Part

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign united of omaha medicare

Edit your united of omaha medicare form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your united of omaha medicare form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing united of omaha medicare online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit united of omaha medicare. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out united of omaha medicare

How to fill out United of Omaha Medicare Supplement Insurance Policy

01

Gather necessary personal information: You'll need your Medicare card, Social Security number, and relevant health information.

02

Choose the appropriate Medicare Supplement plan: Review the different plans offered by United of Omaha and select the one that best fits your needs.

03

Obtain an application form: You can get this from United of Omaha's website or by contacting their customer service.

04

Complete the application: Fill in all required personal and health information accurately on the form.

05

Review the application: Double-check all details to ensure accuracy before submission.

06

Submit the application: Send the completed form to United of Omaha through the specified method (online, mail, etc.).

07

Wait for confirmation: Once submitted, you'll receive a confirmation from United of Omaha about your policy acceptance or any additional steps needed.

Who needs United of Omaha Medicare Supplement Insurance Policy?

01

Individuals enrolled in Medicare who want additional coverage for healthcare costs not covered by Medicare alone.

02

Seniors who have frequent medical needs and want to limit their out-of-pocket expenses.

03

People who prefer the flexibility to choose their healthcare providers without network restrictions.

Fill

form

: Try Risk Free

People Also Ask about

How good is Mutual of Omaha supplemental insurance?

It's one of the companies I'd recommend most for 2025. Stand-out features include very low complaint rates and strong premium discounts. However, Mutual of Omaha offers few plan types and extra perks. All told, it's worth considering Mutual of Omaha alongside quotes from a couple of other companies.

What is the best insurance company for Medicare Supplement plans?

Here are NerdWallet's picks for the top five companies for Medicare Supplement plans for 2025. Best overall: AARP/UnitedHealthcare. Best for premium discounts: Mutual of Omaha. Best for member satisfaction: State Farm. Best for low prices: Wellabe. Best for extra benefits: Anthem.

What is the highest rated medicare supplement company?

Best overall: AARP/UnitedHealthcare AARP Medicare Supplement Insurance from UnitedHealthcare has low complaint rates when compared with most competitors. Some plans have several variations with different prices, wellness extras and/or network restrictions, which could make choosing a plan confusing.

Is Mutual of Omaha a good Medicare Supplement insurance?

The scoring formula takes into account pricing, coverage options, online quote availability, complaint data and more. Based on these ratings, Mutual of Omaha Medicare Supplement Insurance is one of the highest rated options on our list of the best Medicare Supplement Insurance companies.

What does Mutual of Omaha Medicare Supplement Plan G cover?

Mutual of Omaha Medicare supplement Plan G covers Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up, Part B coinsurance or copayments, the first three pints of blood, Part A hospice care coinsurance or copayments, skilled nursing facility care coinsurance, the Part A

Is United of Omaha Life Insurance the same as Mutual of Omaha?

Mutual of Omaha's subsidiaries United of Omaha® offers a diversified portfolio of life insurance, fixed annuities, medicare supplement and other insurance and financial services products through Mutual of Omaha's agency sales force, group sales offices and independent agent networks.

Is Mutual of Omaha trustworthy?

Mutual of Omaha ranked No. 6 out of 21 companies in J.D. Power's 2024 U.S. Life Insurance Study for overall customer satisfaction [1] .

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

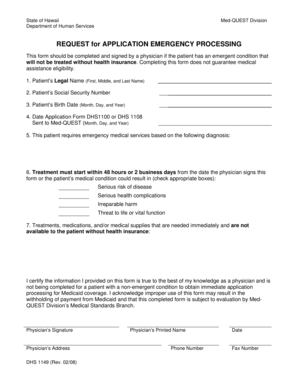

What is United of Omaha Medicare Supplement Insurance Policy?

United of Omaha Medicare Supplement Insurance Policy is a type of private health insurance designed to cover costs not fully covered by Medicare, such as deductibles, copayments, and coinsurance.

Who is required to file United of Omaha Medicare Supplement Insurance Policy?

Individuals who want to enroll in a Medicare Supplement plan from United of Omaha are required to file the policy. This typically includes seniors aged 65 and older who are enrolled in Medicare Part A and Part B.

How to fill out United of Omaha Medicare Supplement Insurance Policy?

To fill out the United of Omaha Medicare Supplement Insurance Policy, applicants should gather their Medicare information, personal identification, and any necessary health history, then complete the application form with accurate details and submit it to United of Omaha.

What is the purpose of United of Omaha Medicare Supplement Insurance Policy?

The purpose of the United of Omaha Medicare Supplement Insurance Policy is to provide additional financial protection to Medicare beneficiaries by covering gaps in Medicare coverage, thus reducing out-of-pocket healthcare costs.

What information must be reported on United of Omaha Medicare Supplement Insurance Policy?

The information that must be reported on the United of Omaha Medicare Supplement Insurance Policy includes the applicant's name, address, date of birth, Medicare number, health history, and desired coverage options.

Fill out your united of omaha medicare online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

United Of Omaha Medicare is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.