Get the free LIMIT OF INSURANCE

Show details

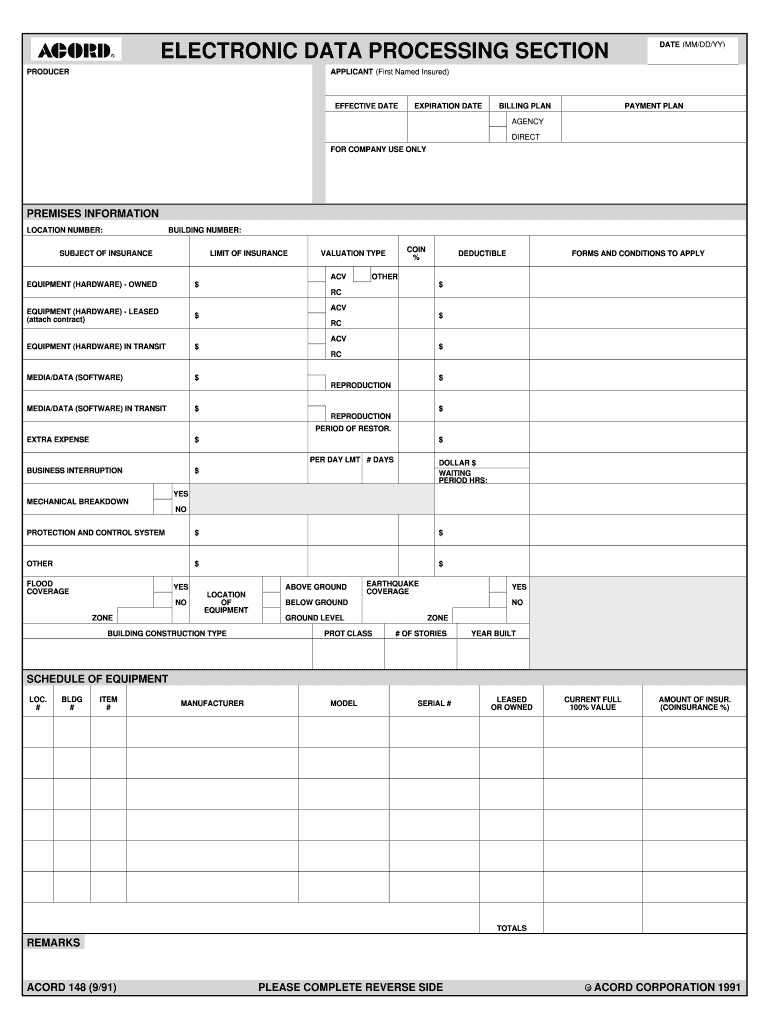

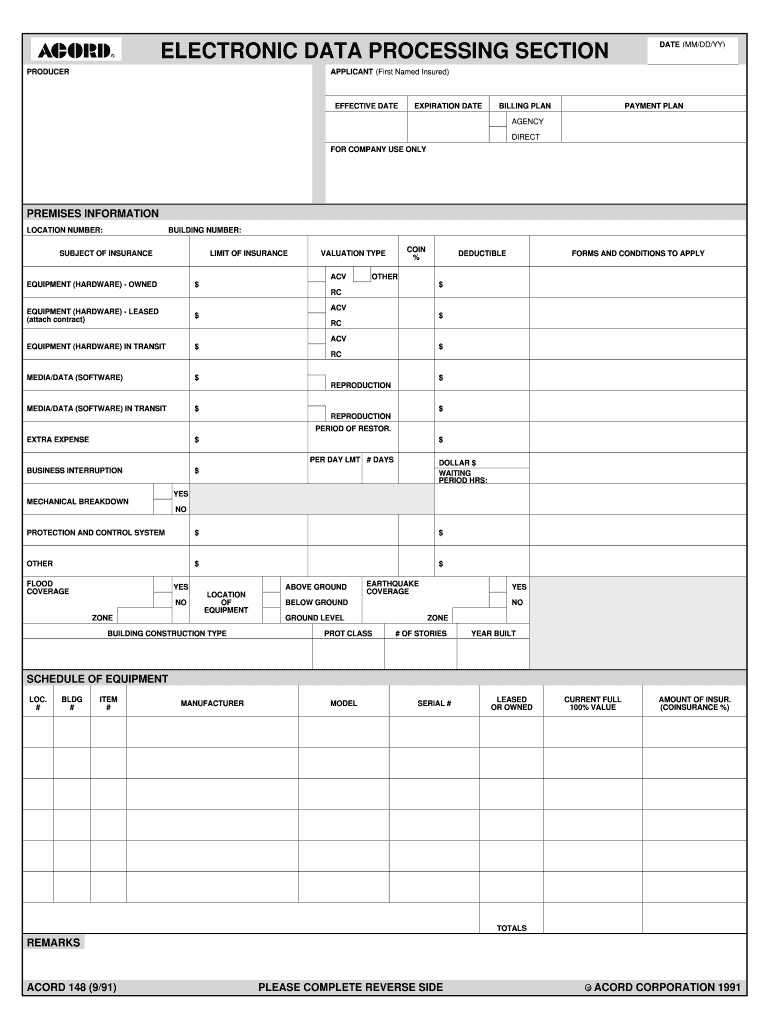

ELECTRONIC DATA PROCESSING SECTION DATE (MM/DD/BY) APPLICANT (First Named Insured) PRODUCER EFFECTIVE DATE EXPIRATION DATE BILLING PLAN PAYMENT PLAN AGENCY DIRECT FOR COMPANY USE ONLY PREMISES INFORMATION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign limit of insurance

Edit your limit of insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your limit of insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing limit of insurance online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit limit of insurance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out limit of insurance

How to fill out limit of insurance?

01

Determine your coverage needs: First, assess the nature of your assets or liabilities that you wish to insure. Consider factors such as the value of your property, the level of risk associated with it, and any legal or regulatory obligations you need to meet.

02

Evaluate potential risks: Identify the potential risks and hazards that your assets might be exposed to. This could include natural disasters, accidents, theft, or other potential incidents that could result in damage or loss.

03

Consult a professional: To ensure that you accurately determine your insurance limit, it is recommended to seek guidance from an insurance professional. They can provide expertise and help you evaluate your specific insurance requirements, considering factors such as local laws, industry standards, and best practices.

04

Assess your budget: Consider the financial aspect of your insurance coverage. Determine the amount you are willing and able to pay for insurance premiums, deductibles, and potential out-of-pocket expenses. This will help you set a realistic limit for your insurance coverage.

05

Review policy options: Research different insurance providers and compare their policies. Look for coverage options that align with your needs and budget. Consider factors such as coverage limits, exclusions, deductibles, and additional benefits or riders.

06

Fill out the application: Once you have determined the appropriate limit of insurance, complete the insurance application provided by your chosen provider. Be thorough and accurate in providing the requested information, as any inaccuracies or omissions may affect your coverage.

07

Review and understand the policy: Before signing the insurance policy, carefully review the terms and conditions. Ensure that you understand the coverage, limitations, and any exclusions or conditions that may apply. If you have any questions or concerns, seek clarification from the insurance provider.

08

Update your insurance regularly: Insurance needs may change over time due to various factors such as acquisition of new assets, changes in regulations, or adjustments to your financial situation. It is important to regularly review and update your limit of insurance to ensure adequate coverage.

Who needs limit of insurance?

01

Individuals: People who own valuable assets, such as homes, cars, or personal belongings, may need insurance coverage to protect against potential damage, theft, or liability.

02

Businesses: Companies of all sizes, across different industries, require insurance coverage to mitigate various risks. This could include property and casualty insurance, liability coverage, professional indemnity insurance, or specialized coverage tailored to their specific operations.

03

Professionals: Certain professions have legal or regulatory requirements to maintain a minimum amount of insurance coverage. For example, doctors, lawyers, architects, and other service providers often need professional liability insurance to protect against claims of negligence or malpractice.

04

Contractors and construction industry: Individuals or companies involved in construction or contracting work face unique risks related to property damage, accidents, and third-party liability. They typically need insurance coverage tailored to the construction industry to ensure adequate protection.

05

Non-profit organizations: Non-profits often require insurance coverage to protect their assets, directors, and volunteers from potential legal claims, accidents, or other liabilities that may arise in the course of their charitable activities.

It is important to note that insurance needs can vary depending on individual circumstances, and it is advisable to consult an insurance professional to determine the specific insurance requirements for each case.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send limit of insurance for eSignature?

Once your limit of insurance is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I complete limit of insurance on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your limit of insurance. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Can I edit limit of insurance on an Android device?

With the pdfFiller Android app, you can edit, sign, and share limit of insurance on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is limit of insurance?

The limit of insurance refers to the maximum amount of coverage provided by an insurance policy.

Who is required to file limit of insurance?

The policyholder or insured party is typically required to file the limit of insurance.

How to fill out limit of insurance?

The limit of insurance should be filled out accurately and completely, providing all necessary information as requested.

What is the purpose of limit of insurance?

The purpose of the limit of insurance is to establish the extent of coverage provided by an insurance policy.

What information must be reported on limit of insurance?

Information such as policy details, coverage limits, and insured risks must be reported on the limit of insurance.

Fill out your limit of insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Limit Of Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.